Research Digest

US Connected TV Devices: Smart TVs Will Continue to Hold Top Spot

by Frankie Karrer4 min read

Abstract

- More than 200 million people watch Connected TV every month in the US

- Competition between CTV device makers is growing fierce

- There are overlaps in audiences between the many CTV devices

The CTV device market has been heating up over the last few years, and that competition isn’t expected to slow down

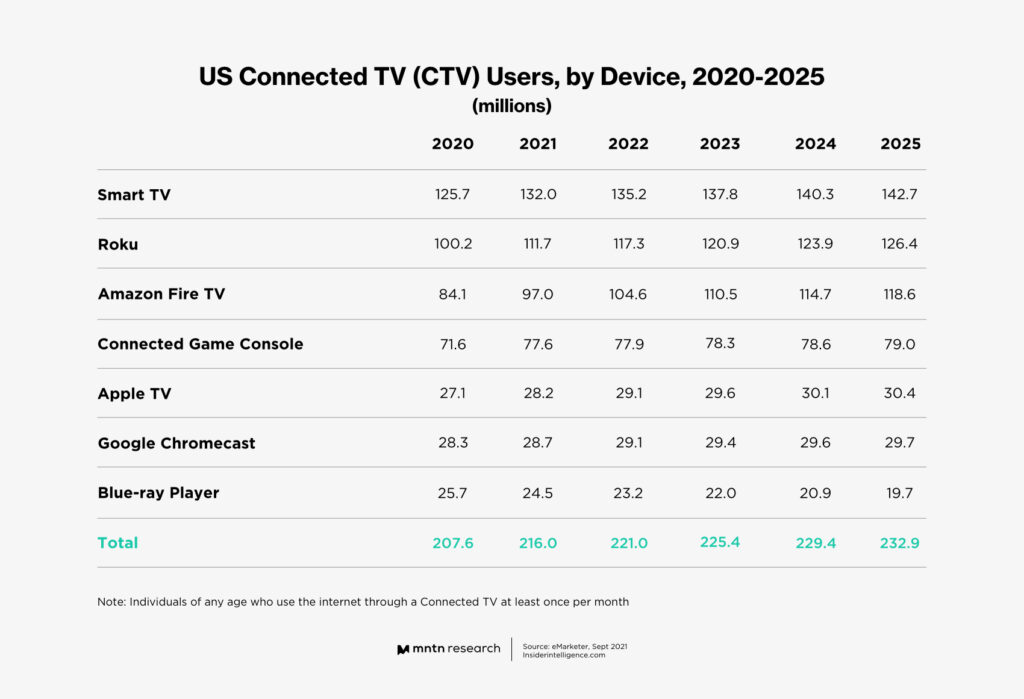

According to data featured in eMarketer’s US Connected TV Advertising Repor1, which examines trends, data, and strategies related to how marketers are approaching CTV, around 216 million viewers used the internet through a Connected TV device last year. And by 2025, that number is estimated to reach 232.9 million.

Over the last few years, the fight for viewers among CTV device makers has become increasingly competitive. According to the report from eMarketer, these companies have a few plans and methods to capitalize on the growing Connected TV audience. Roku and Amazon Fire, for example, have built ad businesses through their streaming sticks and CTV operating systems (OSs), while TV manufacturers Samsung, LG, and Vizio have decided to build their own CTV OSs in order to monetize them through advertising rather than licensing out software. And both Comcast and Amazon have plans to launch their own smart TVs in the coming years.

Breakdown of Device Use

There are a number of ways that CTV users watch their favorite streaming content, and eMarketer breaks this data down in the above chart. Here are some of the main takeaways:

- Currently, the top device used by CTV watchers is Smart TVs. In 2021, 132 million users watched content through their Smart TVs. This device is expected to hold the top spot for years to come, reaching 142.7 million users by 2025. And data from Strategy Analytics suggests this will mirror global marketers—more than half (51%) of all households worldwide will own a smart TV by 2026.

- The next two top CTV watching methods are Roku and Amazon Fire TV. Roku currently holds the second highest spot with 111.7 million users, and will hold that position into 2025, reaching an estimated 126.4 million users. Amazon Fire TV is expected to break 100 million users this year, and by 2025 will capture around 118.6 streamers. This data includes both the Roku and Fire TV powered smart TVs and smart sticks for each brand.

- Connected TV watchers are also accessing content through their game consoles. These devices jumped from 71.6 to 77.9 million viewers last year, but that growth is expected to slow significantly, and game consoles will reach 79 million viewers in 2025 (a number that is still expected to hold the spot for fourth most popular CTV device).

- Apple TV and Google Chromecast have a smaller audience than some other CTV watching devices, with 28.2 and 28.7 million viewers in 2021, respectively. However, Apple TV is expected to pass Google Chromecast in numbers by 2023, reaching 29.6 million viewers vs. Chromecast’s estimated 29.4 million.

- Blu-ray players currently take up the smallest part of the CTV device pie. Last year around 24.5 million viewers watched CTV through their blu-ray players, and by 2025 that number is expected to drop to 19.1 million. This is the only device that is expected to lose viewers over the next few years.

Of course, many CTV viewers have more than one device and method that they use to access streaming content. For example, a user could have a subscription to Amazon Prime but watch that content on both their Roku streaming stick and Xbox gaming console. As a result, many of these devices see some overlap in terms of audiences.

Why It Matters

Competition between CTV device makers has become increasingly fierce. This is because the more people who watch through their devices, the more these companies have a chance to make. CTV device makers often ask for a cut of the advertising and subscription revenues from streaming services that run their platforms through their devices (usually around 30%). And the potential data that can be obtained from audiences that use their devices is increasingly valuable for advertisers, retailers, and content studios alike.

Conclusion

eMarketer’s US Connected TV Advertising Report indicates that there will be a lot of growth in most of each CTV device’s audiences in the upcoming years. And with that growth will come skyrocketing ad revenues—according to data that eMarketer cites from TV[R]EV, ad revenues from smart TV makers Samsung, Vizio, and LG expected to grow from $1.37 billion in 2021 to $6.17 billion in 2026. Ultimately, most CTV devices are expected to hold their positions within the lineup in terms of audience use, barring any new players.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.

Resources

1 US Connected TV Advertising Report (eMarketer)

2 Why 2022 Could Be A Renaissance For TV Advertising (AdExhanger)