Analysis

Data Reveals Increased Investment in CTV Leads to Better Performance

by Isabel Greenfield7 min read

Abstract

- We analyzed first-party data from the MNTN platform, with a focus on advertisers that increased their ad spend, to see what effects additional funds had on performance.

- We compared three time periods, which included X amount of days before the budget increase, and X amount of days afterward. The time periods were 30, 60, and 90 days.

- After 30 days, the number of reached viewers increased by 57%, while return on ad spend, or ROAS, increased an average of 6.57% across advertisers. In addition, 54% of advertisers increased their visit rate, and 58% increased their conversion rate.

- After 60 days, advertisers reached 50% more viewers than in the 60 days prior to their budget increase. Over half of advertisers increased their ROAS, and 58% increased their conversion rate. Importantly, advertisers saw decreases in cost per visit, which dropped an average of 31%, and cost per acquisition which dropped 49%.

- After 90 days, advertisers reached 52% more viewers versus the previous 90, and saw ROAS increase an average of 24%. Average cost per visit decreased by nearly 50%, and cost per acquisition dropped an average of 64%.

- The data suggests increased spending on CTV advertising has both an immediate positive impact on performance, as well as an extended boost over the following months. Even with over 50% more viewers reached over the course of the analyzed time periods, efficiency and costs improved for the majority of advertisers.

As viewers flock to Connected TV, advertisers are evaluating their ad budgets and figuring out how to work this ad channel into their mix. In the past, TV has traditionally been an awareness play, focusing solely on the upper funnel. With its digital roots however, CTV has turned the TV screen into a performance marketing channel that reaches across the entirety of the sales funnel—from driving website visits among desired audiences, to generating conversions at the point of sale.

Just like with any performance channel, as advertisers start to see initial success, they are likely to invest more budget to try to maximize their results. Sometimes more is more.

When it comes to investing in a Connected TV strategy, it seems that might be the case. So we tapped into MNTN’s first-party performance data to examine what happens when advertisers increase their ad spend.

To do this, we examined advertisers who invested an additional 10% or more in their campaigns between April 1st, 2022 and July 31st, 2022. We chose this timeframe to avoid the holiday mayhem of Q4 and the subsequent hangover of Q1, and get a more balanced look at the effects during a time less influenced by major shopping events.

We then broke down the results, and compared performance between three time periods which included X amount of days before the budget increase, and X amount of days afterward. The time periods were 30, 60, and 90 days.

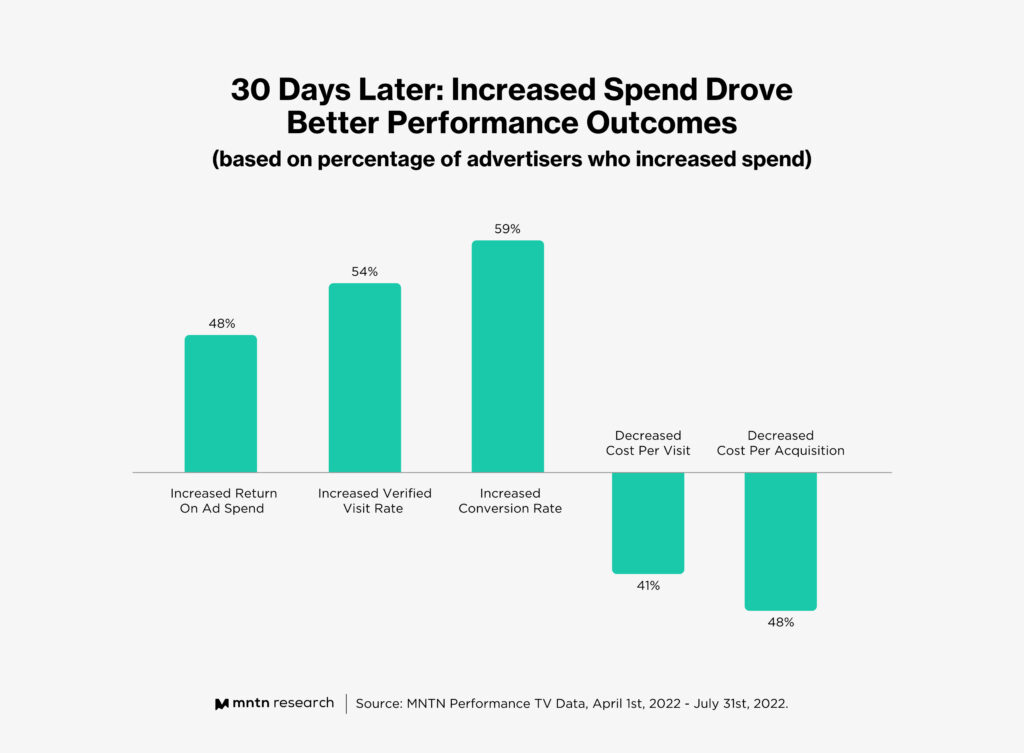

As the chart shows above, investing more in CTV drove better results for a majority of advertisers. From an increased return on ad spend (ROAS), to a decreased cost per acquisition (CPA), advertisers that invested more into their campaigns saw elevated performance. Interestingly, one thing is immediately clear—the longer campaigns run, the better the performance outcomes become for the majority of advertisers.Let’s take a look at the results from each period.

30 Days After Increasing Spend

An important thing to note is the nature of the CTV campaigns we’ve reviewed. In addition to lower-funnel campaigns, top-of-funnel prospecting campaigns were analyzed. These campaigns are designed to reach new audiences, and drive viewers to learn more or visit the advertiser’s website. Naturally, the sales cycle can be a bit longer for these.

Within a month of increasing spend, however, a majority of advertisers were already seeing downstream effects. The data shows that many campaigns benefited even in the early days following the additional investment. In fact, analyzed campaigns increased their reach significantly, seeing a 57% increase in viewers reached in the 30 days after increasing their budgets. Rather than repeatedly hitting the same people with additional frequency, the added funds helped advertisers reach new people within their target audience. And the additional reach provided ripple effects across other metrics.

We found that the additional investment led to an increased verified visit rate for a majority of advertisers—a verified visit being a website visit driven by a CTV ad without any other competing paid media interactions. This is despite the increased denominator of the number of users reached. With 54% of advertisers seeing an increase in this metric, it shows that when they target the right audiences, they can generate interest and inspire action. Advertisers that spent more to reach more of their target audience saw increased traffic to their websites as a result.

Not only did these advertisers see additional visits, but their audience was also taking action. 59% of the advertisers saw an increase in conversion rates within the 30 days after their spend increase. Across all advertisers who increased their spend, the conversion rates increased by an average of 11%. Advertisers that put additional budget towards CTV were already seeing returns just a month after their added investment.

60 Days After Increasing Spend

Two months after the additional investment, advertisers continued to see positive results with an even greater return on their ad spend. They continued to see improvements in the number of viewers reached when compared to the 60 days before increasing their budget, with that number increasing roughly 50%. Not only were advertisers able to reach new prospective customers, but they saw an increase in their performance metrics across the board.

The additional money they put into their campaigns came back to advertisers in the form of conversions. More than half of all advertisers saw increases in site visits and conversions, driving an overall increase in their return on ad spend (ROAS).

Advertisers also saw decreases where it mattered. Half of the advertisers decreased their cost per visit as the system continued to auto-optimize for performance over the 60-day period. 55% of advertisers also saw a decrease in cost per acquisition, continuing to generate performance numbers worthy of the additional investment. The cost per visit fell an average of 32% for all advertisers who increased their ad spend, while cost per acquisition was cut almost in half, with an average of a 49% decrease after the additional investment. And while these numbers were great, the 90-day mark saw even greater performance outcomes for these key metrics.

90 Days After Increasing Spend

At the tail end of our research, advertisers continued to reap the rewards of their additional investment. The campaigns reached 52% more viewers compared to the 90 days prior to the spend increase. This goes to show that Connected TV is a powerful demand generation tool—and with an added investment, can reach an even larger group of potential customers.

The increased reach of new users also had clear positive effects on the performance results of these campaigns. Two in every three advertisers (67%) saw an increase in ROAS—with the average increase coming in at 24%. Other key performance metrics also increased, with 60% of advertisers seeing an increase in verified visit rate and 50% in conversion rate.

Advertisers also continued to see their costs drop, with 60% of them seeing a decreased cost per visit, and 63% a decreased cost per acquisition. And those savings were significant; cost per visits decreased an average of 50%, and cost per acquisitions plummeted an average of 64%.

These results show the value of not just additional funds, but also additional time. The MNTN platform auto-optimizes toward an advertiser’s predetermined business goals. As time passes, the auto-optimization becomes more efficient, learning who is most likely to convert and thus how to more effectively achieve the desired outcome. By this same logic, it’s also valuable for brands to continue to keep their campaigns running, even between key initiatives such as holiday campaigns, as the system will be more efficient during these periods when it’s had time to optimize.

Conclusion

Our findings show that those advertisers who increased their CTV investment were rewarded for the additional investment. A majority of advertisers saw increases in key performance metrics, from users reached to return on ad spend. Similarly, they decreased cost-related metrics, including cost per visit and cost per acquisition. As time went by and the backend system had more chances to optimize, advertisers continued to see the positive effects of adding more budget to their CTV strategy.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.