Consumer Snapshot: Prime Day Shoppers Boosted CTV Ad Efficiency

by Cat Hausler

Abstract

- Consumers aren’t just hunting for deals on Amazon during Prime Days, they’re in full shopping mode across the ecommerce space.

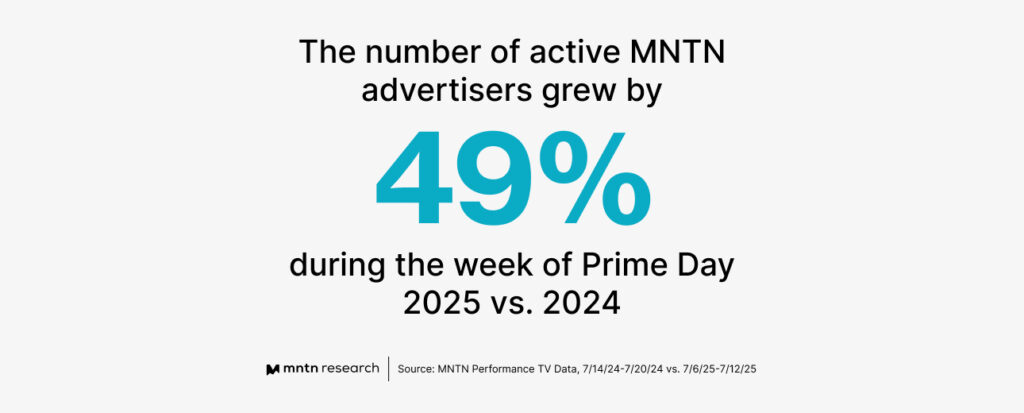

- Brands responded to heightened consumer purchase intent — the number of MNTN advertisers during Prime Day week 2025 grew by 49% YoY.

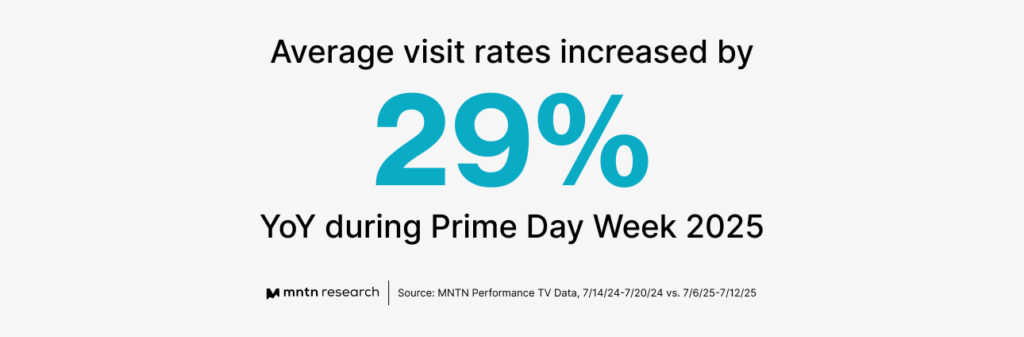

- CTV viewers were shopping, not just streaming — average visit rates increased by 29% YoY.

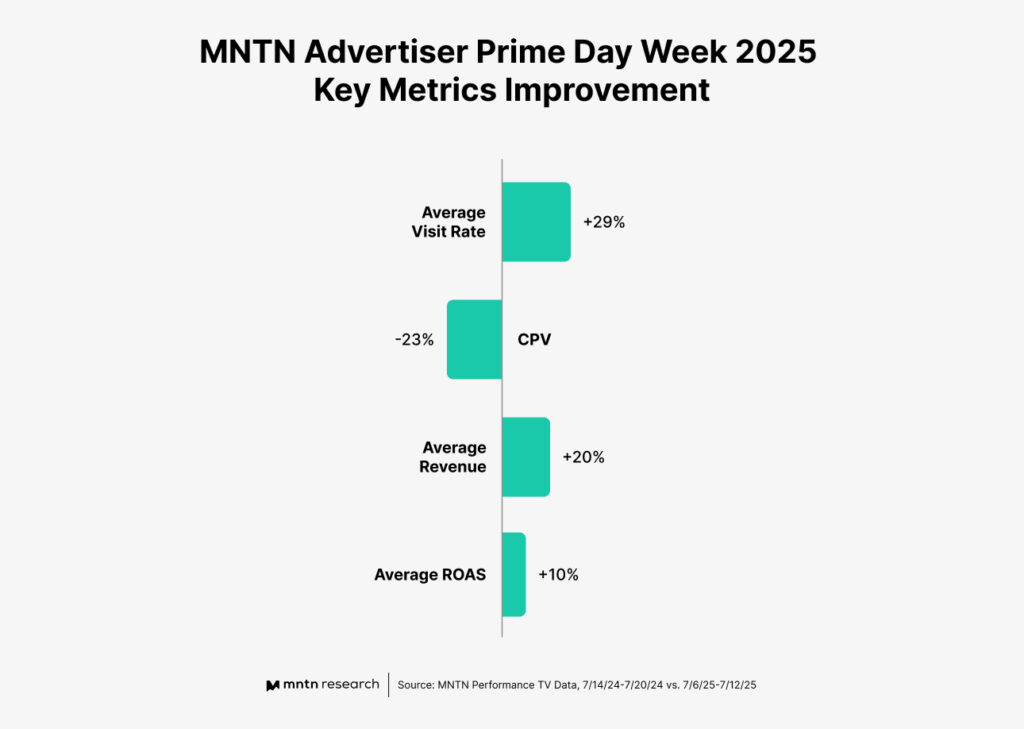

- Brands reached more engaged consumers while spending less to do so — visit rates increased and cost per visit decreased by 23% YoY.

- Consumers’ heightened shopping intent during Prime Day week 2025 created a high-performance environment where advertising dollars worked harder and delivered stronger returns.

Amazon Prime Day might be a retail holiday built by and for Amazon, but savvy brands are turning it into a performance opportunity of their own. What started as Amazon’s loyalty driver has evolved into a retail moment that lifts the entire retail landscape — consumers don’t just hunt for deals on Amazon, they’re in full shopping mode across retailers and categories.

To understand Prime Day’s impact, we analyzed MNTN Performance TV data from two angles: year-over-year (comparing the week of July’s Prime Day 2024 to 2025) and week-over-week (comparing Prime Day 2025 to the same days the week prior). The year-over-year (YoY) comparison revealed the holiday’s growing influence as a retail moment, while the week-over-week (WoW) analysis showed how the event created a distinct high-performance window for advertisers.

Together, these perspectives show that Prime Day 2025 wasn’t just another shopping event — it was a breakthrough moment for advertisers across the board.

Consumers Shopped Beyond Amazon, Advertisers Responded To Meet Demand

Prime Day’s influence has grown dramatically in recent years. Adobe reported 11% sales growth from 2023 to 2024. And in 2025, U.S. retailers drove $24.1 billion in online spend during the extended four-day event period — a 30.3% increase YoY.

Prime Day 2025 created a shopping environment that extended far beyond Amazon’s marketplace. Consumers entered a heightened state of purchase intent — not just browsing for Prime Day deals, instead actively researching and comparing options across all channels and categories. This shift in consumer behavior didn’t go unnoticed by advertisers, who responded by increasing their presence during this high-opportunity window.

As consumers demonstrated their willingness to shop beyond Amazon during this period, brands recognized the opportunity to capture attention from audiences already in a purchase-ready mindset. This surge in participation indicates that advertisers have learned to read these consumer signals and use Connected TV (CTV) strategically during high-intent shopping windows — not just for brand awareness, but for driving real business outcomes.

CTV Viewers Were Shopping — Not Just Streaming

Increased CTV advertiser participation paid off as consumers weren’t just passively watching content, they were actively engaging with brands after seeing their ads. We found that MNTN customers’ average visit rates increased by 29% YoY during Prime Day week 2025, indicating that viewers were more responsive to advertiser messaging and more likely to take action.

This heightened engagement reflects how streaming audiences use CTV during major shopping events. Rather than seeing ads as interruptions, consumers appeared to view them as part of their research and discovery process.

For advertisers, this signaled that their campaigns weren’t just reaching people, they were connecting with those who were already in a decision-making mindset. The 29% increase in engagement demonstrates that when consumer intent peaks during major shopping events, CTV can be used as a powerful tool for converting interest into action.

Engaged Shoppers Drove Ad Efficiency, Despite Rising Competition

Even as more advertisers entered the Prime Day arena, consumer responsiveness created a rare scenario where increased competition actually led to improved efficiency. Our data reveals a 23% YoY drop in average cost per visit (CPV). This improvement in CPV paired with the 29% rise in visit rates indicates that brands reached more engaged consumers while spending less to do so.

Advertising efficiency went beyond traffic acquisition. Average return on ad spend (ROAS) climbed 10% year-over-year despite the crowded advertising landscape, while average revenue per advertiser grew 20%. The combination suggests that consumers’ heightened shopping intent during Prime Day week 2025 created a high-performance environment where advertising dollars worked harder and delivered stronger returns.

The WoW data tells an equally compelling story. Comparing data from Prime Day 2025 (7/8/25-7/11/25) to the same days the previous week (7/1/25-7/4/25) — a historically strong shopping period due to the 4th of July holiday — reveals just how exceptional this performance was. While CPV decreased 18% and cost per acquisition (CPA) fell 11% WoW, average revenue still climbed 6%. This combo of lower costs and higher returns highlights that Prime Day creates a real efficiency sweet spot for advertisers.

Prime Day is a Strategic Opportunity For Every Brand

The data from Prime Day 2025 reveals more than just a successful shopping event for Amazon — it demonstrates how major retail moments can create high-performance periods that benefit brands across all industries. For Connected TV advertisers, Prime Day 2025 proved that strategic timing can amplify campaign effectiveness in remarkable ways. The combination of increased consumer engagement, improved cost efficiency, and stronger returns shows that CTV has evolved into a powerful tool for capturing high-intent audiences.

As retail calendars continue to expand with new shopping events and existing ones grow in influence, the brands that will thrive are those that learn to read consumer signals and position themselves accordingly. Prime Day 2025 wasn’t just Amazon’s biggest event yet, it was a preview of how smart advertisers can turn any major shopping moment into a competitive advantage.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.