Peeks Report

Marketers Pick Netflix for Top Ad-Tier in ’24

by Tim Edmundson1 min read

Abstract

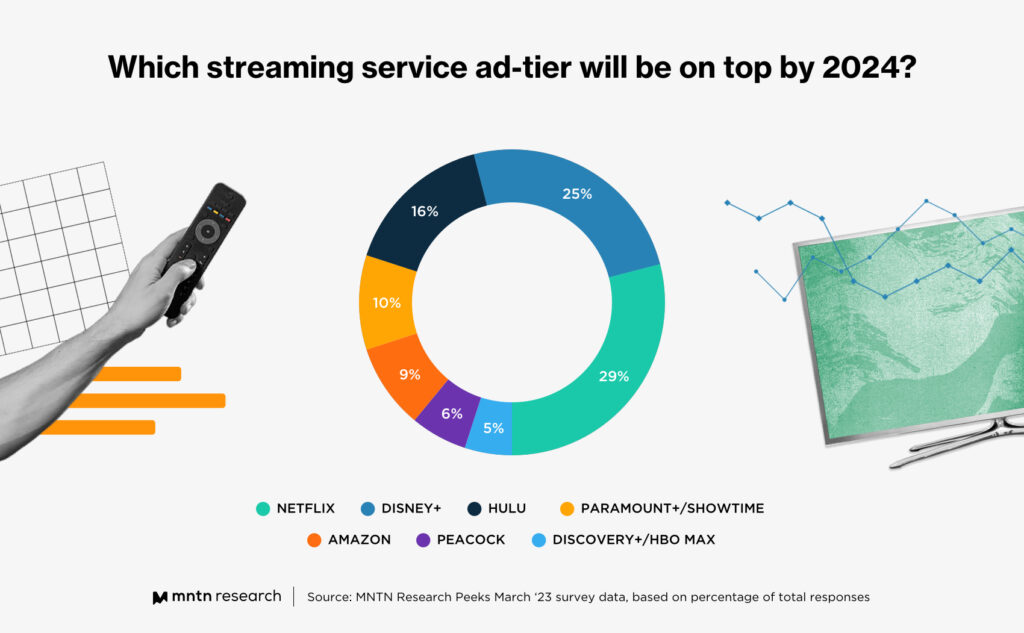

- Respondents predict Netflix will stay on top and their ad-tier will be most successful by end of year, with Disney+ coming in second.

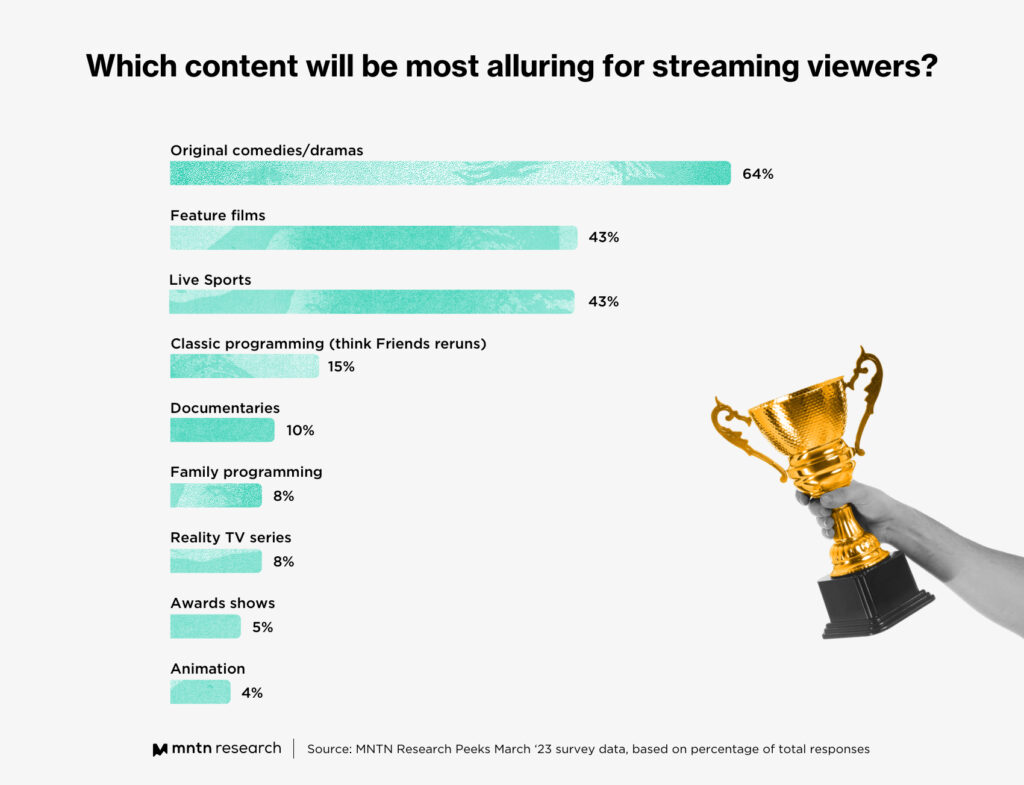

- Original content is seen as the main allure for viewers, with nearly two in three responses naming “Original comedies/dramas” as the best content to draw in viewers.

- “Feature films” and “Live sports” tied for second place at 43%, with “Animation” (4%) and “Awards shows” (5%) bringing up the rear.

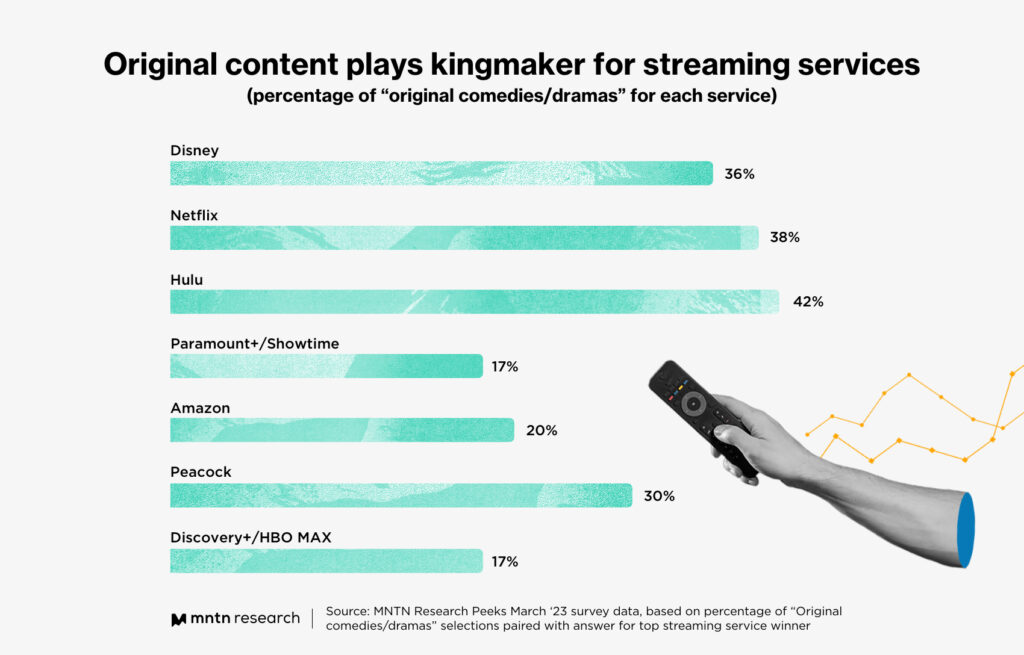

- Original content was a heavy influence on respondents’ pick for top streaming ad-tier.

Ad-tiers Are Everywhere

This past year and change has seen every major streaming platform add an ad-supported option. Even “we’ll never run ads” Netflix joined the fray in late 2022, along with other heavy hitters like Disney+.

This has cemented a brand new playing field for major players in the streaming space: the ad-tier. Often appealing to cost-conscious consumers who originally ditched cable’s high price tag—by cutting the cord, or for younger viewers, never subscribing to begin with—ad-supported options are incredibly alluring (and affordable) for budget-minded viewers.

So with that in mind, we posed a simple question to marketers. Who is going to win?

When you consider the factors that go into who will come out on top, you have to wonder how it will all play out. Will Netflix’s status as top dog help them overcome their newbie status in the advertising world? Will Disney+ and their top-tier content catalog catapult them to dominance (with the help of Hulu’s ad technology)? Other streamers are no slouch either, with Peacock and Paramount+ also offering plenty to viewers and advertisers alike.

The results are in, so let’s dive in.

Netflix Claims the Top Spot

If you read the title of this report, this should come as no surprise. Nor should it if you always back a winner, which 29% of our respondents did.

That said, Netflix hasn’t been without their challenges out of the gate. They had a notoriously slow start right at launch, with less than 10% of new subscribers opting for their ad-tier. Execs were confident however, stating they were taking a long view on their success.

Turns out there may have been something to that whole “patience” thing.

Netflix bounced back with reports of over 1M active users on their ad-tier within the first two months of its launch, more or less in-line with their internal projections. If those internal predictions hold true, they’re looking at over 13M ad-watching subscribers by Q3 2023. Not too shabby for a fledgling ad business.

Moving down our list, Disney+ was a close second. Their ad-tier launched in late 2022 and was accompanied by a $3 price hike of their ad-free option—increasing to $10.99. Nothing like a little motivation for cost-conscious consumers to give it a try.

The launch of Netflix and Disney+ ad-tiers prompted different consumer reactions. Per data from Statista and Hub Research:

- 71% of Netflix subscribers said they would stick with ad-free, and 24% said they would switch to the ad-tier.

- 54% of Disney+ subscribers said they would stick with ad-free, and 35% said they would switch to the ad-tier.

Netflix and their no-ad approach appears to have been a major selling point for their subscriber base, with fewer of them willing to make the switch. Disney+ viewers were more willing to trade a lower cost for some advertising.

Could that be due to Disney attracting more families, who tend to be more budget-focused? This is pure speculation on the part of your author. What’s not speculation however is that Disney+ ranks highest for co-viewing among all major streaming services, based on research from TVision. So maybe there’s something to that.

A Snapshot of the Also-Rans

Hulu took home the bronze medal as it claimed 16% of the vote. The OG of ad-tiers among our list, Hulu will likely lend its ad tech to Disney+ to bolster the mouse’s offering to advertisers. On the viewer side, however, there’s some concerns around ad loads. We’ve noted this can have an effect on viewer attention spans, among other considerations.

Paramount+/Showtime was next in line, with the two merging in the near future. The streamer is still adding subscribers—to the tune of nearly 10M and a 4% boost in ad revenue in Q4 ‘22—but will soon be raising prices on both their basic (AKA ad-tier) and premium options to offset costs.

Amazon, not satisfied with a billion other sources of revenue, decided to generate more ad revenue via streaming. They renamed their ad-supported streaming service IMDB TV to Freevee in 2022, and committed to spending more on its programming. They’ve been mum on recent performance numbers, though they did post a 138% increase in viewership from 2020 to 2021.

Peacock has been making strategic decisions regarding their ad business. They recently shuttered the ability for new subscribers to sign up for their free, ad-supported tier. Instead, new users can sign up for the ad-supported premium plan for $4.99. Which to be fair is very affordable in the spectrum of paid ad-tier options.

Discovery+/HBO Max rounded out our list. This coupling, which has generated a slew of headlines around content cuts and strategic decisions, is a bit of an unknown at this point. Important to note that pre-merger HBO Max famously reversed their fortunes when they launched their ad-tier back in 2021.

What Do the People Want To Watch?

They want originals, that’s what! When asked what types of content will pull in the most viewers, our respondents named “Original comedies/dramas” as the main draw. Feature films and live sports were no slouches, either.

The pairing of feature films and streaming has been in the news, with Apple announcing that they’ll debut a number of films in theaters, before eventually bringing them to their Apple TV+ service (who weren’t included in our poll due to not having an official ad-tier…yet).

The balance between drawing consumers to theaters and streamers is one many have to contend with. Disney+ famously brought 15 films that were originally intended for theatrical release during the pandemic, and is still planning to debut features exclusively on its service. Films are clearly still a draw, and it’s likely we’ll still see them figure prominently in the streaming space even with consumers’ return to theaters.

Live sports are often named one of the main reasons why viewers are hesitant to leave cable behind. Its presence on streaming is expanding however, and it found itself at #3 in our list—a virtual tie with films that was decided by rounding up and down.

There have been some major moves in the sporting arena.

- Apple TV+ locked in rights for Major League Soccer, as well as those to Friday night baseball.

- Amazon famously claimed the NFL’s Thursday Night Football back in 2021.

- Youtube snagged exclusive rights to NFL’s Sunday Ticket last year.

- Paramount+ beat Amazon to retain the highly-coveted UEFA Champions League, with the rights to the top-tier club soccer competition going for $1.5B in 2022.

Streaming networks know the value of sports, and so do viewers. Expect the competition to rights in this space to be hotly contested as networks compete to draw more viewers in.

Original Content Could Tip the Scales

Nearly two out of every three respondents cited original content as one of the biggest draws for viewers. We decided to see how it affected people’s picks for the top streaming service.

You’ll see that the top three ranked streamers also had the highest percentage of paired “Original comedies/dramas” picks. With the exception of Peacock, no other streamer broke out over 20%.

It’s interesting to note that Disney+ and Netflix don’t have a network television equivalent, while many of the others who scored lower (Paramount+ and CBS, Discovery and HBO) are perhaps better known for their broadcast counterparts. We’ll leave Hulu out of that, as it has had a history of attention-grabbing originals (The Handmaid’s Tale, for one) and features a number of networks’ content, many of which aren’t immediately tied to Hulu’s brand presence.

Is there a perception that these streamers are repurposing content, rather than investing in streaming originals? Perhaps, but maybe that’s left to a future Peeks poll.

The Streaming Wars Rage On

As we bring this Peeks Report to a close, we may be early in crowning an ad-tier champ for the year. At time of publication, it’s only April, and a whole lot can happen as we make our way toward 2024.

But there’s something to be gleaned from where sentiment sits—even early in the year. Plus it’s fun to pick winners. And as the ad landscape continues to expand, it’s safe to say the real winners are advertisers.

That’s right, advertisers were the winners the whole time. What a twist!

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.