The Cost of Cord-Cutting: How Rising Costs Impact Viewer Habits

by Stephen Graveman7 min read

Abstract

- Streaming is getting more expensive. A collection of the top services now costs $87 a month

- In one year, the combined monthly fee for all of these services rose nearly 20%.

- Consumers are continuing to cut the cord, but embracing ad-supported channels to save money

- By 2024, 158.5 million US viewers — nearly half the country — will be streaming ad-supported content.

For years, streaming services have operated at a hyper-growth stage. The major media companies that own these services were willing to operate them as loss leaders, driving up subscription numbers in a bid to dominate more of the market share in an increasingly competitive (and crowded) market.

But as anyone who has studied the subscription model knows, these services have a predetermined market penetration rate goal — and once they hit it, they start gradually increasing rates in an effort to make themselves profitable.

For many of these services, this course correction began in 2022. As more audiences cut the cord and streaming began to overtake linear TV in viewership, shareholders were eager to start cashing in on the boom. But as alluded to above, the increases didn’t stop there. This year has seen across-the-board raises in fees, while some streaming services are simultaneously cutting cost-saving tactics like account sharing. All of this is happening against the backdrop of an ongoing Hollywood strike that has ground almost every production to a screeching halt — and is affecting the content production that these streaming services rely on to attract prospective customers and retain current ones.

Another Year of Price Increases

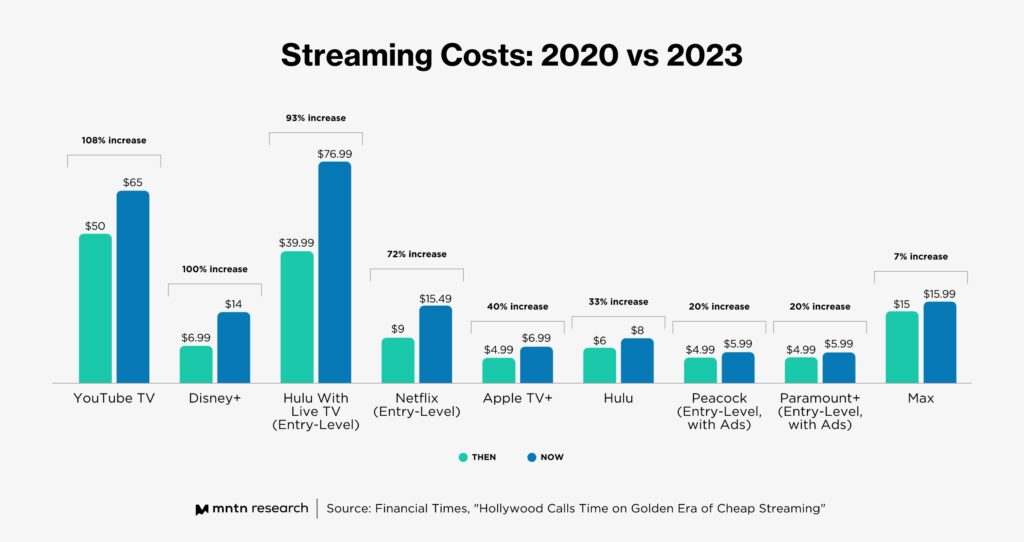

By the end of 2022, a “basket of the top US streaming services” would run a viewer about $73 per month. At the time, viewers were getting apprehensive about rate increases. Netflix, the market leader and originator of streaming, had already raised its prices four times in the last five years, and now its competitors were following suit. In one year, the monthly fee for all of these services combined rose nearly 20%.

Just a year later, that “basket of streaming services” for $73/month has climbed again. By this fall, that same assortment of plans will cost viewers around $87/month — a price tag that’s actually higher than the $83/month cost for the average US monthly cable plan.

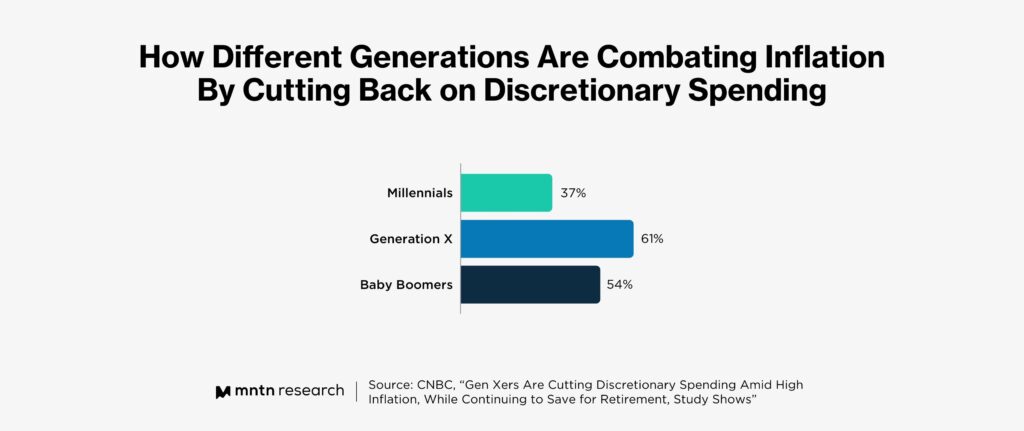

These price increases are coming at an unfortunate time for most subscribers. While the cost of operating streaming services has undoubtedly increased, so too has the cost of life for the average TV watcher. As consumers struggle with the rising costs of utilities and food, they’re scaling back on entertainment and other discretionary spending to budget for the necessities.

There’s already evidence that the continual price increases are having a real impact on subscriber retention. Earlier this year, Netflix admitted in their Q1 earnings call that their rate raises likely contributed to a loss of over 600,000 customers—the first time the streaming giant reported a subscriber loss in over a decade.

Now Disney+ is on a similar trajectory to Netflix. When it first launched, the streamer differentiated itself from Netflix by offering a reasonable price tag that was half of Netflix’s cost at the time — $6.99 a month. But in 2023, the service saw two price increases in the same year alone; the latest increase will raise the ad-free tier of Disney by another 27% to $14 per month. That’s a 100% increase in cost since the service started.

The Rise of Ad-Supported Streaming

While these runaway costs might sound dire, the reality is that streaming has forever changed the way media is consumed. The genie is out of the bottle; just like cable TV’s rising costs didn’t send viewers back to terrestrial radio, the rising cost of streaming won’t cause viewers to reverse cord-cutting altogether. Besides, each of these streaming services have deep war chests that allow them to acquire and create a lot of must-see content—war chests that linear TV just can’t compete with.

To keep audiences subscribed, almost all of the major streaming services have turned to a new income model: ad-supported streaming. In exchange for occasional commercial breaks, consumers get access to the same content for less money. For instance, Netflix’s new ad-supported model can be as low as $6.99 a month, compared to the entry-level cost of $15.49 a month.

So far ad-supported streaming is popular with both new and existing viewers. After Disney+ launched its ad offering last year, the streamer revealed that the ad-supported tier is projected to account for 88% of its global subscriptions by 2028. 1 in 4 paid premium subscribers has signaled interest in switching over to the ad-supported tier, inspiring the service to set an even more ambitious goal of 260 million ad-supported streamers by the end of next year.

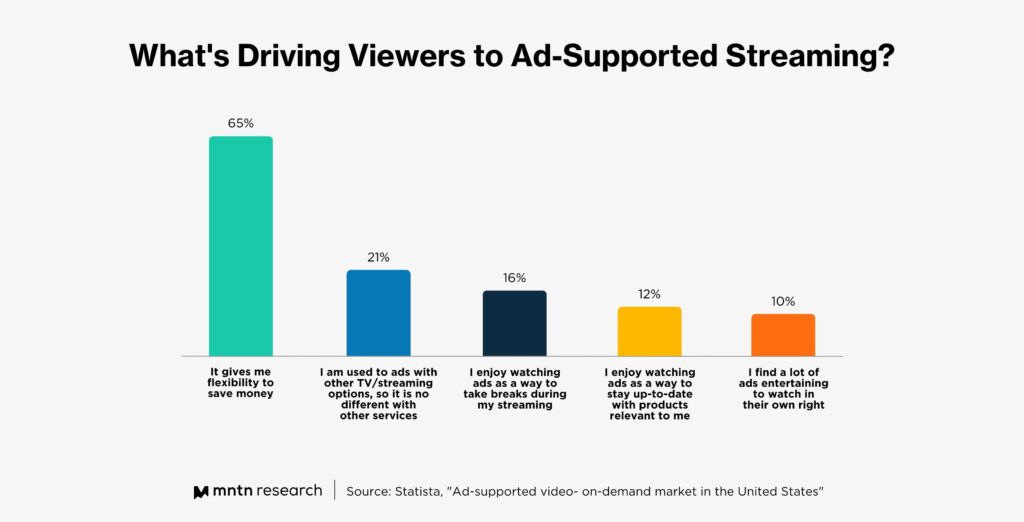

In fact, thanks to CTV’s narrow targeting capabilities, audiences are more likely to be served ads that apply to their interests and lifestyles — and that’s flipping the script on the age-old tradition of being annoyed by obtrusive commercial breaks. While 65% of consumers say they use ad-supported streaming to save money, a combined 38% find the ads enjoyable and entertaining, while another 21% say they’re unbothered by them.

And while consumers flock to ad-supported streaming to save on their monthly bills, the increasingly fragmented Connected TV landscape means that even those more affordable options can add up quickly.

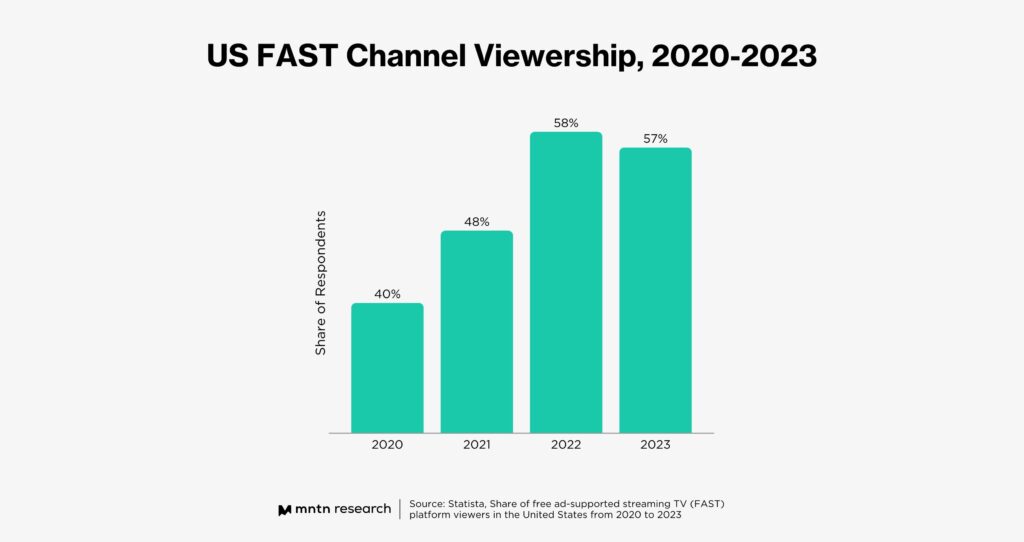

This has opened the door for streamers to take one step further: offer completely free streaming. Free Ad-Supported Streaming, or FAST, has picked up speed in recent years, with channels like Roku, Tubi, and Pluto making a name for themselves with their own hit exclusive programming.

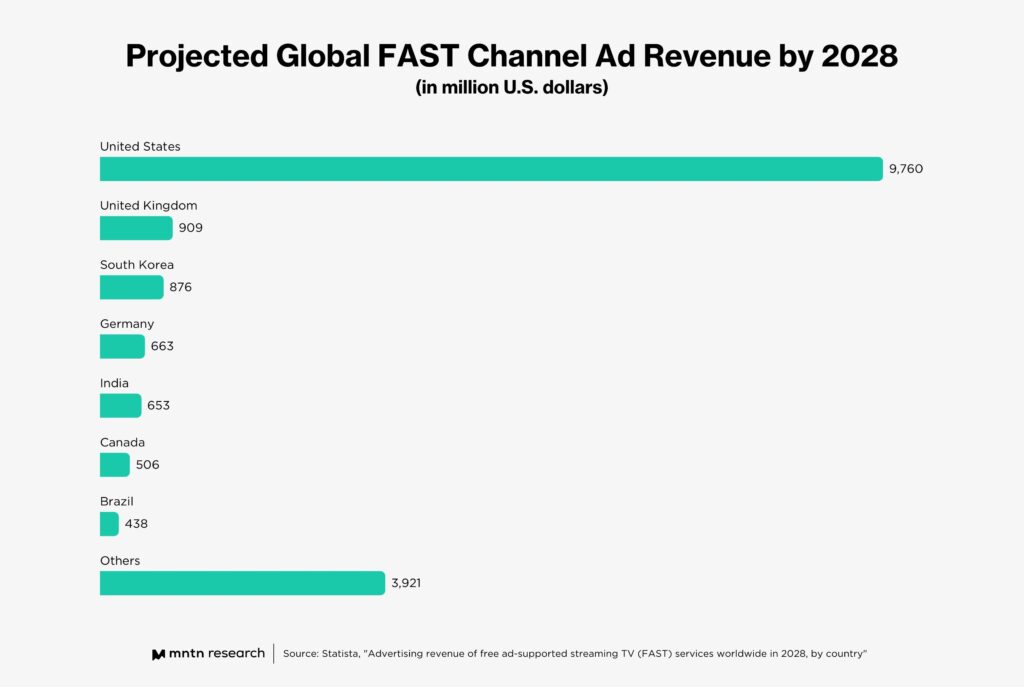

Amazon Freevee’s “Jury Duty,” for example, was a breakout success; the series is now Amazon’s most popular show ever and nominated for four Emmy awards, including Outstanding Comedy Series. Thanks to programming like this, FAST channels are gobbling up more viewership hours, and are predicted to reach a revenue of 18 billion US dollars by 2028.

And it’s not just consumers flocking to FAST channels; advertisers are, too. The ad revenue of FAST channels in the US is on the rise and is expected to reach 9.76 billion U.S. dollars by 2028.

Conclusion

In another industry, a service rapidly raising its rates multiple times in one year would test the limits of brand loyalty — if not outright destroy it. Consumers are obviously not thrilled by the prospect of paying more, but they also seem game to pick up a lifeline in the form of streaming’s recent shift to ad-supported streaming. Viewers stay plugged into their favorite channels and shows while paying less, or nothing at all, in exchange for ads they enjoy (or at least, don’t hate) anyway.

By the end of 2023, eMarketer predicts, households that don’t pay for TV will outnumber the ones that do, and by 2024, over 158.5 million US viewers — nearly half the country’s population — will be streaming ad-supported content. This ability to save money, watch on-demand content, and get contextually relevant commercials is changing how we think of television and advertising — and that’s going to open up a lot of new opportunities for advertisers, streaming services, and viewers.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.

Resources

1 Hollywood Calls Time on Golden Era of Cheap Streaming (Financial Times)

2 It's Time to Rethink Our Relationships with Streaming Services (The Verge)

3 Free Ad Supported TV: A Guide to FAST Streaming Services (MNTN)

4 1 in 4 Disney+ Subscribers May Opt for Ad-Supported Tier (Adweek)

5 ‘Jury Duty’ Emmy Nominees On Freevee’s Surprise Underdog Comedy Contender That Beat All The Odds – Behind The Lens (Deadline)

6 AVOD Viewers, US, 2023-2027 (eMarketer)