Research Digest

Sticking to Ad Spend Plans in the Face of Economic Uncertainty

by Frankie Karrer6 min read

Abstract

- The advertising industry is facing uncertain times, but ad spend is still expected to rise in 2022.

- During the recession in the 1980s, companies who continued to advertise saw 256% higher sales than their competitors post-recession.

- Brands that kept their CTV campaigns running at the height of economic uncertainty at the beginning of the pandemic saw 26% higher ROAS in the following months than brands that were inactive.

- The Harvard Business Review recommends that brands focus on building a strong brand, maintaining ad spend, and optimizing towards their ROI during a recession.

As marketers gear up for a potential downturn, it’s time to take a look back on previous times of economic uncertainty to know what worked

Ad Spend Expectations Were High in 2021

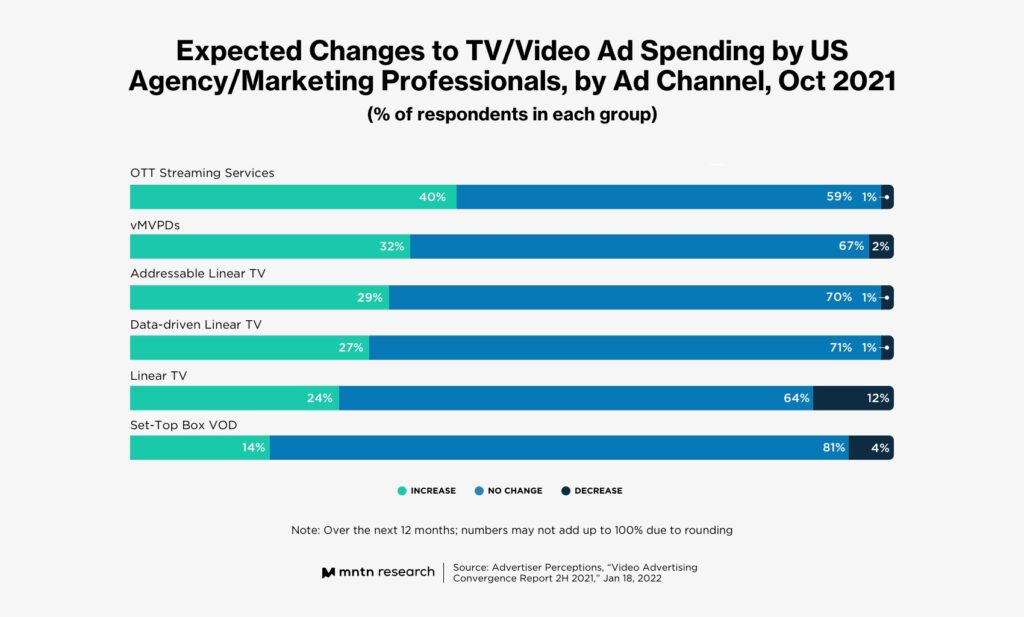

In October of 2021, consumers and advertisers alike were indicating their interest in the rising channel of Connected TV. The number of CTV viewers reached a whopping 218.3 million, and according to data from eMarketer, advertisers planned to increase (40%) or maintain (59%) their ad spend on OTT streaming services, as seen in the chart above.

Of course, this data was collected last year. The last few months have seen a lot of economic uncertainty, with rising inflation, supply chain issues, and an erratic stock market putting many brands on guard.

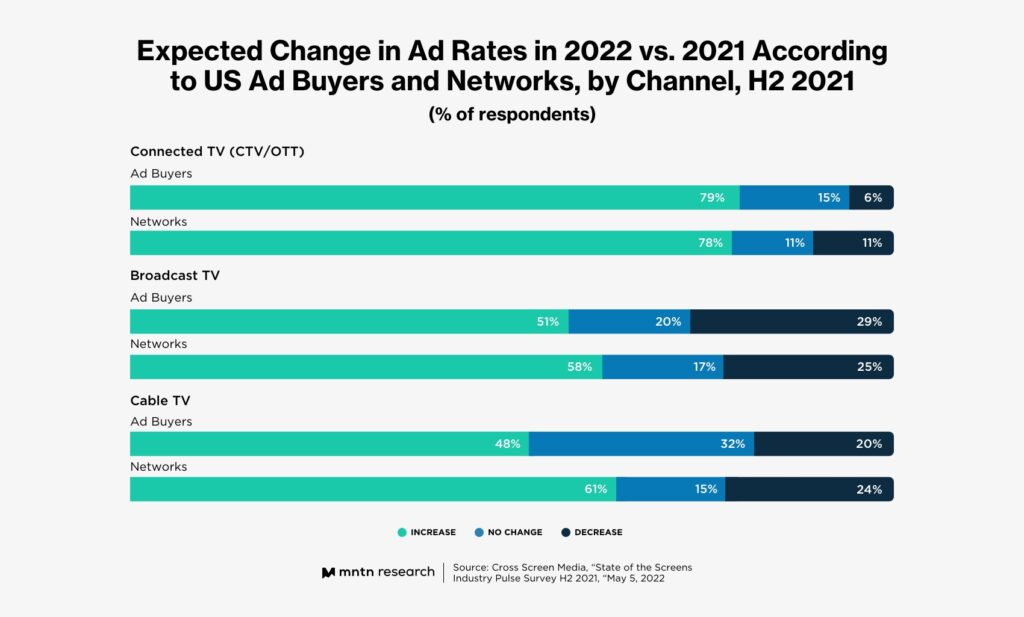

TV ad prices are also expected to rise this year. A study from Cross Screen Media found that 51% of buyers and 58% of sellers said they expected broadcast TV ad rates to increase in 2022 compared with 2021. Cable is expected to have similar rises, with 48% of buyers and 61% of sellers anticipated increases. And on the Connected TV side, 79% of buyers and 78% of sellers are expecting increases.

Outlook on the Future

However, these factors don’t capture the full story. While the way consumers spend has been changing, it remains strong overall. And advertisers seem to know this—according to eMarketer, digital ad spend is still at a record high, and they expect the total ad spend in the US to increase 13.2% YOY this year.

For the TV industry in particular, there are positive signs that advertisers can weather the storm. Industries like financial services, insurance, and healthcare increased their spend on TV advertising as a whole during the pandemic, helping to keep the industry stable. And now, sectors like travel and cinema, which pulled back on TV advertising during the early days of the pandemic, have mostly returned to pre-COVID levels of spending.

And when it comes to TV ad prices, Erin Firneno, VP of Business Intelligence operations at Advertiser Perceptions, says that while, “We will most likely be seeing moderately higher prices in the scatter market this year,” she doesn’t believe there will be a big change in the percentage of budgets that advertisers allocate to upfronts. A report from Insider Intelligence analyst Peter Newman found that the 17.5% decrease in ad spend in 2008 mostly came from mediums like print, which began its decline around the same time. TV and digital ad spend, on the other hand, remained strong for years.

The TV industry is also fairly insulated from concerns about what impact new privacy changes will have on advertising going forward. In fact, eMarketer suggests that some of the troubles that Meta and Snap have been experiencing might actually drive more spend to TV ad channels.

Looking Back on Previous Downturns

So will advertisers continue to follow through with their plans to increase ad spend on Connected TV this year? When we look back on how brands dealt with similar instances of economic turmoil, it becomes clear that they should.

During the the COVID-19 pandemic, while some advertisers chose to reduce their spend, brands that kept their CTV campaigns running in the months at the height of the pandemic’s uncertainty (March-April 2020) saw better outcomes than those brands that were inactive, according to MNTN data. In fact, brands that kept their campaigns live saw 26% higher ROAS in the following months (May-June) than those who were dark the previous two months. They also increased their ad spend 63% in those following months, and still saw positive ROAS growth even with the increased ad spend.

After the 2008 recession, Harvard Business Review did an analysis of those brands that managed to not only remain strong during uncertain times, but even drove significant growth. According to the report, they all had three things in common:

- They built a strong brand: Rather than decreasing spend on channels like TV during the recession, brands like Colgate-Palmolive and Johnson & Johnson made sure to build on the momentum of their previous brand-building campaigns. After all, according to the report, “Brands that are out of sight on the television screen will sooner or later be out of mind for a large percentage of consumers.”

- Maintain Ad Spend: Harvard Business Review found in their analysis that firms who should be “pushing their advantage” if they can during a recession, and maintain their advertising spending captured market share by capitalizing on lower costs. On average, brands that increase their marketing spend during a recession ultimately boost their financial performance in the year following that recession.

- This has also been true during other times of economic uncertainty. In a study of the recession in the 1980s by McGraw Hill, they found companies who continued to advertise during the two-year recession saw 256% higher sales than their competitors post-recession.

- Optimize Towards ROI: Of course, it can sometimes be easier said than done to justify maintaining spend when marketing budgets are often the first thing to go when times are tough. By optimizing towards ROI, marketers can better justify their ad budgets. And since TV has historically been a great channel for brand building but less easy to track, brands have sometimes made the error of cutting it from their lineup. Luckily, the rise of the performance-driven channel of Connected TV has changed that, making it easier than ever for brands to track the returns on TV campaigns and justify those costs.

Conclusion

Though it might sometimes feel like the economic outlook for the advertising industry is gloomy, there are ways to mitigate the effects a downturn might have on marketing efforts. Brands that maintain their ad spend in order to build their brand efforts will have stronger returns post-recession. And with the rise of Connected TV, it’s never been easier to justify ad spend on a channel that has shown itself to be essential when times are tough. Ultimately, it looks like the best way to make it through these headwinds unscathed is to continue the course advertisers set out on when they made their CTV campaign plans for this year.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.

Resources

1 Connected TV Users, US, 2021-2022 (eMarketer)

2 Expected Changes to TV/Video Ad Spend by US Agency/Marketing Professionals, by Ad Channel, Oct 2021 (eMarketer)

3 Fed Official Says 0.75-Point Interest Rate Rise Seems Most Likely in July (The Wall Street Journal)

4 Here's Why You Shouldn't Worry About Supply Chain Issues This Holiday (MNTN)

5 Expect TV Ad Prices To Rise This Year (eMarketer)

6 Inflation Pushes People Back to the Pandemic Playbook (eMarketer)

7 Ad Spending Will Remain Strong Despite a Looming Recession (eMarketer)

8 TV Ad Spending 2022 (eMarketer)

9 Data-Driven Insights From Running 10M+ Hours of Ads: Pulling the Curtain Back on CTV (MNTN)

10 How to Market in a Downturn (The Harvard Business Review)