Research Digest

Why CTV Ad Spend is Increasing Faster Than Projected

by Stephen Graveman5 min read

Abstract

- The gap between linear TV and CTV ad spend is closing fast, as viewers and advertisers continue to cut the cord

- Advertisers are taking note as this year’s ad spend is projected to reach $19.1 billion.

- This explosion in ad spend and viewership numbers has surpassed estimates and timelines

- People are watching more CTV—especially ones that feature ads—for 80 minutes a day in 2021 (up 8.7% from 2020)

Increased advertising spending is changing how audiences, brands, and marketers interact with Connected TV

Connected TV’s continued rise to dominance in the television landscape has been predicted for some time, as viewers continue to leave behind linear TV in favor of CTV. Accelerated by cost-cutting measures and original programming, as well as new habits formed during the COVID-19 pandemic, the rise of streaming services has surpassed expert predictions. As a result, ad spend has also increased faster than expected, as brands cut the cord to pursue their new audience on a service that provides tools previously unavailable for television, including detailed targeting methods and real-time feedback.

Recent research from eMarketer’s US Connected TV Advertising Report examines the trends, data, and strategies being used by marketers with their approach to CTV.

Why Advertisers Are Focusing on CTV

In 2021, more than 213.7 million people a month watched Connected TV, and the average viewer watched at least 80 minutes a day—an increase of 8.7% over the previous year. While the COVID-19 pandemic and subsequent lockdowns accelerated streaming’s grip on the market, viewership and adoption rates did not decline in 2021 despite the arrival of vaccines, increase in travel, and resuming of pre-pandemic habits.

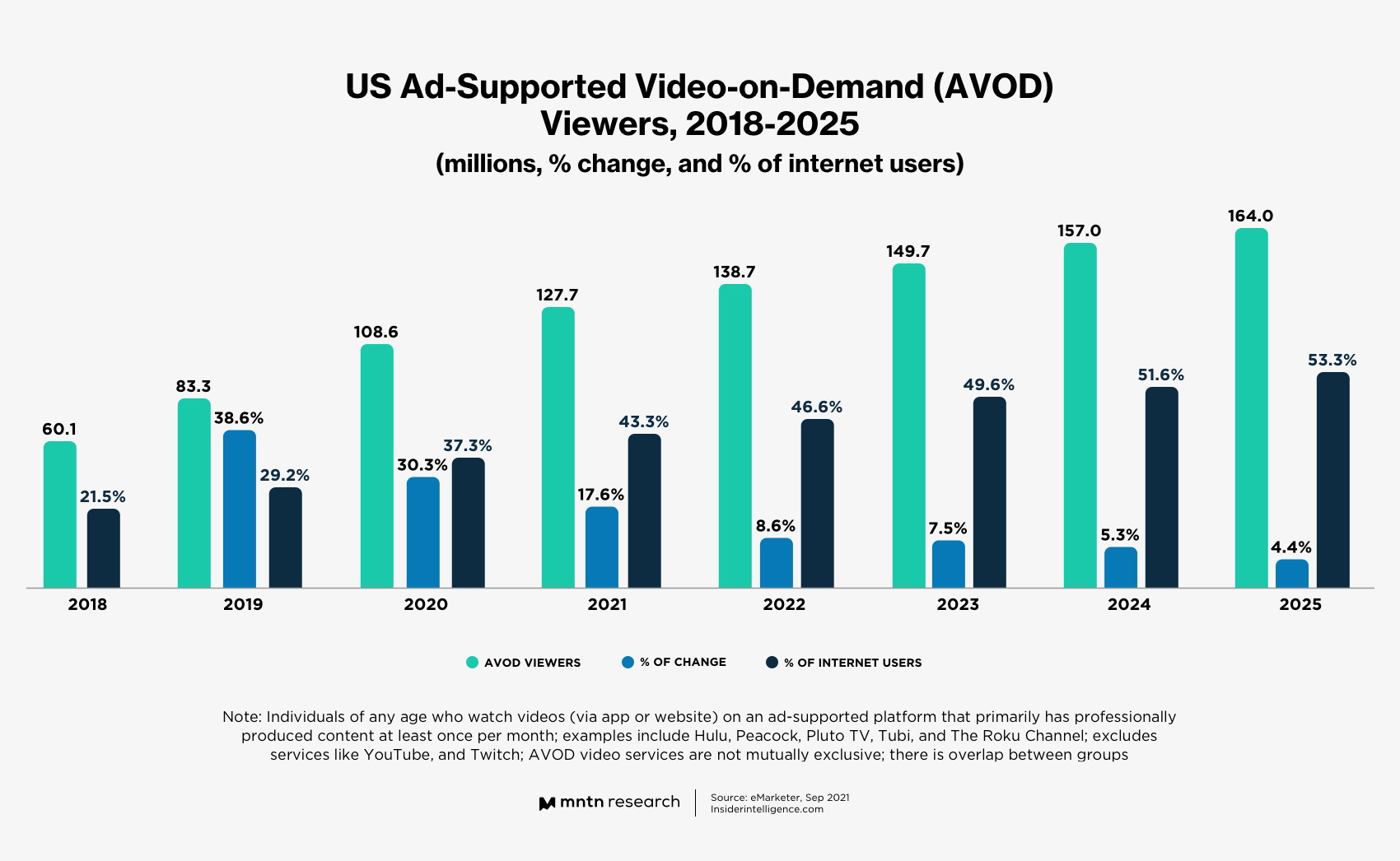

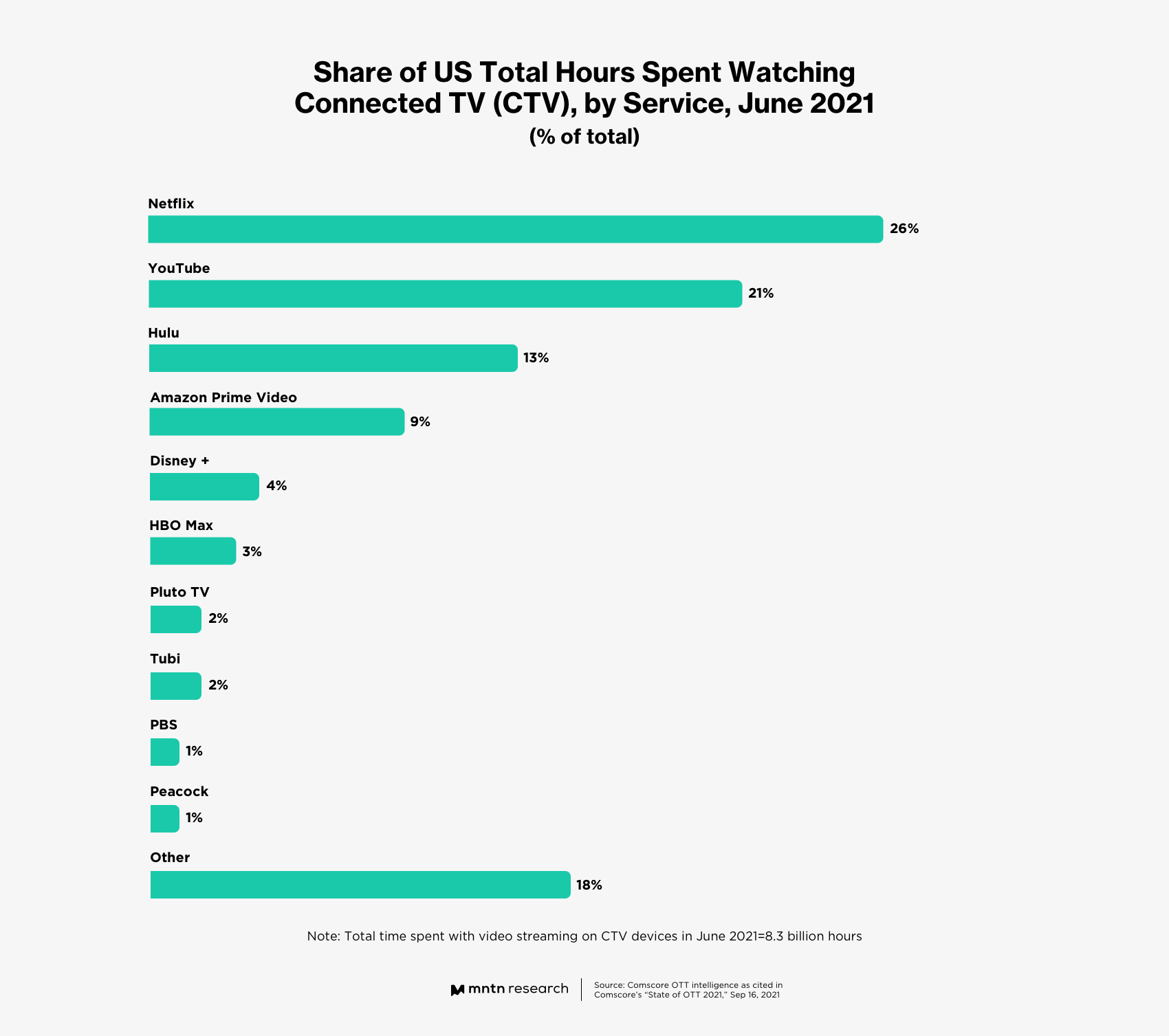

While CTV’s popularity explosion has been a success story, it can be a complex market thanks to streaming services being split into two camps: ad-free subscription services and ad-supported video-on-demand (AVOD) platforms (fig. 1). While ad-free solutions like Netflix, Disney+, and Amazon Prime remain heavy hitters in the space, AVOD services like Pluto, YouTube, and Crackle are gaining ground. Today, AVOD viewers make up close to half of all US internet users, with AVOD channels cumulatively attracting more viewers on CTV than paid subscriptions (fig. 2).

Some streaming platforms like Hulu, HBO Max, Peacock, and CBS All Access, have decided to serve both ad-free and AVOD audiences by offering an ad-supported tier at a discounted cost. Within these offerings, platforms find that their ad-tier subscriptions significantly outnumber the ad-free offerings (Hulu reports that around 60% of all subscribers choose the ad-tier). A 2021 TiVo study found that 79% of streamers would rather use free, ad-supported content than subscribe to another paid streaming service. Similarly, Statista found that nine out of 10 U.S. viewers watch ad-supported content.

Ad Spend Outpacing Expectations

Thanks to this rapidly expanding user base and rise of ad-supported channels, CTV has become a significant piece of advertiser strategy. While CTV ad spend continues to lag linear TV spend, the gap is closing quickly. In 2021, 60% of advertisers polled reported shifting ad dollars away from linear TV and towards CTV and OTT marketing. As the CTV landscape heats up and gets competitive amongst brands, the question for many marketers is no longer “is CTV worth it?” but rather a question of how to execute it strategically.

This change in thinking has moved budgets and mindsets to embrace CTV at an accelerated rate. As a result, the gap between CTV and linear TV has rapidly shrunk in a timeframe faster than expected. In 2019, eMarketer reported that CTV ad revenues were nearly one-tenth of linear TV ad revenues. Now, they project that CTV’s ad revenue will be more than half of linear’s by 2025. Not only has streaming maintained momentum—it has surpassed expectations.

- In November 2020, eMarketer expected that US CTV ad spend would hit $11.36 billion in 2021 and grow to $18.29 billion by 2024.

- Now, it’s projected that ad spend in 2022 will hit $19.1 billion in 2022 and reach $30 billion by 2025.

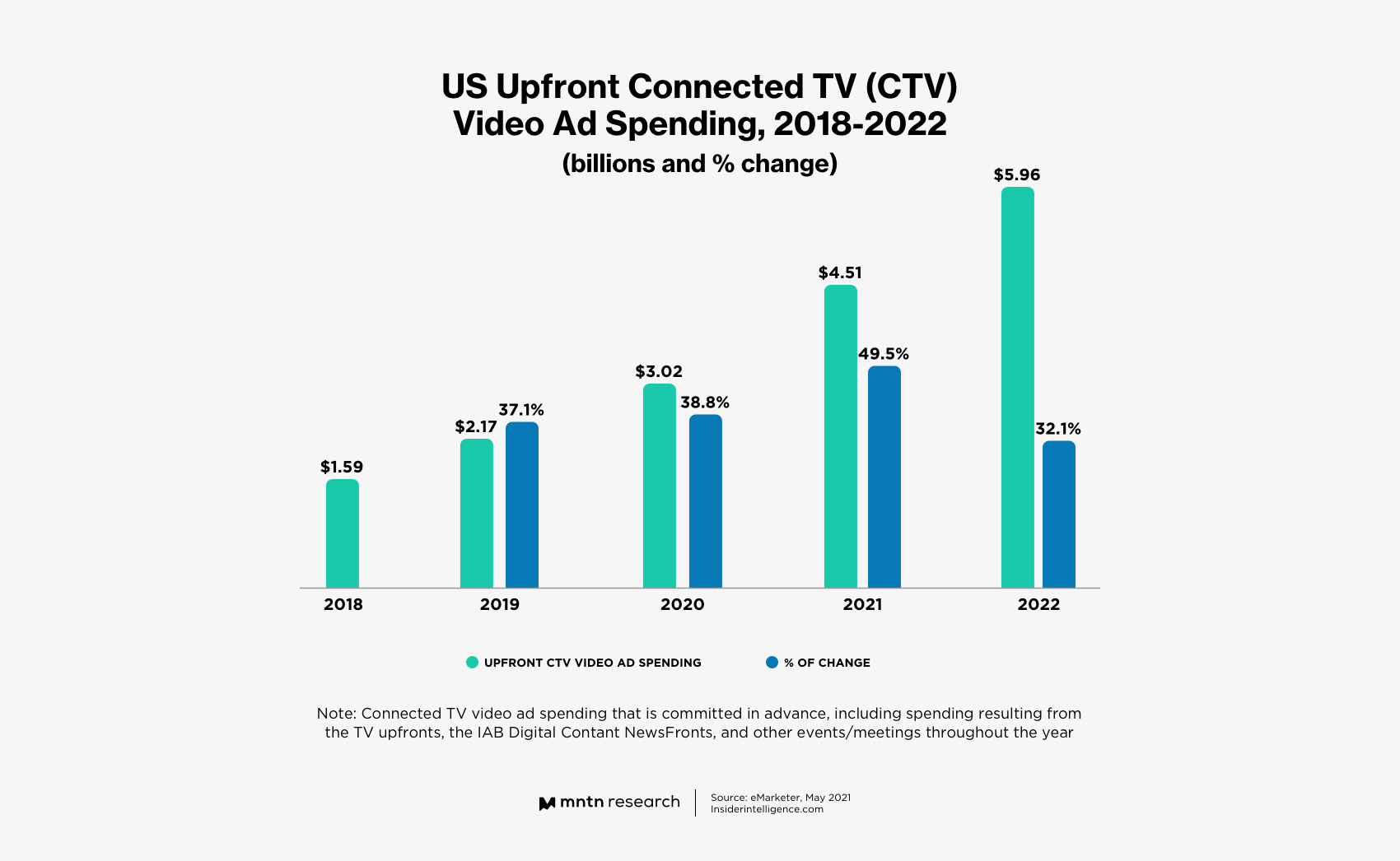

As the CTV environment continues to mature, TV networks are putting more focus on their streaming services, including putting them at the center of their upfront ad selling (Fig. 3). With upfronts, TV inventory is sold in advance in bulk for discounted prices; the rise of CTV in the exchange has led to a significant increase in upfront CTV ad spending, which now accounts for one-third of all CTV ad spend.

Conclusion

Between January and September of 2021, more than 5,000 advertisers ran ads on streaming services, and a recent Mediaocean report finds that 70% of brands plan to increase their advertising investment in 2022. As advertisers think about their campaigns and goals for the rest of 2022 and beyond, it would behoove them to factor in the meteoric rise of CTV and think strategically how it’s being used across advertising, their industry—and by their competitors.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.

Resources

1 CTV and digital advertising: How Connected TV is one of the fastest growing channels in 2022 (Insider Intelligence)

2 Study Shows 81% of Users Want a Free Ad-Supported Tier of Netflix or Prime Video (The Streamable)

3 Roku: Streaming Has Surpassed Linear Viewing, Bigger Push for Shopping (The Streamable)

4 Hulu Continues to See Most Customers Choose Ad-Supported Plan (The Streamable)

5 CTV and digital advertising: How Connected TV is one of the fastest growing channels in 2022 (Insider Intelligence)

6 CTV Users Watch Ad-Supported 47% Of The Time, Are Twice As Likely To Buy After Seeing Ads (MediaPost)

7 Mediaocean 2021 Market Report and 2022 Outlook (Mediaocean)