Research Digest

SVOD vs AVOD: How Consumers are Watching Connected TV

by Frankie Karrer5 min read

Abstract

- The number of AVOD viewers in the US will rise to 140.1 million in 2022.

- Consumer sign-ups for the lower-cost, ad-supported tiers of premium SVOD services totaled 42.2 million last year.

- Connected TV viewers are a valuable consumer group—they have higher levels of income than the general population and are more willing to research brands that interest them.

SVOD still reigns supreme in the CTV space, but with AVOD audiences on the rise, advertisers are presented with an opportunity to reach a valuable consumer group.

As more and more users turn to Connected TV to watch TV content, they tend to subscribe to two main types of streaming platforms: Subscription video on demand (SVOD) and Ad-supported video on demand (AVOD). Each has its own draw for consumers, who might be interested in the lower price point of AVOD services or the ad-free environment of some SVODs.

But over the last year, the line between the two has been fading. Around 25% of US internet users also already watch a combination of the AVOD and SVOD channels, according to data from Ampere Analysis.

Streamers have also been increasing the number of services they subscribe to every year, leading them to find ways to watch content at a lower price point if possible. A report from Nielsen found that 18% of American consumers subscribe to four streaming services in 2022, and 93% plan to either add another paid streaming service or keep the same number in the future. As a result, the growth in the number of streaming services that provide ad-supported content and the consumers who are watching that content are both rising.

AVOD Viewers Are On the Rise

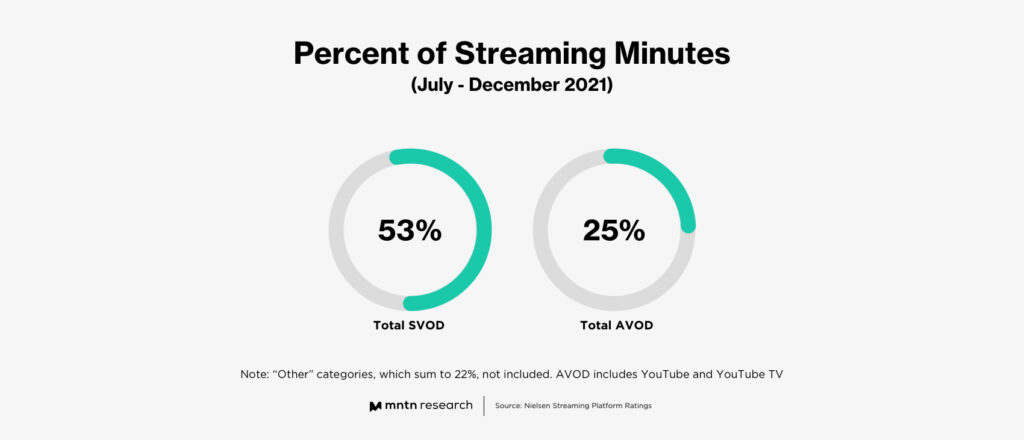

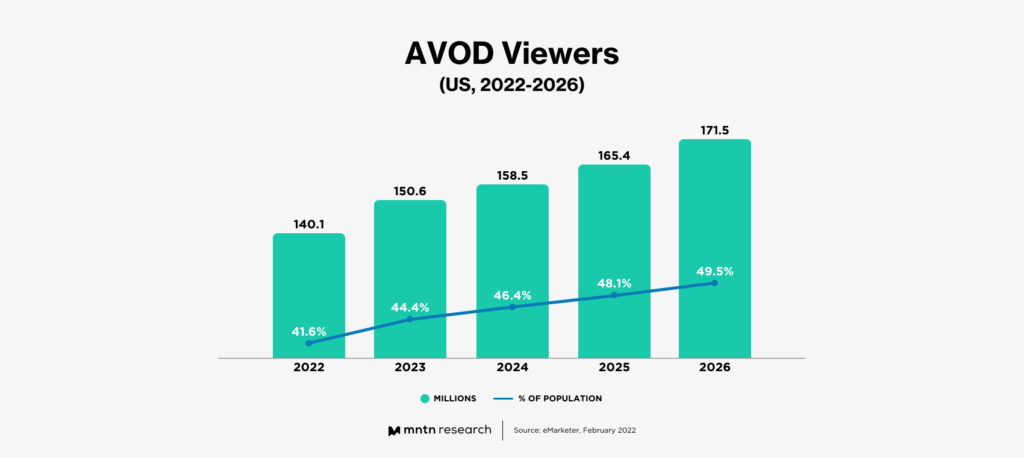

The number of consumers watching AVOD is growing, and expected to continue that behavior in the coming years. eMarketer reports that the number of AVOD viewers in the US will rise to 140.1 million this year, an 8.6% YOY jump. Viewers are also spending more time with AVOD services. Nielsen’s annual State of Play video report found that AVOD now accounts for 25% total streaming time.

While the growth of AVOD audience has slowed somewhat over the last few years (down from 17.7% in 2021 and 30.3% in 2020), by the end of 2022 AVOD viewers will make up more than 54.3% of all digital video viewers in the US.

Many streaming services have been looking to capitalize on the opportunity that AVOD audiences represent:

- Many new AVOD subscription services popped up during the pandemic, including Paramount+ and Peacock.

- Hulu has always had both ad-free and ad-supported tiers for viewers to watch, leading them to hold a 13% market share—putting them at third in the lineup behind Netflix and Amazon Prime.

- Historically ad-free SVOD platforms have started to explore ad-supported tiers. HBO Max included this offering just this year, and Disney+ is preparing to launch their own in hopes of adding 30 million viewers by 2024. Warner Bros. Discovery has also indicated an interest in an ad-supported tier, stating in their Q4 2021 earnings call that the free tier would help them reach more people and make use of content that paying subscribers aren’t watching as much.

- Due to a loss in their subscriber base after hiking their prices, Netflix will be adding an ad-supported tier as soon as this year.

Current SVOD Viewer Numbers

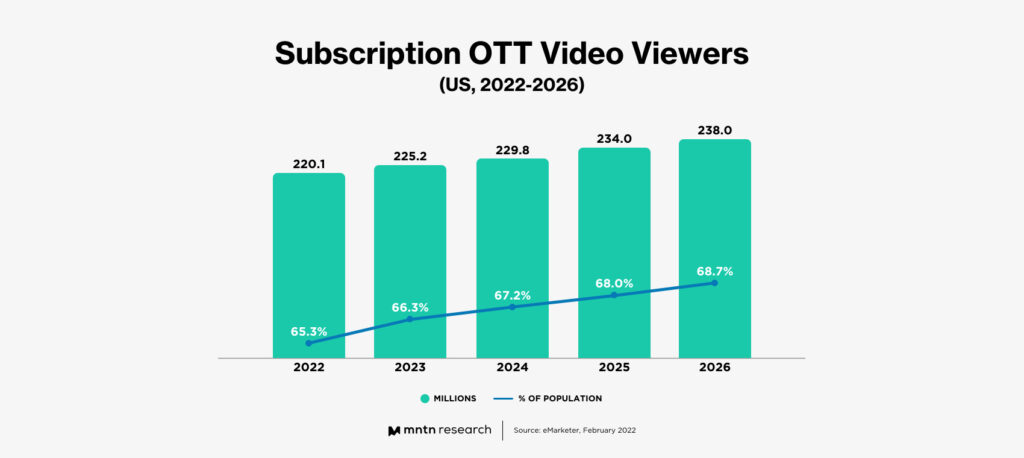

Even with AVOD’s recent gains in audience signups and time spent, SVOD platforms are still the leaders in the Connected TV space. These services account for 53% of all streaming time, and around 220.1 million viewers (65.5% of the population). By 2026, eMarketer expects that that number of viewers will rise to 238 million subscribers.

But even in those SVOD services, their ad-supported content has attracted a lot of viewers. Antenna found that in 2021, consumer sign-ups for the lower-cost, ad-supported tiers of five major premium SVOD services totaled 42.2 million. This jump in users accounted for 32% of total sign-ups for those SVOD services.

Why Does this Matter for Advertisers?

As more viewers spend time with AVOD and ad-supported tiers through SVOD services, advertisers who run their campaigns on Connected TV will have an even bigger audience pool to work with.

Connected TV viewers are also an extremely valuable consumer group, for a number of reasons.

- A report from Amazon found that they average higher levels of income than the general population, giving them more purchasing power than their counterparts. They also are more willing to research brands that interest them, and once they find a company that they like, connected consumers will tend to stick with them for future purchases.

- CTV viewers also tend to skew younger which makes them less averse to TV advertising—80% of CTV watchers ages 18-34 are watching streaming for at least an hour through AVOD or vMVPDs on a weekly basis.

- Nielsen also found that AVODs tend to attract more diverse audiences than both traditional linear TV and SVODs—36% of Pluto TV’s viewing audience and 39% of Tubi’s are Black, over twice as many as linear TV (17%).

For more information on the demographics of CTV viewers, we wrote a breakdown of the different generations of consumers watching CTV in this research digest.

Conclusion

Ultimately, as consumers continue to indicate their interest in AVOD content to offset the sometimes high prices associated with maintaining multiple subscriptions, it looks like many services are looking to capitalize on those numbers by including ad-supported content tiers in their lineups. And considering the high-income levels and curiosity associated with these consumers, advertisers running their campaigns on Connected TV are primed to benefit from this transitional period.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.

Resources

1 Who Are Connected Consumers and How Can You Engage and Delight Them? (Adweek)

2 Over Half of Consumers Want a Streaming Bundle Option (eMarketer)

3 US Average Time Spent per Day with Subscription OTT Video Forecasts (eMarketer)

4 Market Share of SVOD Platforms in the U.S. (Statista)

5 Netflix Tells Employees Ads May Come by the End of 2022 (The New York Times)

6 AVOD Viewers Make Up More Than 50% of US Digital Video Viewers (eMarketer)

7 AVODs Now Account For 25% Of Streaming Consumption (MediaPost)

8 Warner Bros. Discovery’s Streaming Service Learns From Peacock, Could Soon Offer a Free, Ad-Supported Tier (eMarketer)

9 Report: 50% of US Population to Stream AVOD Content by 2026 (Media Play News)

10 Generational Breakdown: Who is Watching Connected TV? (MNTN Research)

11 Over-the-Top (OTT) Video Service Users, US (eMarketer)

12 Lower-Priced, Ad-Supported Tiers Drew 32% Of SVODs' Total Sign-Ups In 2021 (MediaPost)