Research Digest

Identifying and Reaching the ‘Movable Middle’ on Connected TV

by Melissa Yap5 min read

Abstract

- Reaching the movable middle yields better results for advertisers, with more than 50% lift in return on ad spend (ROAS) and better market penetration across all buyer types

- Brands can drive higher performance through reallocating their marketing dollars to segments where their brand’s movable middles are most prevalent.

- An outcome-based plan outperforms the reach plan by reaching receptive new buyers and driving both higher revenue and ROAS.

Connected TV advertising works best with an audience-first, instead of content-first approach, which raises the age-old question, “How do I find the sweet spot in the first place?” Audience segmentation is much more than demographics and simple economic factors, and Connected TV goes beyond these to capture the diversity of consumer behavior. This research digest dissects “movable middle” and how to reach them on Connected TV.

Who is the “Movable Middle”?

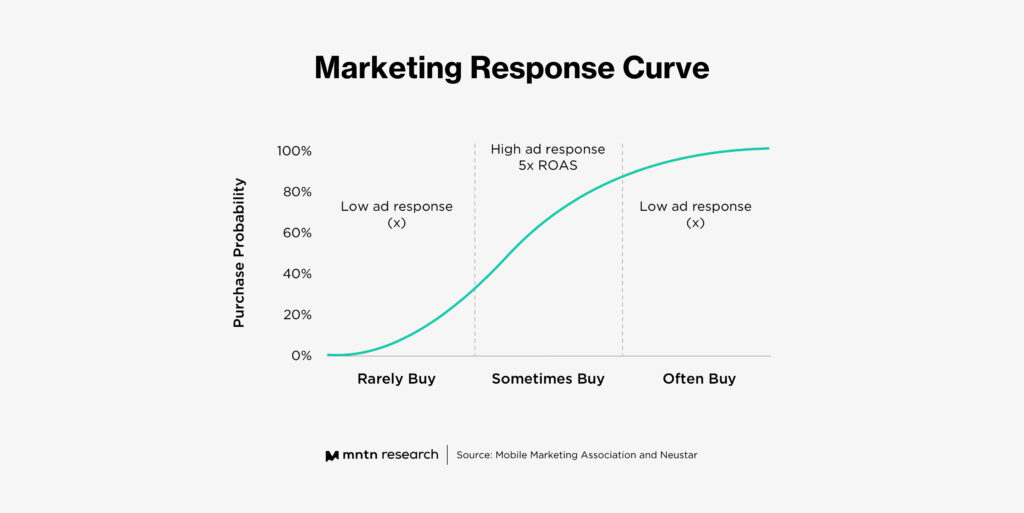

The “Movable middle” is defined as open-minded consumers by their mid-range (20% – 80%) probability of buying a particular brand—an often ‘forgotten’ audience segment with the highest propensity to purchase and be responsive to a brand’s marketing efforts.

This group makes up a larger proportion than loyal customers, giving marketers interested in multiple outcomes—like ROAS and market penetration—a much bigger target to work with. The movable middle is often confused with ‘swtichers’, defined as a purchasing pattern characterized by a change from one brand to another; and ‘heavy buyers’, defined as brand loyalists who regularly purchase from the brand. While these two groups are defined only by their past purchase behavior, movable middles are different because they cut across all levels of past purchase behavior (in other words, some of these audiences may never have bought the brand before).

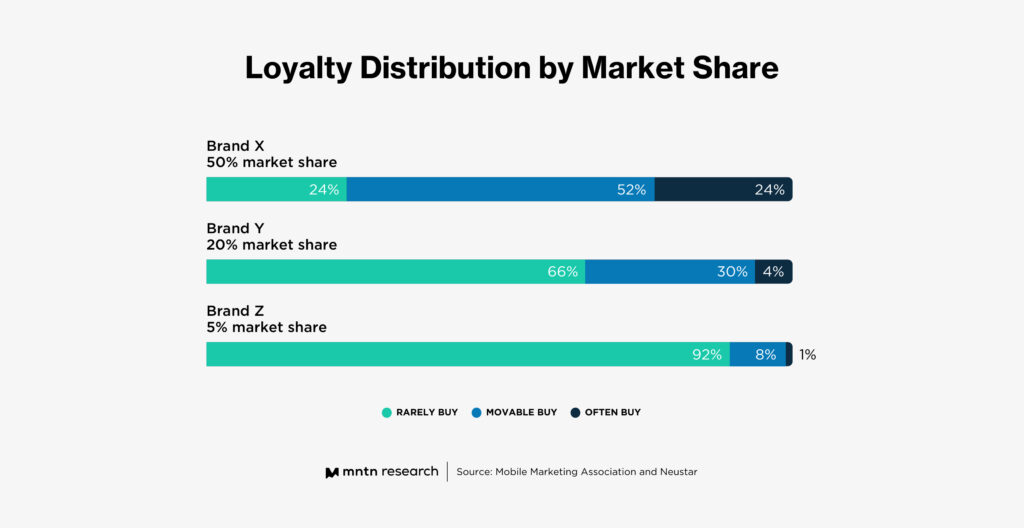

The size of this group varies by brand and their market share, as shown in the chart below.

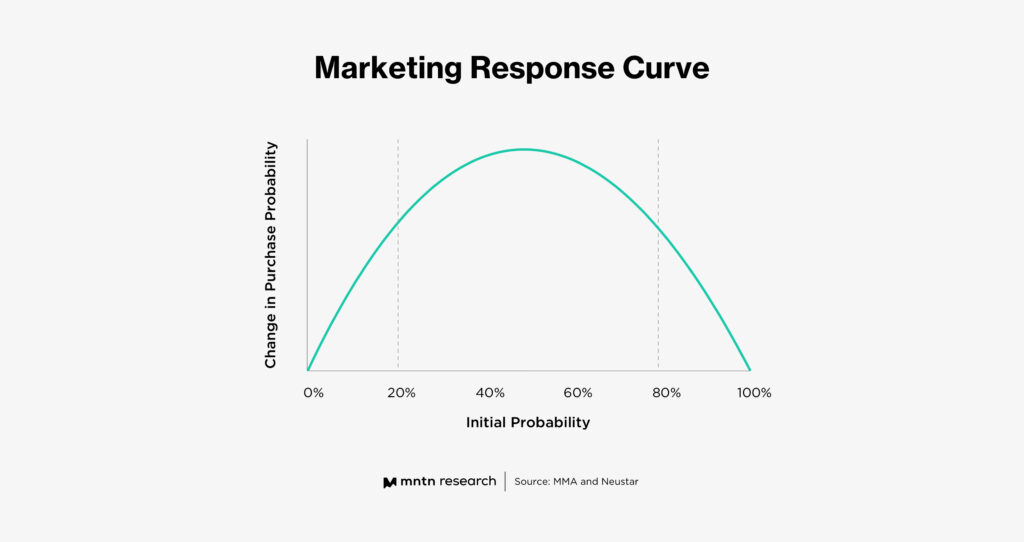

Additionally, we can see below that the movable middle is more responsive to marketing efforts, which illustrates a consumer’s anticipated purchase lift probability (due to marketing exposure) against their initial purchase probability.

Targeting the Movable Middle With an Outcome-Based Marketing Strategy

A research paper by Mobile Marketing Association and Neustar formulated an approach to first identifying the movable middle, and then targeting them with an outcome-based marketing strategy.

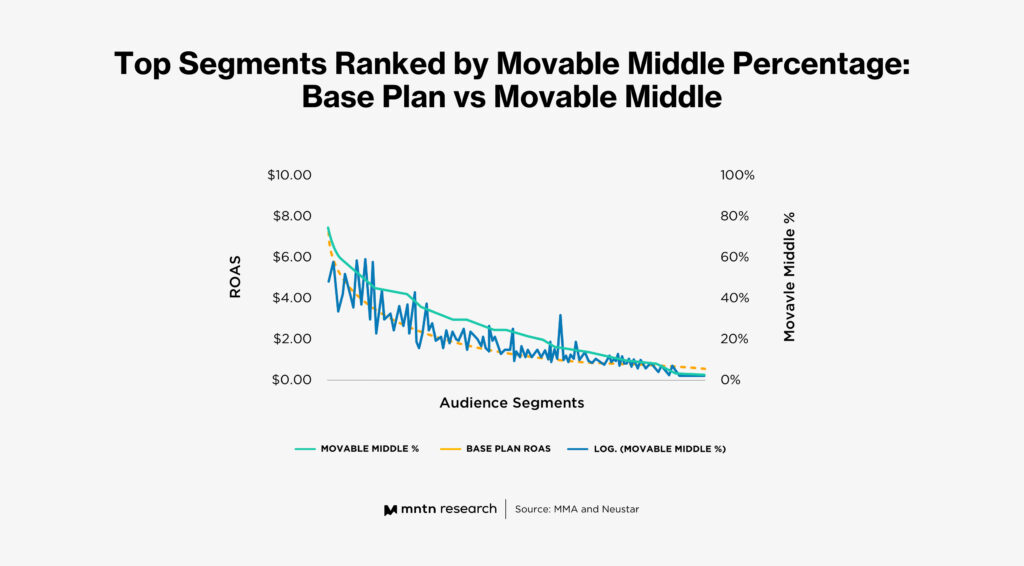

The research study used agent-based modeling (ABM) to simulate multiple markets across a variety of brands, market shares, repeat-buying patterns, ad responsiveness and media allocation scenarios. This sample of 632,000 consumers were then grouped into 172 segments based on shared demographic and life stage factors, and ROAS was computed for each segment from a base media plan (which reflects current practices, CPMs and standard media allocation trends across CTV, desktop video, mobile video, desktop display and mobile display).

The next stage was to rank all segments in descending ROAS order. The chart above shows how the movable middle is distributed across those segments—a media plan that pinpoints the top-performing segments is likely to generate the highest returns.

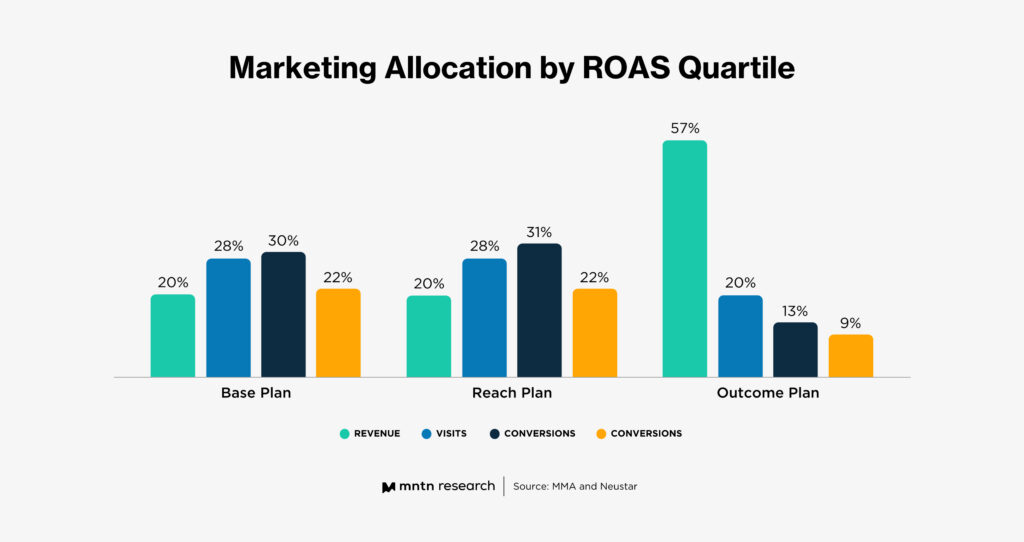

The outcome-based media plan aims to target the movable middle by reallocating marketing budget according to the performance lift across each marketing channel (shifting dollars from digital video to Connected TV, for example), with the remaining budget to be served across audiences based on their likelihood to consume each media. When paired side by side with other conventional media plans (namely, a base and reach-based media plan), it’s clear the outcome-based plan weighs heavily on the top segment quartile that is likely to resonate with the brand.

The study reveals that the outcome-based plan outperforms the reach plan by over 50% on ROAS while reaching more consumers and achieving higher market penetration.

Adding Connected TV Into the Mix

This strategy can be applied when incorporating Connected TV, since CTV advertising can be built off performance-based outcomes, like ROAS. This makes it an easier exercise to A/B test different audience segments and compare ROAS side-by-side to assess the highest performing audience.

Additionally, advertisers should pay close attention to creative best practices to aim for the best possible outcomes—such as including a persistent URL, a clear call-to-action and intent-driven messaging (whether that be through voiceover or copy) to encourage users to take action.

Conclusion

Research shows that advertisers should aim their marketing efforts at the ‘movable middle,’ an audience segment with the highest propensity to purchase and are most receptive to marketing efforts—with a ROAS as much as five times greater than the rest of the population. In order to do so, brands should assess and rank their audience segments based on ROAS, and first prioritize their budget to the top-performing segments and then reallocate the remaining budget across the marketing mix. This outcome-based approach is proven to outperform other types of media plans (like the reach plan) by over 50% on ROAS. Connected TV is a natural fit for this type of media plan, since it is built with performance marketing outcomes in mind (like ROAS). Advertisers should apply an A/B test approach across different audience segments and also pay close attention to creative best practices to optimize performance.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.