Analysis

How Connected TV Will Weather the Great Content Drought of 2024

by Jacob Trussell6 min read

Abstract

- The entertainment industry strikes of 2023 have concluded, but that doesn’t mean new content will be ready to launch by the start of next year.

- Advertisers will need to plan around a lack of new content by shifting their budgets to platforms with large libraries of rerun content.

- By focusing on reruns, advertisers will be able to maintain their performance goals as they wait for new content to ramp back up.

It’s been a dramatic year in the entertainment industry, and we’re not just talking about Love is Blind’s epic live-stream fail. No, Hollywood was upended in 2023 by a pair of strikes by the Writers Guild of America (WGA) and the Screen Actors Guild (SAG-AFTRA) that brought the entertainment world to a standstill.

But after four tumultuous months of negotiations, the WGA, SAG-AFTRA, and the Alliance of Motion Picture and Television Producers (AMPTP) came to an agreement and the strikes concluded in early November. But we’re not out of the woods yet. As the entertainment industry ramps back up production, advertisers will still feel the lingering after effects of the strike: namely, it’s going to take a few months to back fill the content pipeline as TV shows and movies resume filming.

Understandably, the dearth of new shows has created some anxiety for advertisers. Without fresh content bringing in audiences, will there be enough eyeballs on ads to justify budgets? We can assuage that anxiety right here: yes, there will still be plenty of eyeballs to go around. Because it’s important to remember that audiences stream far more than just new shows on Connected TV. They binge their favorite comfort watches; they finally check out that one series that’s been on their to-watch list for years. And as the content drought continues, we expect that behavior to increase.

Rerun Content Takes Center Stage

As audience behavior shifts in response to the scarcity of new shows, advertisers are keeping a finger on the pulse of this trend and reallocating their ad dollars accordingly.

Based on a recent survey from Guideline, ad spend for rerun content has increased to 79%, while spend for new content has dropped to 21%. This is the lowest it’s been since the pandemic, and a 10% decrease from May.

This shift is noteworthy, but not wholly unexpected. Based on historical data, rerun content typically receives a larger share of ad budgets, averaging 59% over the past 6.5 years compared to 41% for new programming.

The rationale behind this ad dollar disparity becomes evident when you consider that many viewers subscribe to streaming services primarily for access to classic shows, like “The Office” on Peacock or “Friends” on Max. Therefore, one immediate strategy to mitigate losses through early 2024 is to redirect advertising budgets towards platforms that house large collections of rerun content.

Streaming Audiences Prefer Reruns

While nearly every streaming platform offers rerun content, not all platforms’ content libraries are created equal, in depth or variety.

Experts expect platforms with extensive libraries will benefit significantly from the shift in ad budgets. Peacock, for instance, caters to various demographics with classic content like “The Carol Burnett Show” for older audiences and complete seasons of “The Office” and “Parks and Recreation” for Millennials and Gen Z.

Free Ad-Supported Streaming TV networks (FASTs) are poised to thrive even more. According to research shared by eMarketer, 57% of TV viewers already tune in to such networks. FAST channels encompass both on-demand libraries of free content and dedicated live-stream channels for specific shows (like Freevee’s The Addams Family channel), offering advertisers ample opportunities to target diverse audiences. When selecting the most suitable platform or channel for their current and upcoming campaigns, advertisers should focus on their target audience’s age, interests, and viewing habits.

But What About Reality TV?

During the last WGA strike in 2007-8, the entertainment industry produced more reality TV content to make up for the lack of new scripted content. Anticipating a similar scenario in 2024, industry experts foresee a resurgence of reality TV.

Reality TV might offer an interim lifeline for studios and advertisers, but it’s essential to temper expectations about how effective and engaging reality shows ultimately are for the majority of audiences.

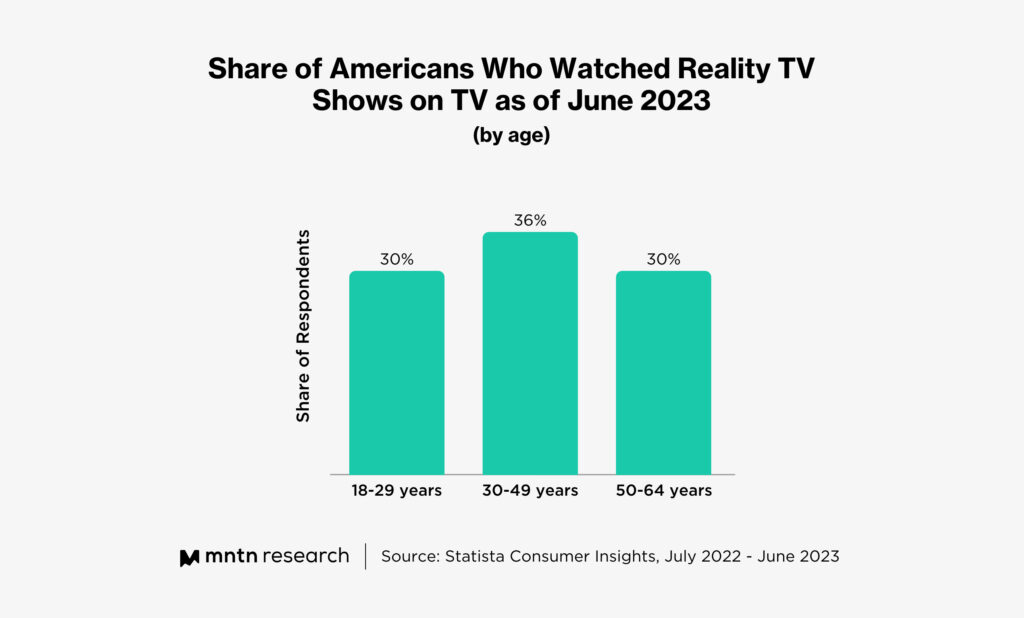

Statista data from June 2023 reveals that less than 40% of TV viewers actually watch reality shows. This figure varies across age groups, with 18 to 29-year-olds at 30%, 30 to 49-year-olds at 36%, and those aged 50 and older back down to 30%.

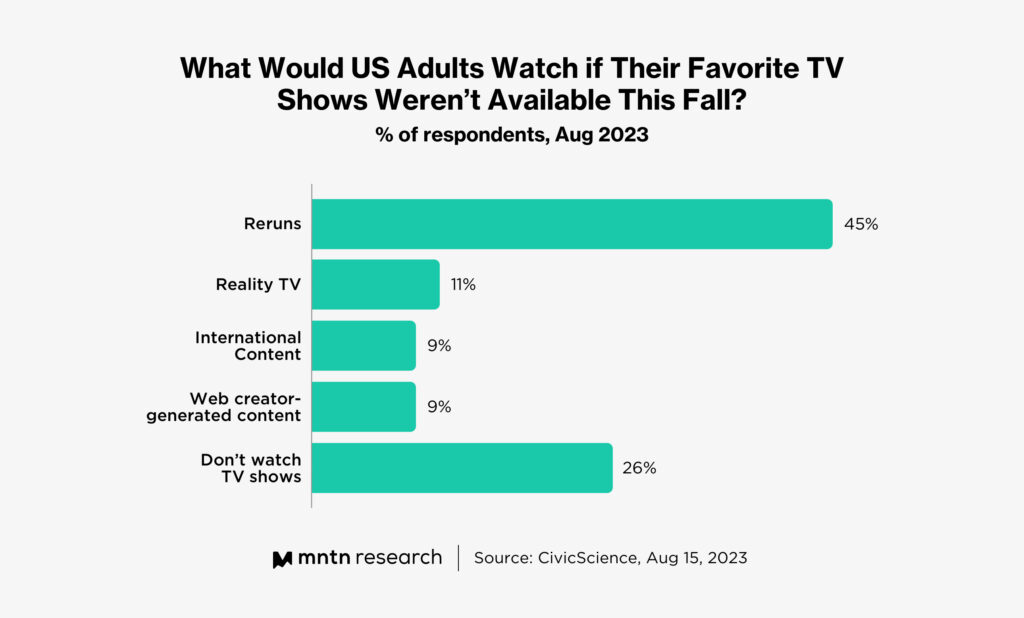

Furthermore, according to a survey from CivicScience that asked, “What would US adults watch if their favorite TV shows weren’t available this fall?” 45% said they would watch reruns, while only 11% said they would watch reality TV.

In other words, relying solely on reality TV may limit which audiences advertisers are ultimately able to reach.

A Silver Lining for Advertisers

Despite the challenges posed by a lack of new scripted content for the foreseeable future, there’s also a silver lining for advertisers. Through this period, Connected TV will only further prove itself as a resilient advertising platform capable of weathering any upheaval in the market. As the data shows, there will always be eyes on television content, so advertisers should feel empowered to maintain an “always-on” approach with their CTV advertising, following their audiences to the platforms where they consume the most content, be that new shows or all-time classics.

Still, if advertisers want to succeed as the content landscape evolves in the coming months, they must take a proactive approach. In addition to understanding audience interests and behaviors, they must also diversify their ad inventory to target the right channels. Advertisers should constantly assess each channel they run ads on to prioritize the platforms that can push the needle. Bigger channels aren’t always better, either; consider niche platforms (like the aforementioned FAST networks), which can offer more bang for your advertising buck.

Overall, the main goal should be to stay agile. If one channel fails to yield results, swiftly shift those budgets to more promising avenues. Tools like MNTN Performance TV facilitate quick-turn changes in campaign strategies, making it easy for advertisers to seamlessly follow audiences as they switch between platforms and channels.

So sure, there’s a big question mark on what the content landscape will look like at the start of the new year. But don’t hesitate — and certainly don’t shift your budgets away from TV. Instead, redistribute them as you diversify your inventory to find new audiences as they binge old content.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.