Research Digest

Cable TV Subscribers Pay $1,618 a Year for Channels (and Ads) They Don’t Watch

by Stephen Graveman6 min read

Abstract

- The average U.S. consumer pays $1,600 annually for cable TV channels they don’t watch

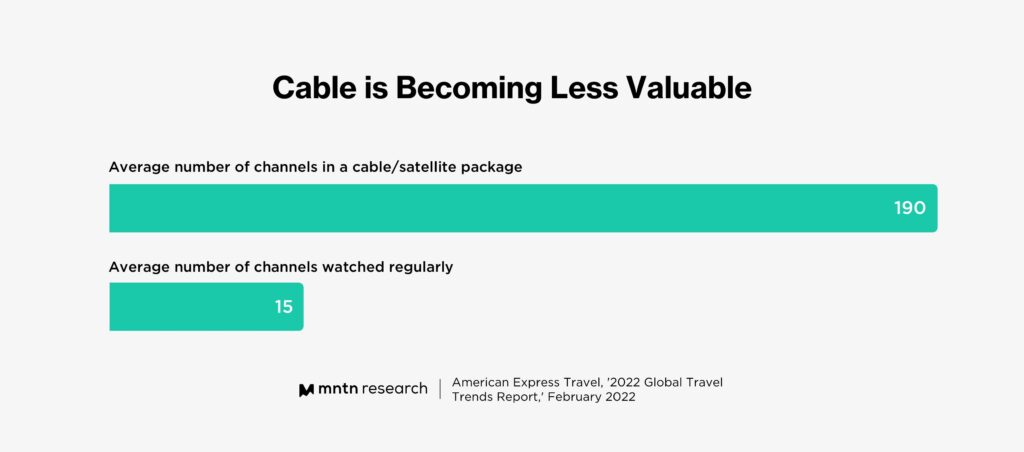

- These audiences typically have access to 190 channels but only watch 15

- Meanwhile, the cable bill has grown 52% in the last three years—speeding up cord-cutting

- 4 out of 5 linear TV customers wish they could pay for just the channels they watch, similar to the streaming model

Today’s audience has more options for entertainment than ever before, and the explosion in streaming services—as well as changing consumer behaviors during the pandemic—has led to more audiences cutting the cord on their cable bill. In 2021 alone, over 4.7 million households cut the cord, and about 1.95 million homes left major pay-TV providers in just the first quarter of 2022. Today, the current cable TV market share is under 50% globally.

Despite this sea change in TV consumption, roughly 90 million subscribers still pay for cable TV in the United States—the third-largest market behind China and India. But a recent study has shed new light on just how much value these cable TV subscriptions are providing, as the average bill continues to skyrocket. Even more alarming for advertisers—most channels (and ad placements) aren’t even being watched in the first place.

Cable is Becoming Less Valuable

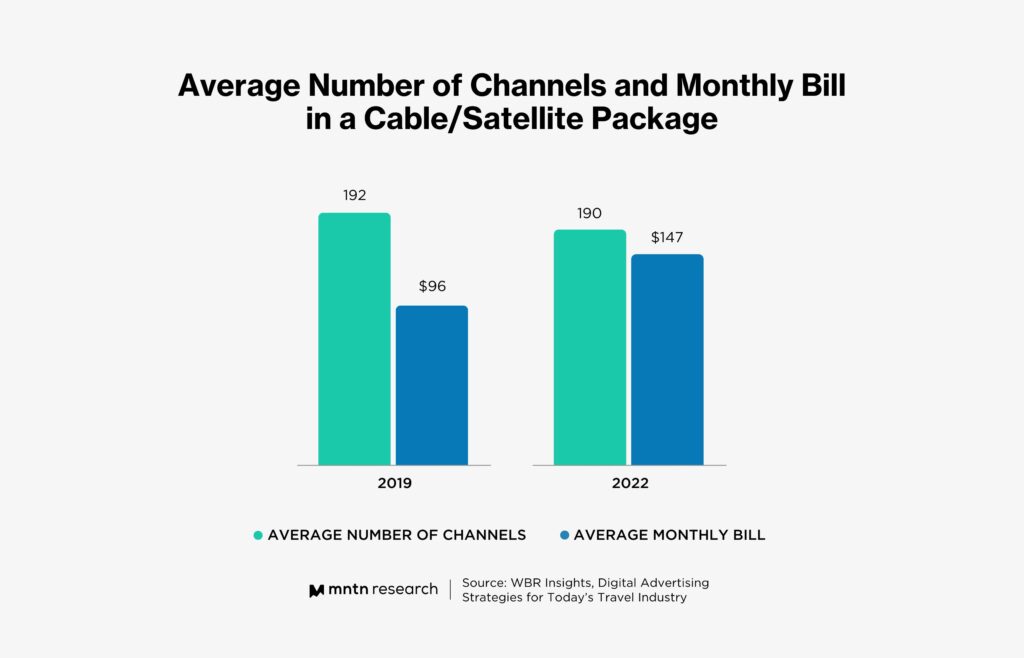

A recent study from CordCutting.com found that while the average number of channels in a cable package has dropped since 2019, the average bill has grown exponentially—from $96 to $147 a month. That’s an increase of 52% in just three years, pushing the price-per-channel cost from $0.50 to $0.77. That’s three times the cost of inflation, at a time when consumers are being more budget-conscience about their entertainment spending.

But perhaps more alarming than the rising costs is that the study found almost all of the channels in the average cable TV package go unwatched.

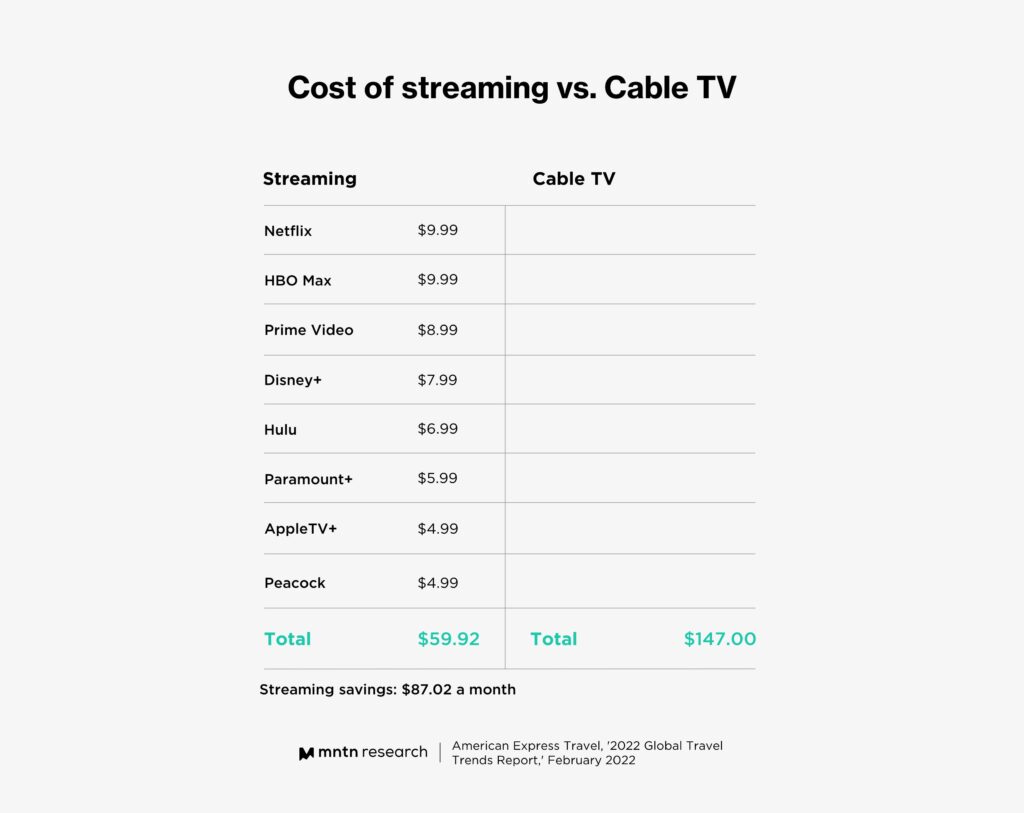

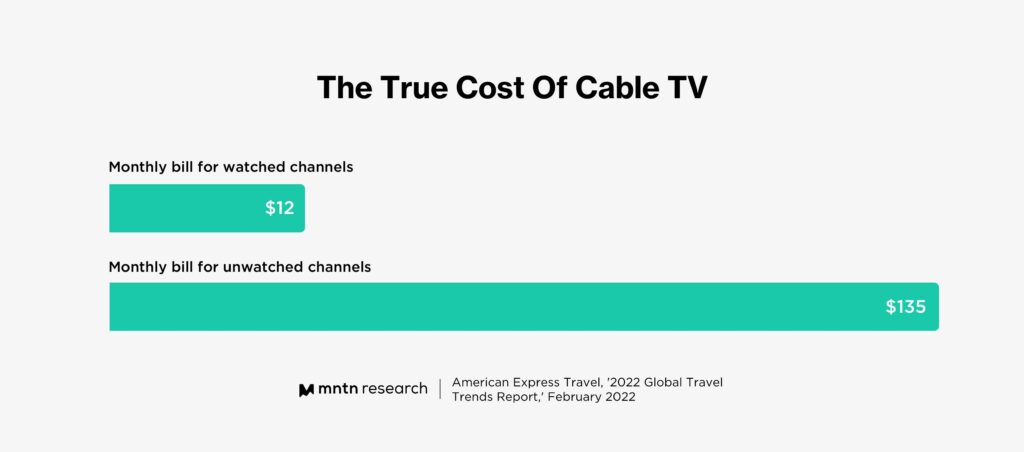

Despite having access to almost 200 channels, the average viewer just watches 15. That leaves 92% of channels unwatched by the average American consumer – and it means that the already-rising cost of cable TV is secretly much higher. A monthly payment of $147 to watch just 15 channels results in a true cost of $9.57 per channel – an amount that either exceeds or rivals the cost of leading streaming services.

In fact, for less than one-third of the cost of the cable TV bill, consumers could get a monthly subscription to all of the major services—and still get access to all of their favorite broadcast and cable TV shows on services like Hulu, Paramount+, Peacock, and HBO Max.

As a result, the average consumer is wasting $135 every month—or $1,618 a year—on channels that they don’t watch. For viewers that watch even less than 15 channels, that cost continues to rise.

Implications for the Cable Industry

The rising cost of cable TV—and the amount of unwatched channels that get forced into packages—is causing growing frustration amongst subscribers at a time when the cable TV industry cannot afford to lose any more ground to streaming.

Over half of all customers polled—62%— think they’re wasting money on their monthly TV bill. Further, 45% say they’d cancel their subscription altogether if their cable wasn’t attached to the internet provider—a sign that cable’s strategy to bundle services together and keep people subscribed is causing people to feel “locked in” rather than elect to pay for cable TV. As the monthly bills—and frustrations—grow, these consumers will likely start looking for alternatives, including ISPs that don’t force cable TV packages.

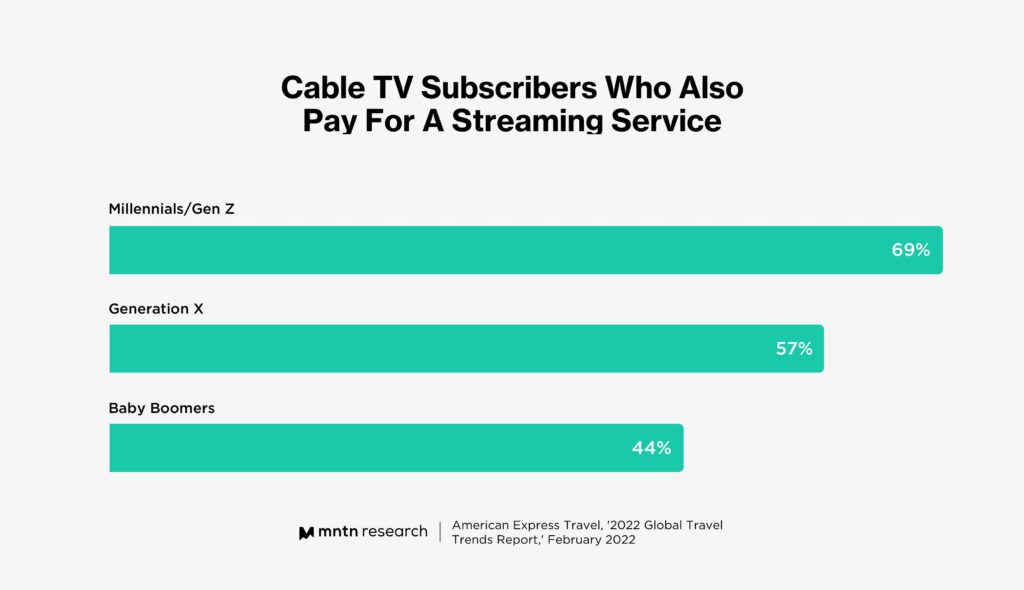

Even satisfied cable TV audiences aren’t staying completely faithful to their provider. Even if they have yet to cut the cord, the majority of cable TV subscribers are at least flirting with the idea. Over 54% of all cable TV customers polled pay for at least one additional streaming service—and the generational breakdown may surprise you.

While it’s not surprising that Millennials and Gen Z lead the pack, even nearly half of all baby boomers are experimenting with streaming content. This growing familiarity with Connected TV is impacting how subscribers view their relationship with cable—four out of five customers wish they could pay for just the channels they want, wishing that cable TV was more like streaming.

What This Means for Advertisers

Advertisers buying media placements on cable TV are looking at two separate, but equally important, conflicts in this report. First, as cable TV packages continue to rise in cost, audiences will likely increasingly get agitated and look for alternative solutions—driving up the rate of cord-cutting and lowering the number of impressions on each ad buy.

Second, the revelation that over 92% of channels go unwatched means that finding the right audience with your ad—an already tricky proposition thanks to cable’s lack of targeting and measurement—is suddenly more difficult. Now brands have to not just worry about the ads being relevant to the audience, they have to worry that their money is being completely wasted on channels that the viewer doesn’t even watch—or know exist.

Conclusion

With the increasing shift of ad dollars going to CTV (often being pulled from both linear TV and social media budgets), it’s clear that advertisers are chasing their customers to this new opportunity. CTV offers advertisers a broader reach, the ability to target your ideal customer regardless of when or what they’re watching, and the measurement to provide meaningful ROAS metrics.

Barring any kind of seismic shift in public sentiment, CTV will continue to overtake its cable TV forebearer as prices continue to increase, audiences cut the cord, and advertisers follow.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.

Resources

1 Major Pay-TV Providers Lost About 1,950,000 Subscribers in 1Q 2022 (Leichtman Research Group)

2 2022 Update: Paying for Channels You Don’t Watch (Cordcutting)

3 5 Reasons The Cable TV Industry Is Dying (Investopedia)