Why Inflation and the Rising Costs of Streaming Are Driving Viewers to Ads

by Stephen Graveman7 min read

Abstract

- Streaming TV is more popular—and more expensive than ever.

- In one year, the overall monthly fee for all services combined climbed 20%

- While consumers are cutting back on spending, they’re not unsubscribing—they’re just migrating to ad-supported streaming

- By 2024, nearly half the U.S. population is expected to use ad-supported streaming

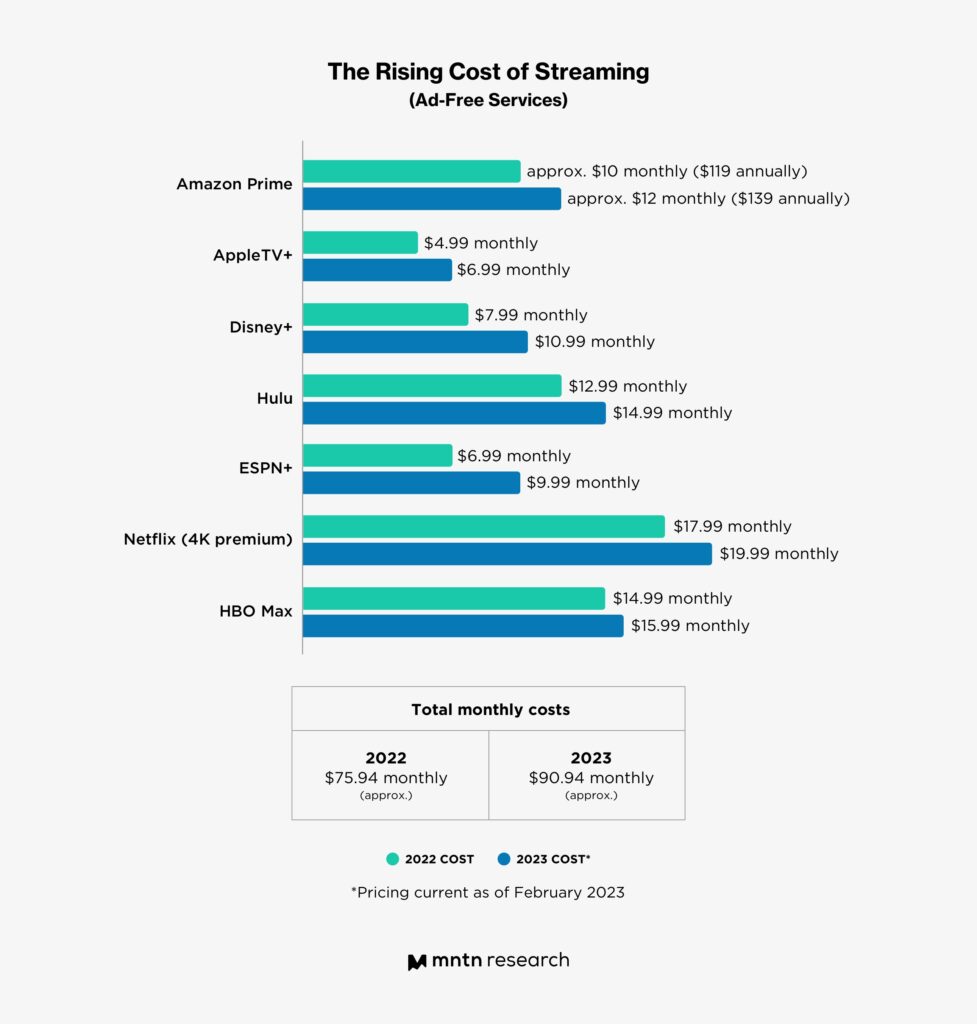

As we enter 2023, Connected TV is more ubiquitous, more popular, and more expensive than ever. In the past year, almost every major streaming service—aside from Paramount+ and Peacock – raised their prices for ad-free streaming (Fig. 1). Some of these price increases were a surprise; AppleTV+’s increase of 40% marked the first time the technology company raised its rates. Others were less shocking; Netflix raised its prices four times in the last five years. In one year the monthly fee for all of these services combined climbed nearly 20%.

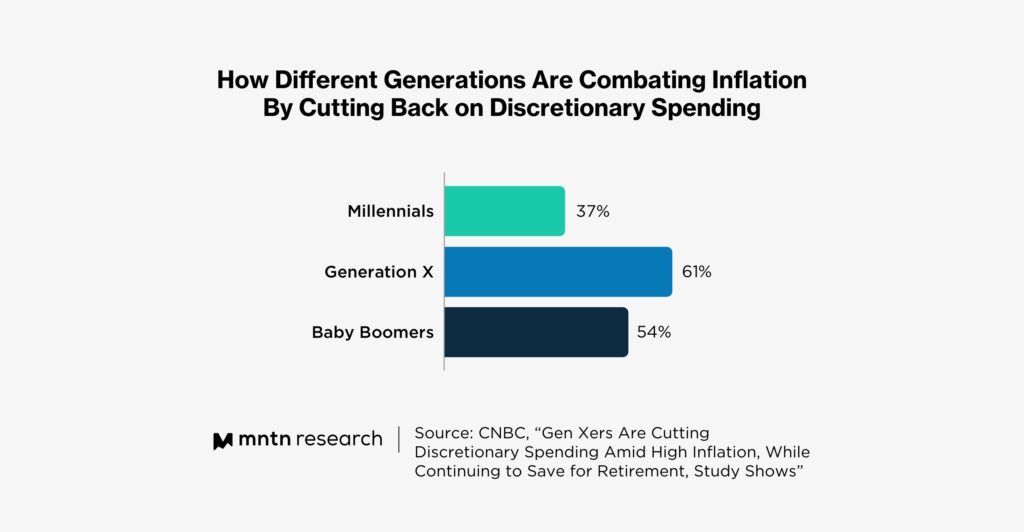

These rising costs aren’t unreasonable; it costs money to create content, secure licenses, and maintain the servers that stream it into households. Unfortunately, these price increases come at a time when inflation is impacting all aspects of life globally. As consumers deal with rising costs of utilities and food, they’re more likely to shift their budgets to these necessities—and scale back on luxuries like entertainment budgets (fig. 2).

Netflix’s most recent price hike was intended to drive revenue, but likely drove away customers. In their Q1 earnings call last year, Netflix contributed the rate raise to a loss of over 600,000 customers—the first time the streaming giant reported a subscriber loss in over a decade.

The average American household subscribes to four streaming services. But as these costs continue to climb and the streaming landscape evolves—HBO Max is rumored to be climbing again once it merges with Discovery+ this summer—three or four ad-free services will start to feel more expensive.

Ad-Supported Offerings Offset the Cost

During the time that inflation and subscription prices rose, something else happened in the CTV market: services started embracing ads. After Netflix’s disastrous earnings call, the company—once a brand that proudly defined itself as anti-ad—changed its entire streaming strategy and announced a less costly ad-supported option.

The new model, which can cost as low as $6.99 a month, has been a hit. Netflix executives are pleased with its adoption rate, and the ad-supported offering is predicted to hit 7.5 million U.S. subscribers by the end of this year. Even Reed Hastings, the former co-CEO of Netflix who was the architect of the service’s streaming model—and CTV as we know it today—publicly admitted that he was “wrong” and should have embraced ads long ago.

Similarly, Disney+ recently launched its ad offering after raising prices. Like Netflix, Disney has seen its viewing audience widely embrace the new ad tier. Disney+’s ad-supported option is now projected to account for 88% of its global subscriptions by 2028. And these sign-ups aren’t being driven exclusively by new subscribers; Disney says that 1 in every 4 paid premium subscriptions may switch over to the ad tier. The service now has a goal of signing up 260 million subscribers to its ad-free option by the end of 2024.

Streaming: Need vs Want

There’s a reason for the sudden industry-wide embracing of ad support – it’s a hit with consumers. Many viewers spent the last few years, especially during COVID-19 lockdowns, signing up for services and enjoying the exclusive premium content. Today every major streamer is investing billions of dollars in producing and securing shows and films to keep their viewers engaged, making it difficult for even the most fiscally-minded viewer to unsubscribe.

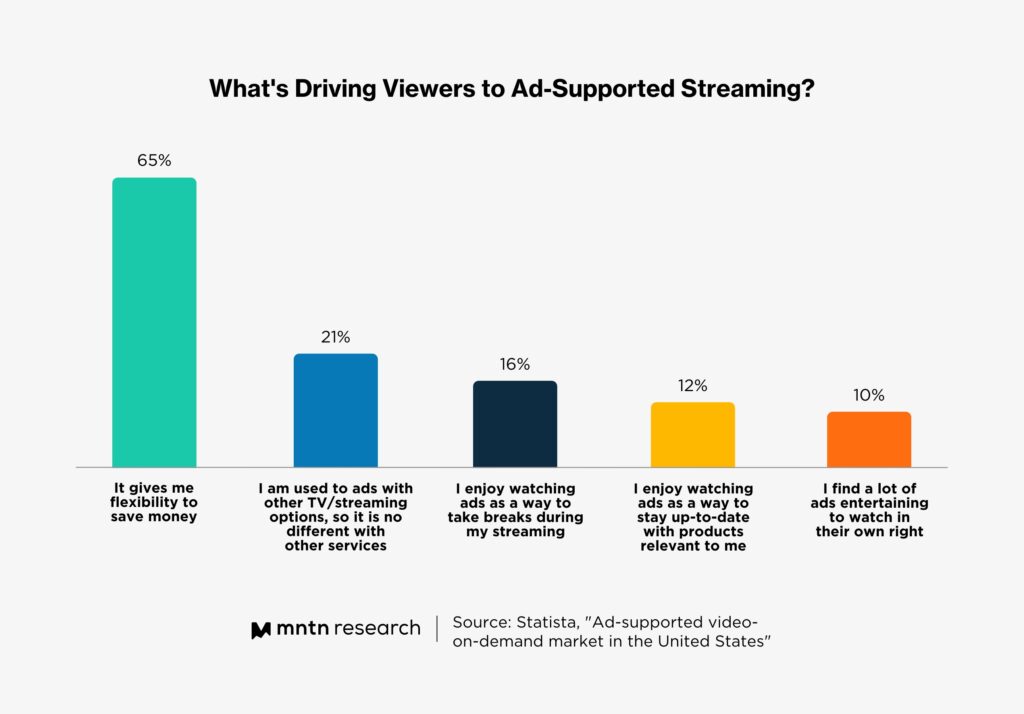

The ability to offer access to the same hit programming for less money is a compromise that benefits all parties. Streaming services help to mitigate any major subscriber loss by lowering the barrier to entry in exchange for advertiser dollars—and viewers are more than happy to agree to this proposition. 65% of viewers say they like ad-supported tiers because it saves them money, and 21% say they’re used to the ads anyway (Fig. 3).

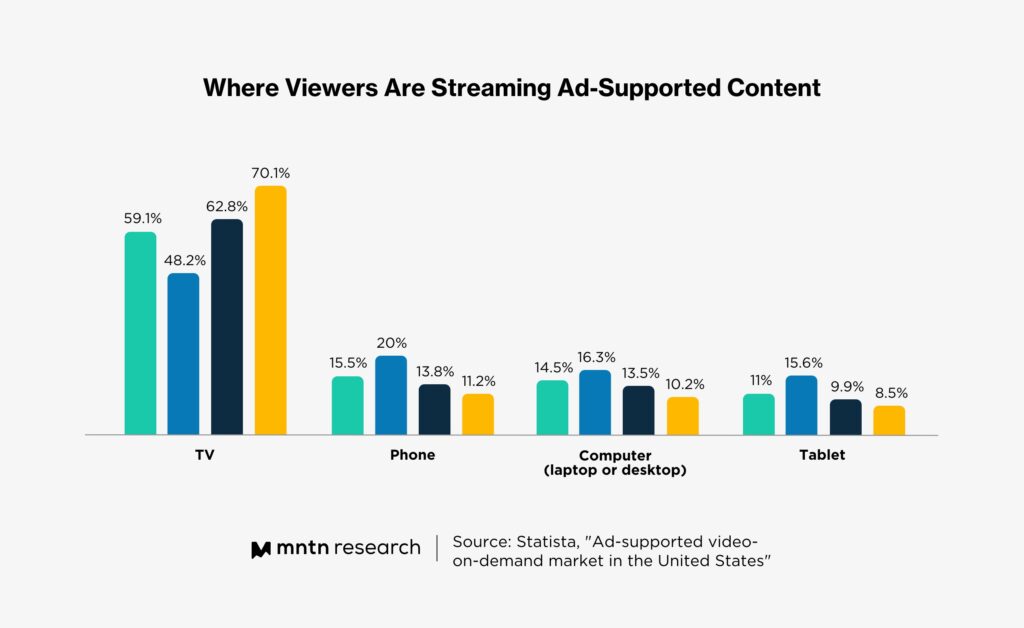

Studies show that consumers aren’t just tolerating CTV ads in exchange for keeping up with their shows; they’re embracing them more than other ad channels. 73% of consumers say they prefer “ad-supported CTV viewing” over a “no ads” model, with 60% saying they prefer ads that are customized to them – something that CTV’s targeting allows. These consumers overwhelmingly watch their streaming services, and ads, on their television (Fig. 4). This gives them a big-screen experience that helps to capture their attention—but also easily enables them to take action as 95% of consumers stream TV with a smartphone on hand.

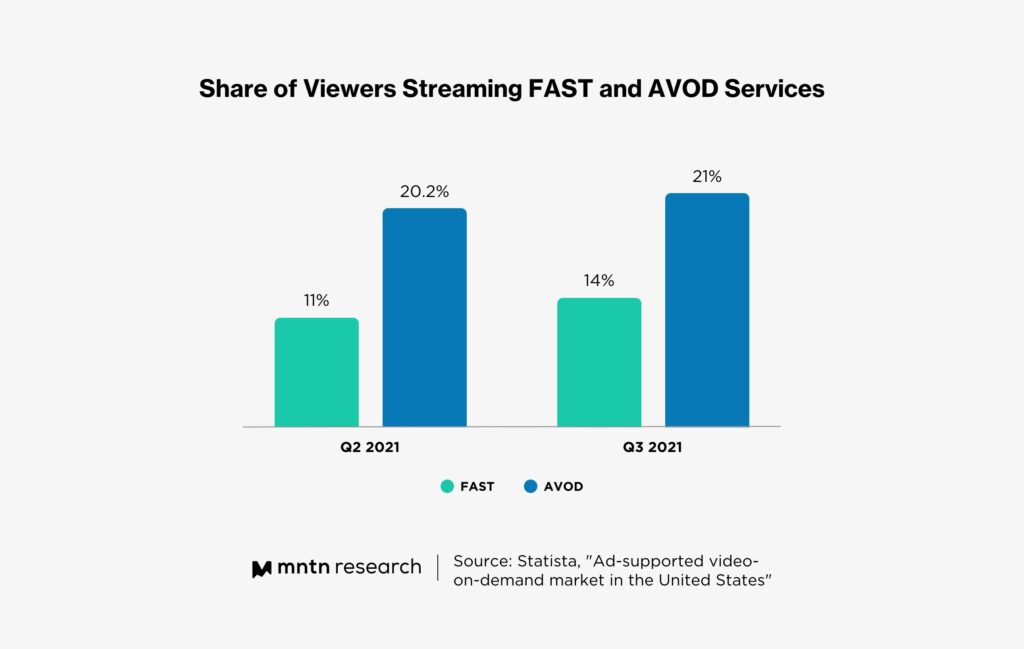

This embracing of ads and efforts to save money has led to an increase in both FAST (free ad-supported streaming TV) and AVOD (ad-supported video-on-demand) services. In just one quarter in 2021, FAST channel usage jumped by 27.27%, and AVOD streaming increased by roughly 4% (Fig. 5). It’s also worth noting that during the time of this data capture heavyweights like Netflix and Disney had yet to roll out ad-supported streaming options and there was less economic anxiety.

AVOD streaming has made an uphill climb over recent years; eMarketer predicts that by the end of 2023, households that don’t pay for TV will outnumber the ones that do. And by 2024, they predict that 158.5 million U.S. viewers—or nearly half the U.S. population—will be streaming ad-supported content (Fig 6).

It’s highly possible that with recent global events, more ad-supported offerings, and the continued evolution of streaming trends, these benchmarks will be quickly blown through and AVOD support might reach higher viewership than originally anticipated.

Conclusion

Few things in the consumer market are immune to inflation and price increases, including streaming services. While some operate on a model that offers a low introductory rate to build an install base before raising rates, nearly all of them are raising prices to keep up with operation costs and to offset their spending in an increasingly competitive TV arms race.

While consumers are cutting back on discretionary spending, the industry-wide embracing of ad-supported content has helped to stem subscriber loss—and even boost subscription numbers. While streaming TV once prided itself on not featuring ads like its linear TV forebearer, CTV’s ability to target ads on a granular level has made TV advertising less obtrusive—and more enjoyable—for viewers. This ability to save money, watch on-demand exclusive content, and get contextually relevant ads has changed how consumers, streamers, and brands think about advertising.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.