Research Digest

Streaming Sports Viewership is a Growth Opportunity

by Frankie Karrer4 min read

Abstract

- 53% of adults watch or stream sporting events at least once per month.

- Live sports streaming now accounts for 30% of all CTV streaming.

- 49% of live sports streamers believe TV ads are an important part of their TV watching experience

While sports viewers have been slower to make the switch to streaming due to the lack of live content, that looks like it will change in the near future.

The Current State of Connected TV Viewership

Connected TV has continued to rise in popularity among most TV watchers. 82% percent of American households now have at least one internet-connected TV device, and according to eMarketer, there are 223 million Connected TV viewers in the U.S.—that’s 66% of the total population. The main driver of the switch to streaming has been the uptick in cord-cutting behavior by Americans over the last few years. By the end of 2023, less than half of US households will have a traditional pay TV subscription. This will bring the total number of pay TV households to 65.1 million, a 4.8% decrease over 2022.

But one TV audience has been slower to make the transition to streaming than their counterparts. Sports viewers have long been the last hold out of traditional television, mainly due to the lack of content available through Connected TV up to now. But as that begins to change, with more and more streaming options available to these viewers, it looks like they will also be turning to CTV in the next few years.

The Future of Sports Viewing on Connected TV

One of the main reasons that sports viewers have been slower to make the switch to Connected TV is that they prefer live content—a survey from Magnite found that 70% of sports programming is watched in real time. So when it comes to the cable hold outs, while 22% of cable subscribers plan to cancel their service within the next six months, 44% said they would cancel if they could access live sports through streaming.

There are a number of streaming platforms that are working to change the game for sports viewers looking for an alternative to cable. Services like FuboTV and Hulu + Live TV allow live access to a number of sports networks—in fact, for FuboTV, 93% of sports content on their platform is viewed live. NBCUniversal’s Peacock also recently began offering live coverage of Premier League games. For football fans, Amazon’5 11-year deal with the NFL will make the platform the exclusive home of “Thursday Night Football” starting this year.

The rise in the number of streaming services that offer live sports coverage has increased the amount of viewers making the switch to streaming. According to Magnite, live sports streaming now accounts for 30% of all CTV streaming, and live sports streamers are more likely to watch multiple ad-supported services (averaging 3.6 sports apps per viewer). It’s estimated that 57% of Americans watch sports at least once a week, with 44% of those viewers watching these games outside of linear TV. This number also rises to 65% among adults ages 18-34, who are more likely to be cord-cutters or cord-nevers when it comes to cable.

Why Sports Streamers Matter

So why do advertisers and streaming platforms care about this audience group? There are two main reasons:

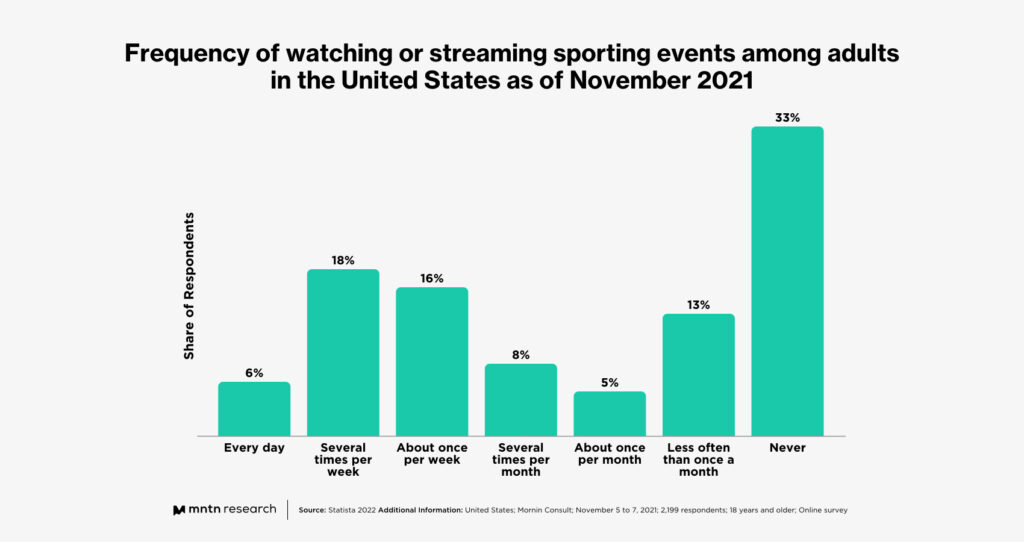

- Sports viewers are loyal watchers: One of the main drivers behind the push for streaming services to get sports content onto their platforms is the built in audiences that they provide. As already established, sports viewers are extremely loyal to their content, with the above chart from Statista revealing that 40% watch sporting events at least once weekly, and 53% watch monthly. The lifetime value of appealing to a sports viewer is ultimately much higher than their counterparts.

- They respond well to advertising: Sports viewers are also extremely important to advertisers because they show higher levels of acceptance for advertising while watching TV content. Magnite found that 49% of live sports streamers agreed with the statement: “TV ads are an important part of my TV watching experience,” and 62% said they had discovered new products as a result of watching ads on streaming services. And they are less opposed to the targeted ad experience that comes with Connected TV—67% sports streamers said they pay more attention to ads that match their lifestyle and interests.

Conclusion

Ultimately, as streaming providers add more live sporting events and networks to their offerings, it looks like sports viewers will continue to follow the content to Connected TV. And considering the loyalty and value of this audience, advertisers should be looking to take advantage of their willingness to watch ads by following them to Connected TV.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.

Resources

1 US Connected TV Device Rate Hits 82% (Broadband TV News)

2 Forecast: Connected TV Users (eMarketer)

3 US Pay TV Penetration Will Drop Below 50% in 2023 (eMarketer)

4 Magnite: 68% of Connected-TV Viewers Engage With Commercials (MediaPlay News)

5 Amazon Previews NFL's Shift to Streaming with Super Bowl Spot (Marketing Dive )

6 Sports Events Streaming Frequency in the US 2021 (Statista)

7 Streamers Eye Sports Rights as a Way to Stand Out With Subscribers (Adweek)