Research Digest

Increased Streaming Fragmentation Has Led to an Interest in Streaming Bundles

by Frankie Karrer5 min read

Abstract

- Time spent watching Connected TV has risen by 18% YOY, continuing a streak of double digit growth.

- 46% of streamers say the increase in streaming options makes it difficult to find what they are looking for.

- 64% of streamers are interested in bundled streaming packages.

As the streaming landscape continues to heat up with more services entering the mix, consumers are indicating an interest in bundled content to offset the growing price of being a streaming viewer.

The Current State of Streamer Behavior

Nielsen’s State of Play Report, which explores the shift in how consumers engage with TV and video, confirmed that streaming is here to stay. Viewers increased the time they spent watching streaming by 18% over the last year. They have also expressed satisfaction with the medium, with only one in 20 consumers stating that they have negative feelings regarding their streaming experiences.

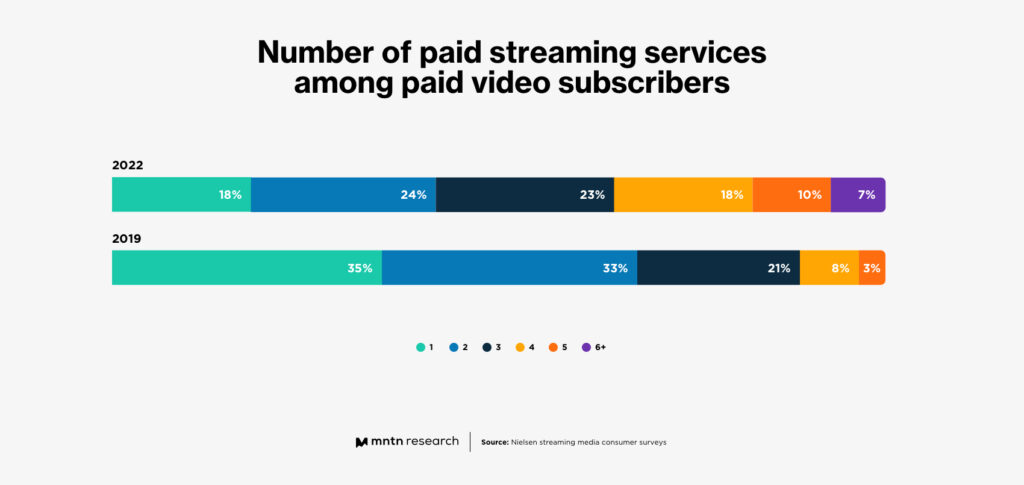

Streamers have also increased the number of services that they subscribe to. The percentage of consumers who are subscribed to four streaming services rose to 18% in 2022, a jump over the 8% in 2019 (as seen in table 1). And though some Americans expressed they have reached a saturation point when it comes to the number of streaming services, 69% say they didn’t cancel any services in the past year, and 93% plan to either add another paid streaming service or keep the same number in the future.

Consumers are more likely to add new streaming services when content appeals to them. That said, economics does figure into the equation—56% say cost is the primary reason why they don’t subscribe to more services. Here are more of the insights revealed by Nielsen that explore consumer behavior around streaming costs:

- Many consumers are already spending a significant monthly amount on streaming, with the highest percentage of consumers (21%) spending between $20-$29.99 monthly.

- 15% of consumers surveyed are spending more than $50 or more a month on streaming services.

- The low end of the scale, streamers who spend less than $4.99 a month, make up only 3% of consumers.

- Only 2% of those surveyed reported that they use streaming services, but don’t personally subscribe to any.

- Of the age group that is spending the most on streaming services (consumers ages 35-49), 24% of pay for five or more services a month.

The Future of Streaming

The world of streaming is currently fragmented, with new streaming services launching every year, and consumers are starting to express they are getting overwhelmed. According to The Future of OTT Aggregation Study from media analyst company Interpret, 20% of survey respondents agreed that they “subscribe to too many video streaming services.” And Neilsen’s report found that 46% of consumers say the increase in streaming options makes it difficult to find what they are looking for.

Some consumers have chosen to “service hop,” or keep the same number of subscriptions while switching between streaming services or resubscribing to services that provide content they are interested in month-to-month. Parks Associates found that 36% of OTT subscribers, or approximately 32 million U.S. households, are service hoppers.

But another solution that consumers have expressed an interest in is bundled streaming packages. Nielsen found that 64% of consumers are hopeful that there will be more bundled streaming packages in the future, while only 9% think that there is no need for such options. This is a significant change in consumer attitudes, as in the past streamers were more interested in the ability to pick and choose streaming services as needed. According to Interpret, while consumers expect financial value from streaming bundles, they are also excited by the potential value of removing pain points of the subscription and cancellation processes involved in service hopping.

64% of consumers are hopeful that there will be more bundled streaming packages in the future, while only 9% think that there is no need for such options.

– Nielsen

Streaming services are aware of this consumer interest in bundles, and many platforms have been adjusting to this shift in consumer preferences. Disney currently offers a bundle of Disney+, Hulu Live TV, and ESPN+, and many other services, such as Amazon Prime and Paramount+ offer the ability to add select services (like Showtime) to existing packages. Verizon also recently announced their new +play platform, which partners with Netflix, Peloton, Disney+ and other streamers. However, other content providers are blocking attempts to bundle streaming services, due to a desire to control their own parts of the content journey, data, and advertising opportunities.

Why it Matters

While the world of streaming has seen a lot of growth over the last few years, that might start to slow if consumers become more frustrated by this fragmented landscape and the high price that comes along with maintaining multiple subscriptions. There are a number of reasons that advertisers should be aware of the ways consumers are changing their viewing behavior, and why CTV audiences matter.

- Streamers are a Valuable Audience: Streamers are known for their forward-thinking attitudes and openness to new ideas and brand messaging. Connected TV watchers are more likely to stay up to date on the latest trends and technology than their counterparts, and often have more considerable purchasing power

- Connected TV is Effective: Connected TV advertising is one of the most effective ways to grab audience attention due to the captive behavior of streamers and the premium environment of a TV screen. In fact, 92% of advertisers believe that CTV is highly effective at meeting or exceeding their KPIs, and 26% say that CTV outperforms linear.

- Cross-Device Opportunities: 71% of consumers will use second devices while watching TV, and many of them will look up information on a brand on that device after seeing a streaming ad. By advertising on CTV, brands can reinforce brand messaging with cross-device campaigns that will reach consumers after they have seen an ad while streaming.

Conclusion

Ultimately, the recent explosion in the number of streaming platforms and services has made it hard for consumers to keep up, despite their eagerness to do so. Streaming brands will have to make adjustments in the future to retain streamer numbers and secure customer loyalty. And considering that TV ads are an extremely valuable platform for ad recall and influencing searches, being able to find consumers more easily through streaming bundles will also impact advertisers looking to follow their audiences to streaming.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.

Resources

1 State of Play Report (Nielsen)

2 Streaming is heading toward a breaking point with consumers (Fierce Video)

3 The Future of TV Report: June 2021 (The Trade Desk)

4 Who Are Connected Consumers and How Can You Engage and Delight Them? (Adweek)

5 INSIGHTS 2022 (Audience Project)

6 Television Is Most Important in Influencing Purchase: TVB Study (Broadcasting + Cable)