CTV is Playing a Bigger Role Than Ever in Advertisers’ 2024 Plans

by Stephen Graveman6 min read

In partnership with:

Abstract

-

- MNTN and Digiday once again surveyed 100 leading brands and agencies to learn about their experiences with Connected TV and their future plans with the platform.

-

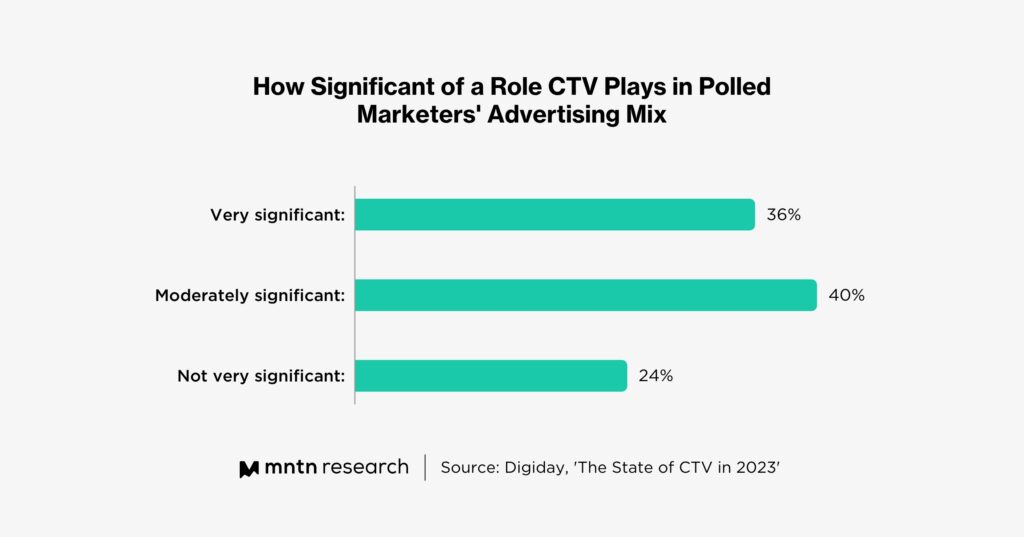

- A combined 76% of advertisers said CTV is either moderately or very significant to their advertising campaigns.

-

- By 2024, 24% of brands expect CTV to represent 60-80% of their revenue — a year ago that was just 7%.

-

- 66% of advertisers have reallocated social media funds to CTV, with other performance marketing channels not far behind

Over the last few years, Connected TV has increasingly absorbed more advertiser mindshare as a performance marketing platform. As more streaming services and viewers embraced ads, and as the platform’s targeting and measurement capabilities continued to evolve, CTV found itself at the focal point of advertisers’ omnichannel marketing mix.

In 2021, MNTN and Digiday teamed up to poll leading brands and agencies on their CTV usage. To get a sense of how much has changed and understand where CTV lies in advertisers’ strategies today, they decided to revisit the topic two years later with another study.

Unsurprisingly, CTV is more important than ever for advertisers.

A little more surprising is the scale of its importance, and what this means for the future of advertising.

Growing Importance

No longer a nascent technology, Connected TV has established itself as an integral part of the marketing mix — and the poll reflected that. Of the respondents who said that CTV was part of their marketing strategies in 2023, a combined 76% said it was either moderately or very significant to their advertising campaigns.

The intense focus on CTV can be attributed to brands having years of experience getting familiar with the channel — and understanding what it is capable of. As an example, brand Adam and Eve recently told Digiday about how streaming ads and CTV’s targeting capabilities helped to weather times of economic uncertainty.

“If we want to continue to be in front of the consumers that we need to be in front of, we have to go with where the eyeballs are,” Chad Davis, director of customer acquisition at Adam and Eve told Digiday. “If we find a media that works and it’s acquiring customers in a very efficient way, we’ll spend money on that until the cows come home. If it works, we’ll keep spending on it and look to always grow.”

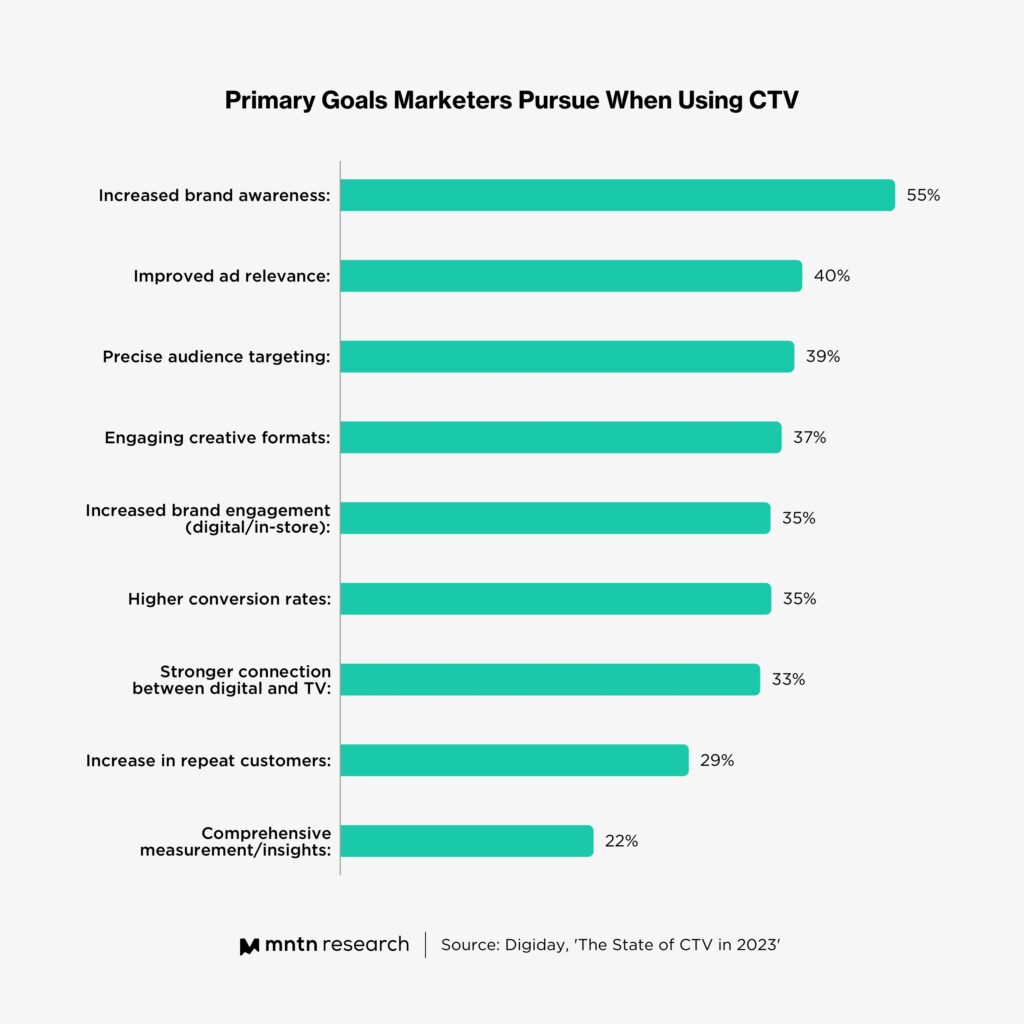

Advertisers that are serious about growing their business have increasingly been drawn to Connected TV as it continues to blend modern performance marketing tactics with tried-and-true brand awareness plays. That said, CTV is still being used primarily as a brand awareness platform, with performance goals being tied to a focus on ad relevance and targeting.

In the survey, 55% of respondents cited “increasing brand awareness” as their primary goal for using CTV advertising.

That said, performance marketing is continuing to gain ground. Improved ad relevance (40%), and precision audience targeting (39%) follow close behind. Engaging creative formats (37%), increased brand awareness (35%), and higher conversion rates (35%) round out spots 2-6.

The feedback is demonstrable proof that performance and brand marketing are continuing to merge in importance for CTV marketers. While brand awareness has always been the traditional strategy for television advertising, performance marketing is becoming increasingly relevant as marketers learn of its ability to drive consumer engagement.

CTV’s Growing Importance

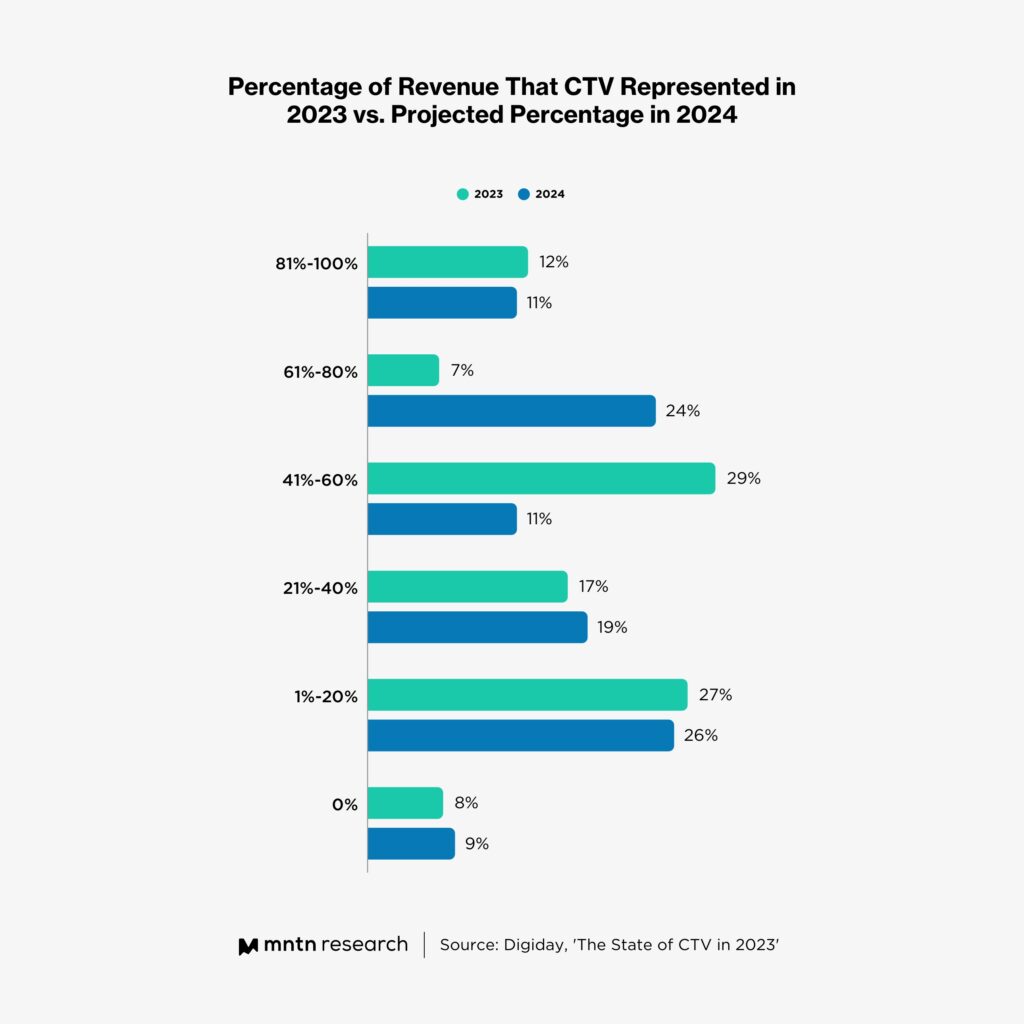

With CTV playing a bigger role in marketing mixes and driving loftier goals, it’s perhaps not surprising that advertisers are relying on the channel for about half of their ad revenue. When asked about the revenue that CTV generates for their organizations, more than one-third of respondents said they expect it to drive a significant amount — 40% or more of their ad revenue in the coming year.

The biggest jump in polling is the 61-80% range, which jumped from just 7% in 2023 to 24% for 2024 — an expected increase of 17 points.

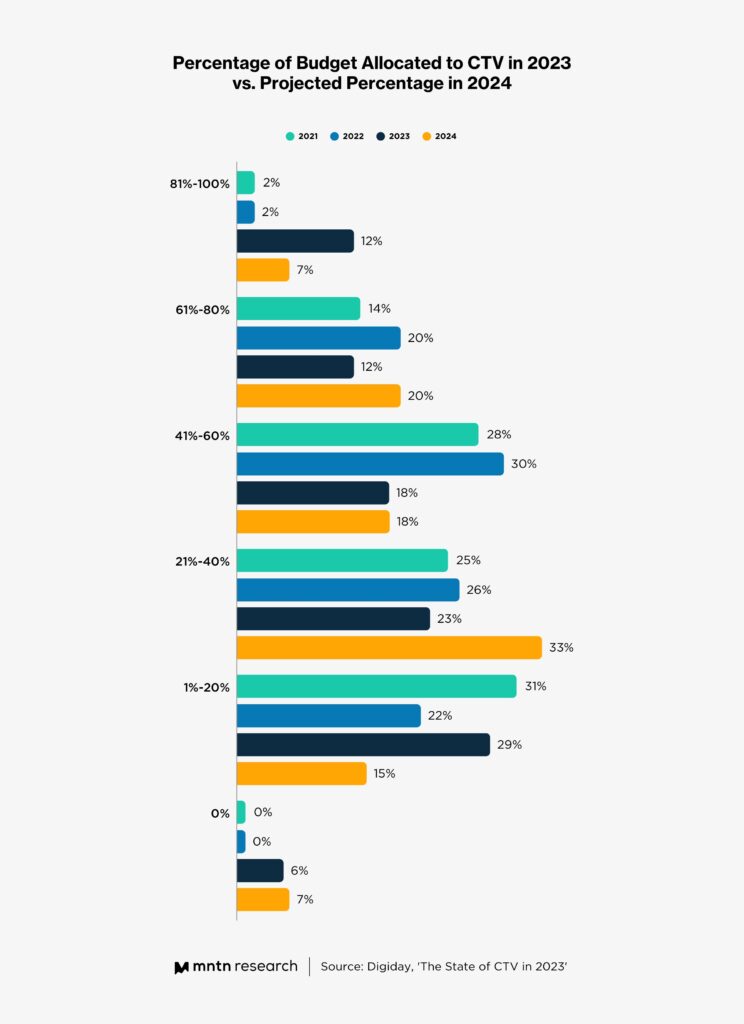

Understandably, these outcomes for the channel mean that advertisers are budgeting to capture the revenue they’re predicting. About half (42%) said they put 41% or more of their ad budget into CTV campaigns and strategies this year; in 2024 that number is expected to increase slightly again (45%).

This shows that advertisers are still taking a bullish approach to CTV, despite the diminished budgets and economic squeeze facing advertising departments today. In fact, advertisers have demonstrated that they see Connected TV as more of a long-term payout that’s worth investing in now — rather than lose ground to competitors and the market.

The Surprising Ways That Brands Fund CTV

Of course, this increased investment and focus on CTV as an ad channel means that the (already scant) ad dollars must come from somewhere. In the Digiday poll, 24% of respondents said that they’re so committed to the channel that they’ve already created a dedicated budget line for the channel (an additional 30% said they plan to do the same in 2024).

The rest of the respondents reallocated budgets from other channels, often from surprising sources.

In the 2021 State of CTV report between MNTN and Digiday, polling found that linear TV was the channel that was chosen the most often (51%) for budget reallocation to CTV. Two years later, that statistic has surprisingly fell to 21%.

Today, other digital performance marketing channels like social media, display, and paid search are seeing more of their budgets being shifted to CTV. Perhaps the biggest change in two years is email marketing; in 2021 it was seventh on the list; today it’s second.

Conclusion

While most advertisers would reasonably expect Connected TV to play a more crucial role in today’s advertising strategies, MNTN and Digiday’s poll shows a growing intensity for the channel that might be surprising. From the ad channel buckets it pulls from to its role in the omnichannel mix, CTV has made major strides in just two years as more advertisers become familiar with the channel and what it can achieve.With ad-supported streaming and FAST channels on an accelerated rise, it’s reasonable to expect that in another two years, these numbers will look quaint by comparison.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.

Resources

1 The State of Connected TV Advertising (MNTN Research)

2 The State of CTV in 2023: As Some Challenges Fade, New Tech Enters the Picture (Digiday)

3 This Sexual Wellness Brand is Doubling (Actually, Tripling) Down on CTV (Digiday)

4 85% of Ad-Supported Streaming Tier Sign Ups Are New Subscribers (MNTN)