Research Digest

Local Advertisers Begin the Move to Connected TV

by Isabel Greenfield4 min read

Abstract

- While many advertisers have been making the switch to CTV over the past few years, local advertisers were slow to adopt due to their specific targeting needs.

- In 2021, CTV was the largest growing ad channel for local advertisers as they shifted some budget away from paid search and into the newest TV solutions.

- Local advertisers have specific needs from geotargeting to measurement that CTV can offer.

- Sports leagues, a key partner for local businesses on linear TV, are struggling to find the right solution on streaming. Local advertisers no longer need to rely on sports to align with the correct audience. CTV targeting capabilities mean they can reach their local target on any content they are watching.

The streaming industry now caters to the specific needs of local businesses.

It’s no secret that where people are watching TV is changing. As viewers cancel their cable subscriptions, they are spending more time streaming. Advertisers have been following suit, shifting their ad spend from linear upfront buys and investing in the Over-the-Top (OTT) content. While national brands have been on the move for years, local brands have been stuck waiting for streaming technology to catch up to their specific needs.

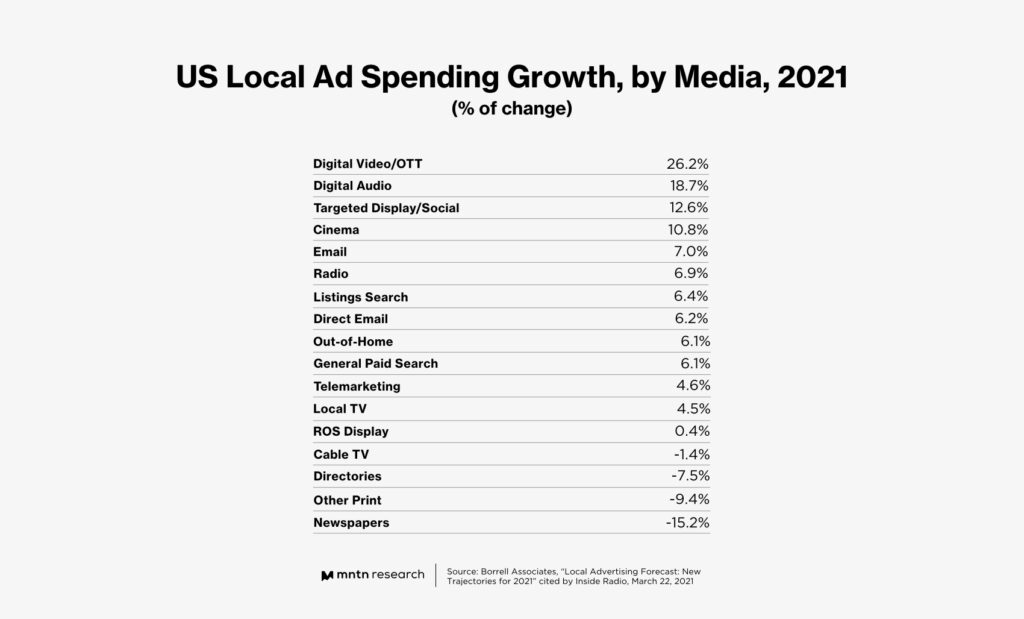

According to eMarketer, 2021 saw many local brands follow their national counterparts with a 26.2% increase in spending on digital video and OTT. Borrell Associates Benchmarking Study noted local advertising shifting away from paid search during the second year of the pandemic, investing some of this previous budget into Connected TV. Streaming ad platforms are making it easier for local brands to buy both the location and audience targeting they need to make CTV advertising a feasible solution for them. Plus, with the right platform, the impact of CTV campaigns can be tracked as a performance channel, making it even easier for advertisers to measure the impact of their ad budgets.

Local Advertising Needs

Local advertisers are looking for specific features from any ad channel they are adding to their mix:

- Geotargeting: Local businesses need to be able to confine their ad campaigns to only where they are located or that they service. In the past, TV ads were geotargeted by DMA, which stands for Designated Market Areas. Created by Nielsen, DMAs were a way to segment the US into geographical areas–210 distinct markets. However, this is often imprecise as DMAs cover large areas and don’t allow local businesses to define their own area of business. Now, many platforms offer the ability to target by city or even as granular as zip code so local advertisers can control where their ad is seen.

- Inventory: On linear TV, specific inventory was reserved for local businesses; usually the last ad spot of a commercial break. This meant that all local businesses were competing for the same spots within a program. With CTV, advertisers have access to any impression that runs within the designated locations creating additional inventory and lessening the bidding war for businesses in the same area.

- Cost-effective: One reason paid search and other ad channels have been the preferred ad channel of choice for local businesses is due to the cost associated with TV. TV was often bought upfront with expensive commitments that can be more taxing on a small local business than a larger national brand. CTV democratizes the TV buying process by allowing brands to determine the amount they’d like to spend at any given time and allows everyone access to the same inventory.

- Measurement: With a limited ad budget, every impression counts. Local advertisers need to be able to determine the impact of their ad budget across each channel. Linear TV reporting is usually delivered after a campaign is over so there is no way to make adjustments during the flight. CTV not only offers near-live reporting (depending on the platform), but it can also measure the performance of the TV creative, tracking conversions and return on ad spend. These metrics are essential for businesses looking to make the most of each dollar.

Sports on CTV

In the world of linear TV, live sports were the perfect opportunity for local advertisers. Games are broadcast locally creating a clearly defined local audience. For example, for a Green Bay business, a Packers game is an essential time to find potential customers locally. Sports have been the cornerstone of TV advertising for local businesses. With the growth of CTV, local advertisers are no longer relegated to sports advertising. Now they can reach a local viewer with any content that they are viewing, thanks to CTV targeting capabilities.

This comes just in time as sports leagues are also learning to navigate the world of CTV. Amazon struck a deal with the NFL for exclusive rights to Thursday Night Football and Apple+ viewers will be treated to exclusive Friday night MLB games. However, networks like NBC are still grappling with how to offer local games without driving up the streaming costs to cover the rights fees, which would increase the price for everyone, including non-sports watchers. Local advertisers now don’t need to wait for the updated distribution plans of sports leagues and networks to enter into the CTV world.

Conclusion

Local advertisers have been biding their time waiting for CTV to offer the capabilities they need before adding them to their ad mix. With precise geotargeting, access to inventory, and CTV measurement capabilities, today’s CTV ad platforms are a key space for local businesses. And advertisers are taking note–CTV was the fastest-growing channel for local advertisers in 2021.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.

Resources

1 US Local Ad Spending Growth, by Media, 2021 (eMarketer)

2 Local Digital Ad Spend to Surpass $92B, Budgets Shift From Paid Search to Targeted Banners (MediaPost)

3 3 Tips About Local TV Advertising (Extreme Reach)

4 NBCU Weighs Selling Regional Sports Channels or Putting Them on Peacock (eMarketer)