Retailers Tie Goals to CTV Ads Easier Than Linear TV

by Stephen Graveman6 min read

Abstract

- MNTN and WBR polled 100 retail marketing leaders across the United States and Canada on their TV ad strategies

- 81% of retailers are currently running CTV ads, compared to 82% advertising on linear TV

- 99% of retailers polled say that CTV is effective at measuring and tying success to specific goals such as revenue and website visits

- 95% of retailers reporting that CTV will play a “significant” role in their marketing strategy in 2023

For about as long as the format has existed, linear TV has been a favored ad channel of the retail industry. Regardless of vertical, size, or geographic location, retailers have leveraged television’s audio-visual capabilities to showcase merchandise, promote sales, and build excitement all year long. With the development of cable television in the 1980s and wider adoption in the 1990s, retailers could successfully broadcast an ad to millions of viewers across the country, as well as internationally, with a single ad purchase.

However, the power of linear TV has waned in recent years. Streaming services are now more popular than ever as cable TV bundles continue to skyrocket in price and consumers make the shift to CTV. This past summer, streaming viewership surpassed broadcast and cable television for the first time—a monumental event that was unthinkable just a few short years ago. This growing shift in consumer behavior is changing how brands think of approaching their customers and the ad channels that they use as a vessel for doing so. To see how retail marketers are responding, MNTN and Worldwide Business Research (WBR) recently polled 100 leading marketers on their TV advertising strategies. Keep reading below for a glimpse of our findings.

What Retail Marketers Think of Linear

Despite the channel’s status slipping, respondents told us that linear TV remains an integral part of retailers’ omnichannel marketing mix, especially during high-profile seasons like the holidays.

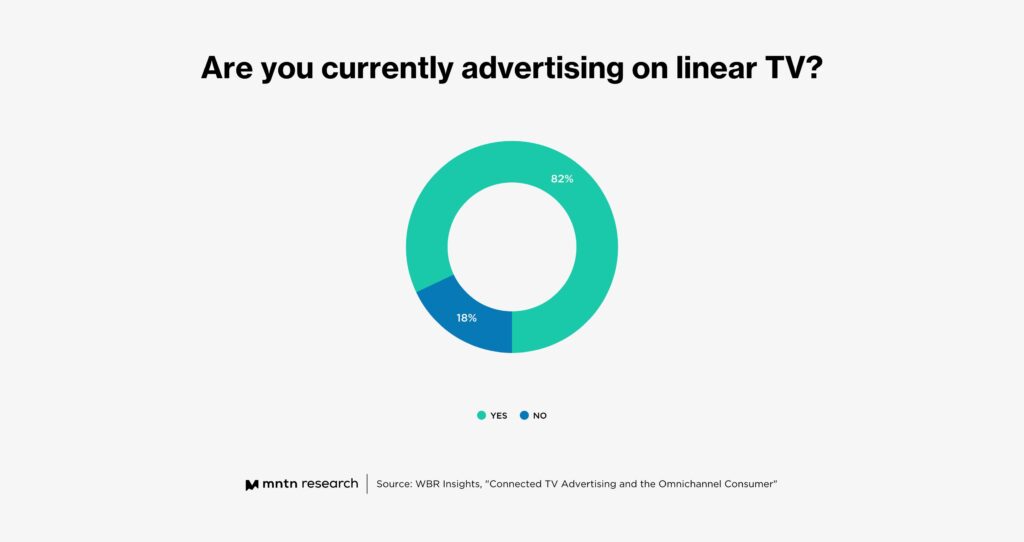

82% of respondents said they’re currently running linear TV ads, as opposed to 18% who have no linear TV ads in the pipeline (Fig. 1). While linear TV ads will continue to be an important part of retailers’ marketing strategies for the foreseeable future, the arrival of CTV has highlighted some of its forebearer’s flaws—namely the lack of targeting and measurement available.

With CTV bringing the digital age to television, respondents told us that linear’s lack of TV attribution is a challenge that’s harder to overlook these days. With no way to generate data directly from customer interactions, it’s difficult for retailers to determine if new or returning customers are engaging with a brand after watching an ad.

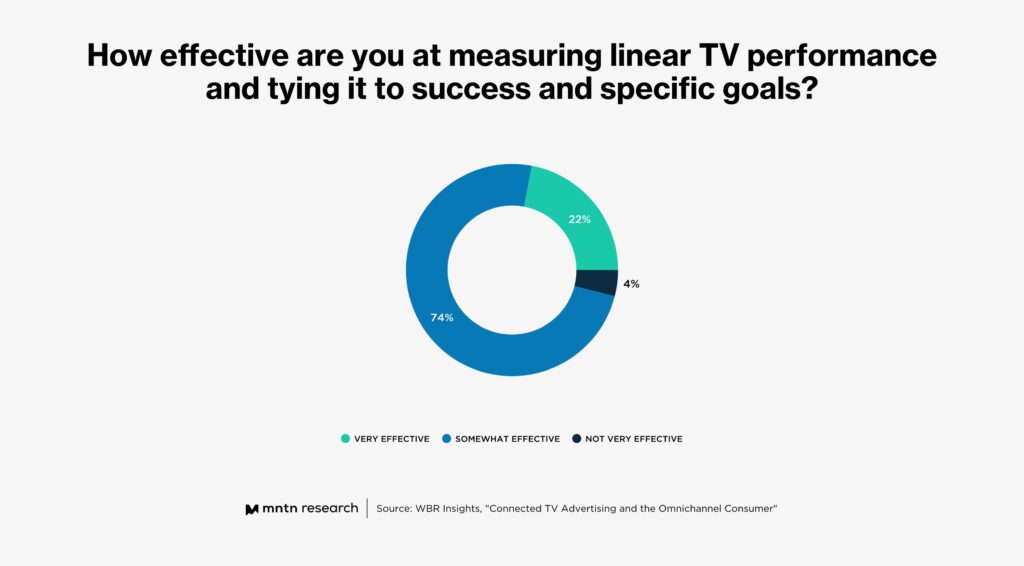

Nearly 3/4ths of respondents (Fig. 2) told us that linear TV is only somewhat effective at measuring and tying success to specific goals, such as revenue and website visits. Only 22% said that it was very effective. With economic anxiety currently driving marketing departments to slash budgets, reallocate dollars, and focus on measurable outcomes through performance channels, linear TV’s lack of insights is becoming a challenge for retailers who need to justify ad spend and prove their investments have been worthwhile.

And while there are solutions that help brands measure linear TV ad results, the ads themselves still don’t generate the data retailers need to develop customer profiles. While only 4% of respondents told us that linear TV has not been effective in measuring outcomes, everyone stated that they struggle with linear thanks to a “lack of transparency or visibility into reporting metrics.”

What’s Driving Retailers to CTV

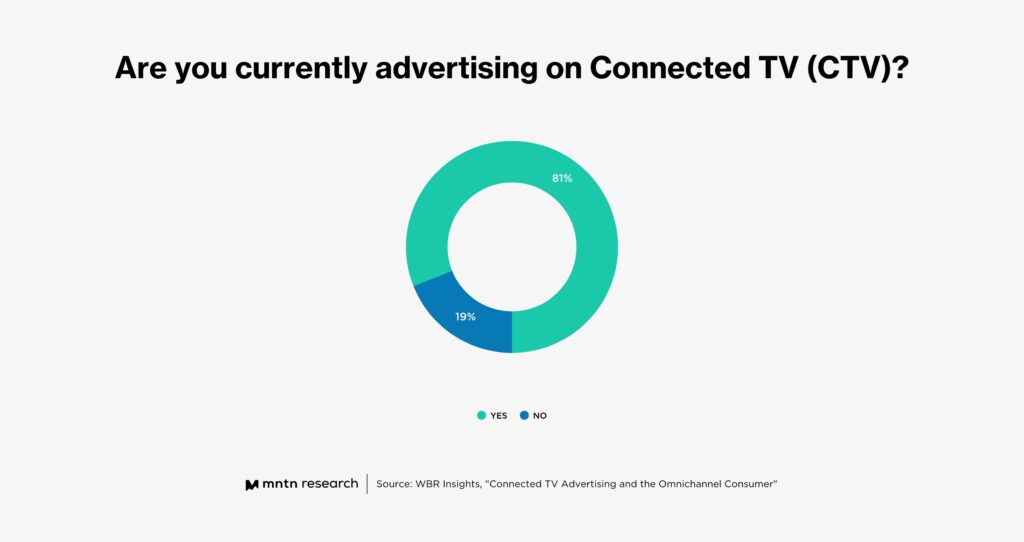

This lack of transparency around reporting metrics and KPIs have helped Connected TV advertising gain a foothold with retailers in recent years. 81% of respondents (Fig. 3) told us they are running CTV ads, nearly tying the channel’s popularity with linear—despite being a newer ad platform. And while CTV is practically matching linear TV in popularity with retailers, it’s outperforming linear in regards to reporting and attribution.

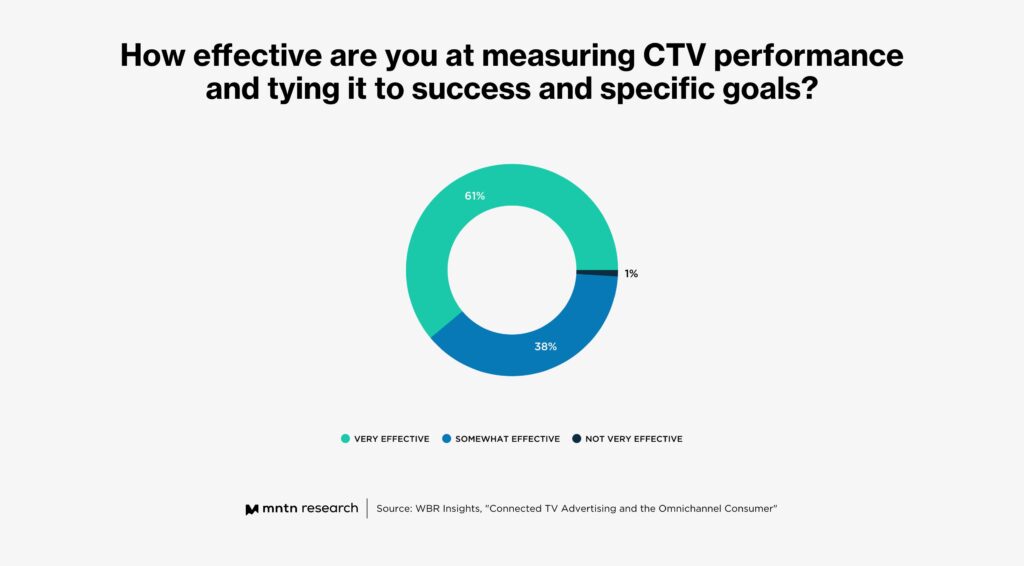

99% of retailers polled say that Connected TV is effective at measuring and tying success to specific goals such as revenue and website visits (Fig 4). 61% said the channel is “very effective” at this task, compared to 22% for linear. Only 1% of respondents said the channel is “not very effective.”

When we drilled down further on that 1% outlier, they told us they struggle with two factors. First, the platform that they use places too much emphasis on awareness and reach goals, as opposed to crucial metrics like return on ad spend (ROAS) or return on investment (ROI). Second, these respondents told us they simply don’t have the resources or time to perform routine and critical campaign analysis. The advertisers in this 1% audience would benefit by switching to a new CTV ad solution that gives them better transparent and customized reporting that aligns with their goals.

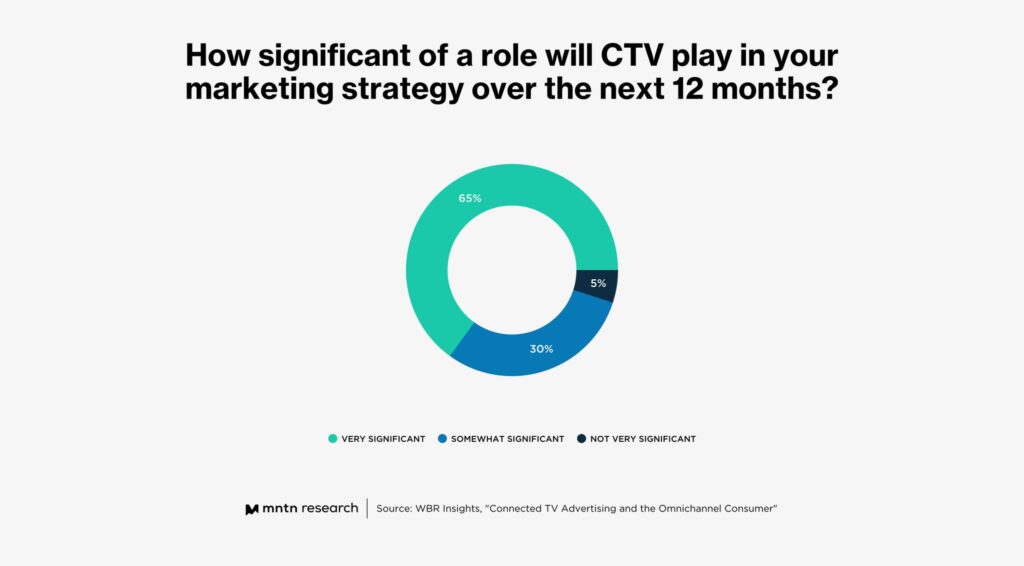

Additionally, respondents say they’re committed to CTV in the new year, with 95% of retailers reporting that CTV will play a “significant” role in their marketing strategy in 2023 (Fig. 5). The 5% who say it will not play a significant role report issues with their advertising processes and CTV platforms. As an example, this 5% category noted that their CTV ad platforms have too many manual processes and that they’ve struggled to place ads alongside premium inventory or content.

Unfortunately, not every CTV platform offers the important features that retailers need to maximize the channel’s abilities and opportunities. Retail marketers would benefit from pursuing CTV ad solutions with a rich feature set including TV audience prospecting tools, performance retargeting, incrementality reporting, and the means to produce creative efficiently, such as a Creative-as-a-Subscription (CaaS) offering.

Conclusion

While linear TV has long been a reliable ad platform for retailers, CTV’s performance marketing capabilities—including robust targeting and CTV measurement features—are driving marketers to shift to streaming in numbers that rival its linear forbearer. CTV’s ability to maximize every ad dollar spent and provide detailed campaign performance will continue to drive its popularity with retailers in a performance marketing future.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.