Quarterly Report

The Q4 Performance TV Report

by Tim Edmundson7 min read

Abstract

- To better understand the growth of performance marketing on Connected TV, we analyzed 2021 and 2022 metrics sourced from the MNTN platform.

- Analysis was limited to advertisers who had reported performance data >90% of the total days in Q4. This was done for both 2021 and 2022 for year-over-year comparisons.

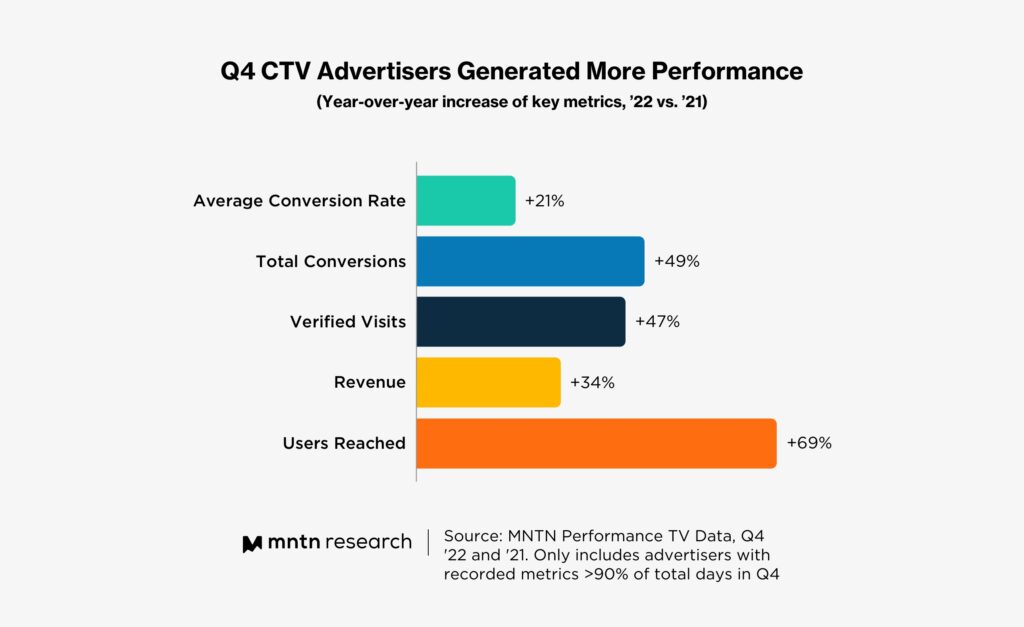

- CTV performance marketing, or Performance TV, showed significant year-over-year growth in key metrics, including campaign revenue, website traffic, conversion rates, and more.

- Year over year growth for average return on ad spend (ROAS) was significant in November (+26%) and December (+18%).

- Conversion rates improved as well, with the average conversion rate improving 21% YoY for Q4.

- Advertiser spend increased by 21% YoY in December, spurred on by strong campaign results in November.

Performance Marketing is Thriving on Connected TV

The economy may be in uncertain waters, but the same can’t be said for Connected TV advertising. The outlook is rather rosy for this fast growing ad channel—especially if you’re a performance marketer. This definitely goes against the general economic vibe at the moment.

Overall economic data wasn’t too encouraging for November and December, which saw retail sales fall 0.2% and 0.8% respectively, according to the US Department of Commerce. This was chalked up to consumers tightening their belts in response to inflation—and also retailers front-loading holiday sales earlier in the quarter. Many notable brands such as Amazon and Walmart launched Black Friday deals in October and early November to get out ahead of possible drops in consumer spending.

So with economic headwinds in full effect, how did performance marketers fare on CTV (AKA Performance TV) in Q4? Quite well—it generated more conversions, revenue, and website traffic than in its history as an ad channel.

To get a sense of how Connected TV is maturing as a performance marketing channel, we analyzed data sourced from the MNTN platform for Q4 2022. To illustrate how it grew year-over-year, we also pulled data from the 2021 holiday shopping season for comparison purposes.

What we found is an ad channel that is proving to be invaluable for advertisers.

Performance on CTV Isn’t a Standard Feature

Before diving in, we want to note again that the following data is sourced from MNTN Performance TV. Not all CTV ad solutions are built the same way; many focus on reach or impressions, instead of performance outcomes like ROAS, conversions, etc.

The data illustrates the results when CTV is optimized for performance, similar to a paid search or paid social campaign. We’ll sometimes refer to the ad channel as Performance TV below. Now without further ado, on to the numbers.

It’s a Growth Story

Starting with a look at year-over-year growth for performance metrics for the quarter, it’s clear that advertisers were tapping into CTV’s true potential. Its ability to reach the right audience, deliver effective messaging, and optimize for performance outcomes yielded increases across the board.

Analysis was limited to advertisers with active campaigns reporting performance data for over 90% of the total days in Q4. We took this approach to illustrate the impact of keeping CTV campaigns always-on, instead of running flighted campaigns over shorter windows. Interestingly, there was only a 2% difference in the number of advertisers who fit the criteria in 2022 versus 2021, which underlines how impressive the yearly growth played out.

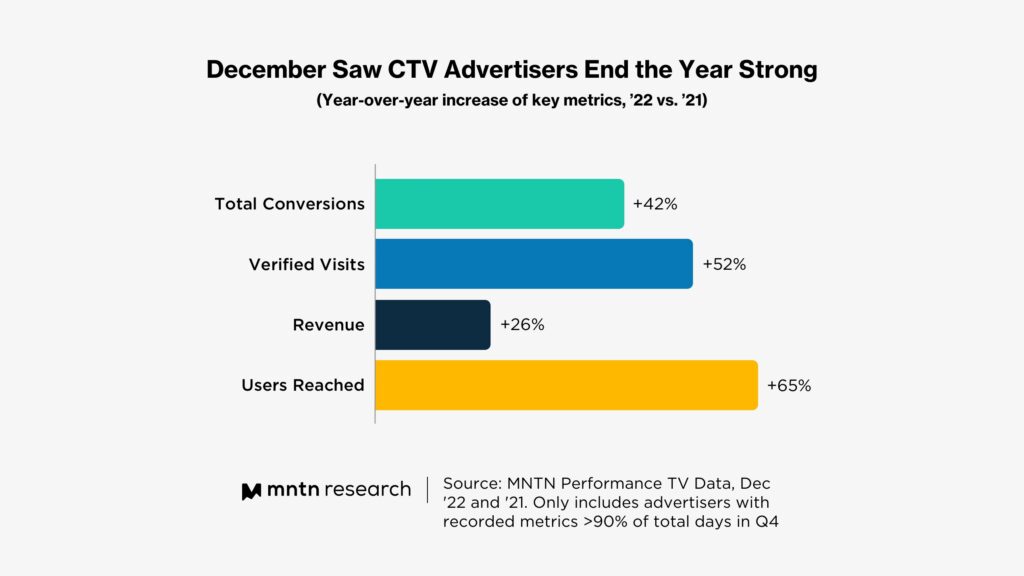

Performance marketers on CTV generated more revenue and conversions, and even saw the average conversion rate improve by 21% versus 2021. Even with optimizing for performance outcomes, reach wasn’t sacrificed—advertisers served impressions to 69% more users as well.

ROAS also saw significant growth in both November and December as prospecting efforts (which targeted new users using 3rd-party audience data) paid off. When it came time to buy, advertisers had placed themselves firmly at the top of shoppers’ consideration set.

- 26% YoY ROAS growth in November

- 18% YoY ROAS growth in December

The Full Funnel Approach Yielded Results

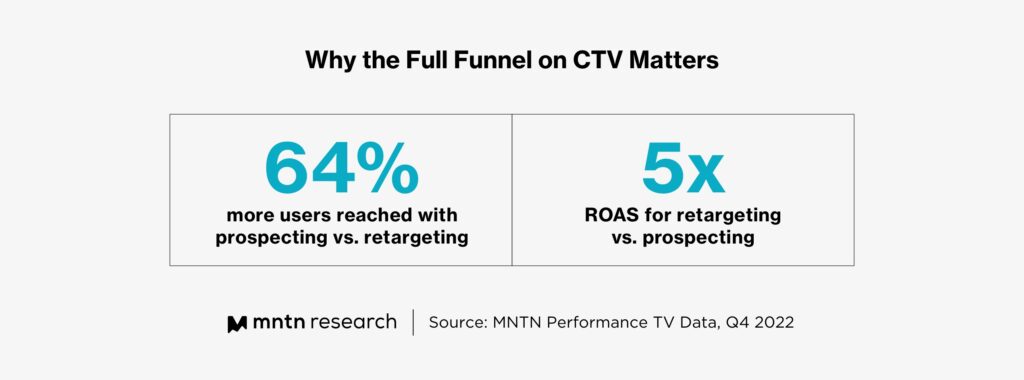

Television has traditionally been viewed as a top-funnel ad channel by many. This is due to it having a wide reach and limited measurement abilities when it comes to tying outcomes to campaigns.

With CTV, that really isn’t the case. And it’s made it a viable, measurable, full-funnel option for advertisers. It has also allowed them to tap into both 1st- and 3rd-party data sets to help them reach consumers.

Third-party audiences were used for prospecting campaigns to reach new audiences and bring them into the sales funnel. Advertisers then used retargeting, which allowed them to serve CTV ads to their website visitors, to stay top of mind.

The importance of this one-two punch cannot be overstated. Other notable findings from the full funnel approach in Q4 included:

- Prospecting campaigns had a slightly higher average conversion rate, illustrating how targeting the right TV viewers, and optimizing for specific performance outcomes, yields results.

- Retargeting audiences’ familiarity with the advertiser helped generate higher return on ad spend, and a lower cost per acquisition.

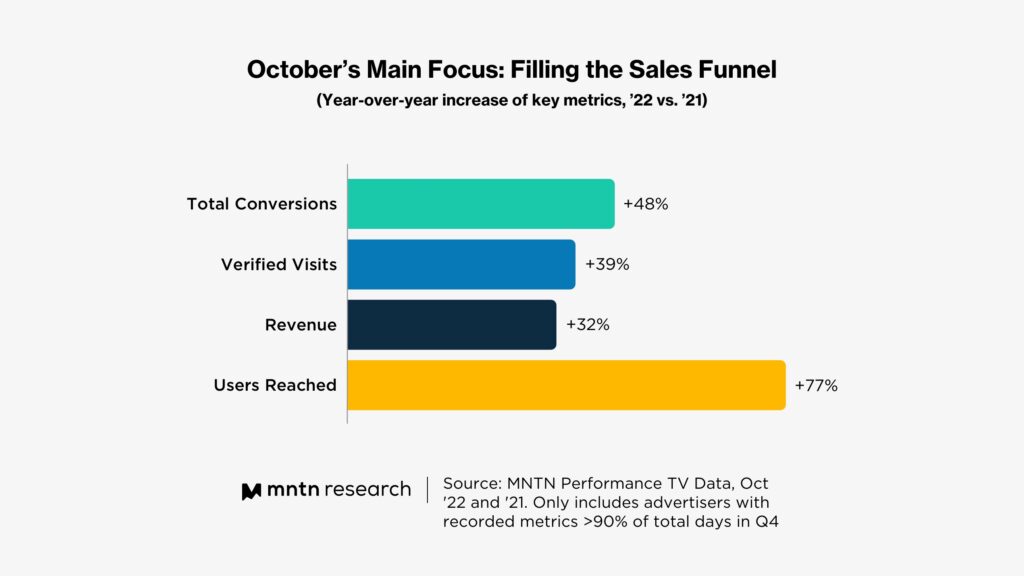

Early Q4 Efforts Focused on Filling the Funnel

Looking at a monthly breakout of key metrics, we see growth in areas that are telling of performance marketers’ focus.

As more consumers make the switch from linear TV, and spend more time streaming, the opportunity to reach more users has exploded. With more reachable consumers, we see how a heavy focus on reaching more shoppers early on paid off with a 77% YoY increase in number of users reached in October. This is a key time for generating touchpoints with holiday shoppers.

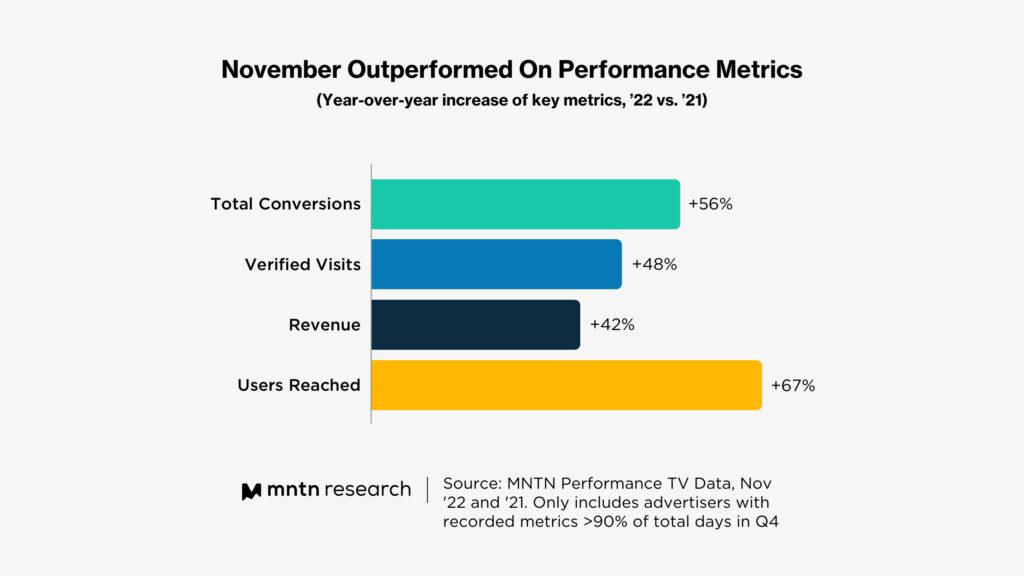

Black Friday Was a Smash Success for CTV

November plays host to the biggest shopping event of the year, so you expect to see pretty impressive results. But on a macroeconomic level, there were fears that consumers may cool their spending.

That didn’t happen, as shoppers were drawn to aggressive sales. Per reporting from CNBC:

- Black Friday posted record revenue of $9.2B.

- Overall online sales for Black Friday were up 2.3% year-over-year.

The good news was even better for advertisers using CTV to entice shoppers. Brands on the MNTN platform, for the month of November, saw their campaign revenue increase 42% year-over-year, along with a host of other key stats.

November saw the quarter’s largest year-over-year growth for revenue and conversions. In a nod to CTV’s efficiency when used as a performance channel, November also saw the highest YoY increase for average conversion rate. As noted earlier, November also saw YoY ROAS increase by 26%.

Put all this together, and you get a sense of CTV’s effectiveness when advertising in a highly competitive environment like the runup to Black Friday.

Advertiser Budgets Stayed Strong in December

It’s a best practice to increase the budget for ad channels that are yielding strong returns. Advertisers, spurred on by November’s CTV campaign numbers, spent more in December than they did in 2021 by 21%.

Increased spend in December yielded the largest YoY increases in impressions served and Verified Visits, which showed CTV’s ability to drive viewers to advertisers’ websites. December YoY ROAS also grew by 18%, meaning that increased spend was well worth it as advertisers were able to claim last-minute shopper dollars.

Conclusion

It was a good year in general for Performance TV advertisers in 2022, but Q4 was especially strong. The numbers show that performance marketing on CTV is on the upswing, and is one of the biggest growth stories in streaming television. As we make our way into 2023, we’ll continue to monitor this ad channel’s growth, and will be sure to share the stats with you each quarter.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.