Research Digest

“Churn and Return” Subscribers and the Sign of a Maturing CTV Landscape

by Stephen Graveman5 min read

Abstract

- Viewers are alternating between services more frequently but this isn’t anything to worry about—in fact, it’s a sign of a healthy landscape.

- As of October 2022, the average viewer subscribes to five services – up from three reported before the COVID-19 pandemic

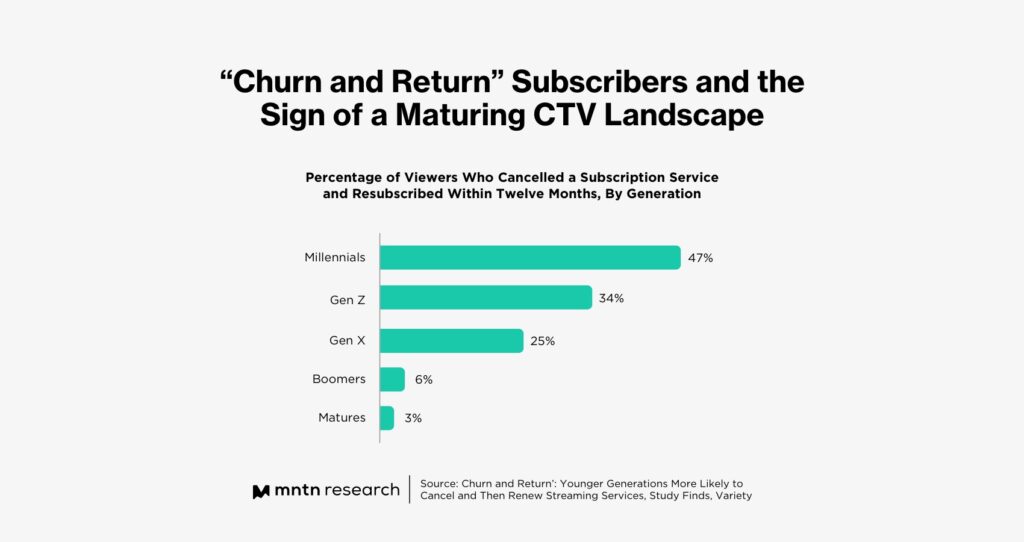

- 47% of millennials and 34% of Gen Z have reported canceling a subscription service and then resubscribing within twelve months

- Overall CTV viewership is at an all-time high: 213.7 million viewers streaming every month, watching an average of 80 minutes a day

Connected TV’s rise in popularity has resulted in a streaming arms race, with providers pumping millions of dollars into their respective platforms to create new content, secure existing content, and drive subscriptions. This highly competitive landscape has resulted in viewers wanting to see all the latest must-see content—but unable or unwilling to stay subscribed to a half-dozen or more services.

As a result, consumers are changing their subscription habits and alternating between services more frequently. But for advertisers on CTV, this isn’t anything to worry about—in fact, it’s a sign of a healthy landscape.

How Subscription Fatigue is Changing Viewing Habits

While CTV’s early days revolved around one or two big services like Netflix and Hulu, today’s audiences have thousands of channels to choose from, with more being added daily. In the last three years alone, the Connected TV landscape boomed with the launches of Disney+, HBO Max, Peacock, Apple TV+, Discovery+, and others. As of October 2022, the average viewer subscribes to five services – up from three reported before the COVID-19 pandemic. This choice of channels, many offering premium must-see content, has led to a new phenomenon—subscription fatigue.

This state of the industry, with countless services competing for a viewer’s limited time and monthly budget, has left some consumers feeling overwhelmed. To help combat exasperation, all the biggest services have unveiled ad-supported offerings that provide access at a reduced cost. But for some customers, that isn’t enough, as the continued market fragmentation has tightened wallets—even at a lower cost to entry. As a result, audiences that want to watch all the latest content but not break the bank have turned to a new strategy: “churn and return.”

The Rise of CTV Churn and Return

The churn and return strategy involves signing up for a service for a short period of time to watch an exclusive TV show or movie, then unsubscribing again until the next season or big film release. Unlike cable TV or social networks, streaming services are easy to cancel, often done in just a few keystrokes without having to speak to a customer representative. This consumer-friendly model makes it easy for viewers to binge-watch or stream premium content that is the talk of the digital water cooler, then easily exit effortlessly.

It’s a tactic mostly used by the coveted demographic of younger generations– 47% of millennials and 34% of Gen Z have reported canceling a subscription service and then resubscribing within twelve months. Conversely, 25% of Gen X report engaging in the practice, while only 6% of Boomers and 3% of Matures churn and return. Regardless of generation, a study by Antenna found that Q1 2022 saw nearly 30 million cancellations across streaming services—most of whom are still using OTT devices to stream other content. Some media companies have started to implement new delivery methods to combat this tactic, like releasing new shows on a weekly basis (as opposed to all at once) or stacking a release calendar so there’s always something new to watch when a previous show ends. Still, these ideas don’t solve the real reasons behind churn and return—62% of users say they canceled a subscription because they finished a show or movie, and the top reason listed for dropping a service is the monthly cost.

A Healthier CTV Landscape

While churning and returning might be a headache for individual streaming services, it’s a sign of a healthier overall landscape—which is good news for advertisers. While individual platforms like Netflix might be losing viewers in record numbers, overall CTV viewership is at an all-time high: 213.7 million viewers streaming every month, watching an average of 80 minutes a day. This discrepancy shows that while users might be swapping services frequently, they’re staying within the CTV ecosystem.

Overall CTV viewership is at an all-time high: 213.7 million viewers streaming every month, watching an average of 80 minutes a day.

While this news isn’t welcome for the media companies behind the services, it’s great news for advertisers and CTV as a whole—and demonstrates a maturing CTV landscape that continues to expand with new offerings. By showing that viewership doesn’t drop alongside canceled subscriptions, CTV manages to avoid the pitfalls that have affected linear TV and its users who cut the cord for another platform altogether.

What This Means for Advertisers

The idea that viewers are routinely cycling between a handful of services would be terrifying for advertisers on other channels like paid social. For instance, a brand that invests heavily in Facebook ads wouldn’t be able to reach its target audience if they all left Facebook and moved to Twitter. This user fluctuation would also lead to discrepancies in viewership metrics like ROAS, shrouding the true value of both an ad’s performance and the ad inventory that was purchased.

Thankfully, CTV advertising platforms can circumvent this dilemma by using audience-first targeting to reach the consumer directly through their IP address. This practice eliminates the need to be locked into one streaming service, instead looking at CTV holistically and piecing together a fragmented landscape. By targeting the viewer, and not the channel, brands don’t have to worry about a service’s monthly engagement rates—they can still deliver the right ad to the right audience, regardless of what they’re watching.

Conclusion

Churn and return stories are likely to continue being a part of the CTV conversation for the foreseeable future, especially as monthly subscription rates continue rising to keep up with soaring production costs. Today’s users have more choices and freedom than ever before on the platform, and they’ll continue to sign up for more cost-effective methods or hop around services to ensure they’re watching everything they want to see. Thankfully, the platform was built to accommodate advanced targeting techniques, so advertisers can rest easy that while streaming services may be losing viewers, their ads won’t.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.

Resources

1 How fast do you cancel streaming services? It’s a problem for Hollywood (Los Angeles Times)

2 What Advertisers Need to Know About Market Fragmentation (MNTN Research)

3 ‘Churn and Return’: Younger Generations More Likely to Cancel and Then Renew Streaming Services, Study Finds (Variety)

4 The Average U.S. Household Subscribes to Four Streaming Services (MNTN)

5 CTV and digital advertising: How Connected TV is one of the fastest growing channels in 2022 (eMarketer)