More Options, More Anxiety: CTV Viewers Are Overwhelmed

by Stephen Graveman6 min read

Abstract

- 46% of US viewers report they are overwhelmed by streaming’s content selection, and have a hard time finding what they want to watch

- Despite this, 72% still say they “love” their experience and streaming more than ever

- 93% of respondents intend to keep, or grow, their current number of subscription services

- There are currently over 817,000 unique program titles available on streaming

If you’ve ever mindlessly scrolled through a streaming service menu, crippled by the amount of must-see content that’s continually releasing, you’re not alone. A study by Nielsen found that nearly half of all streaming users in the U.S. report feeling overwhelmed by the amount of programming at their fingertips, with 46% reporting that it’s difficult to find the content they want to watch.

The ever-increasing amount of streaming services and titles are making it more difficult to determine where viewers can find specific content. Despite this signal for help, the same audience reports being happier than ever with the channel, and have no intent to cut back soon.

Why Viewers Are Overwhelmed

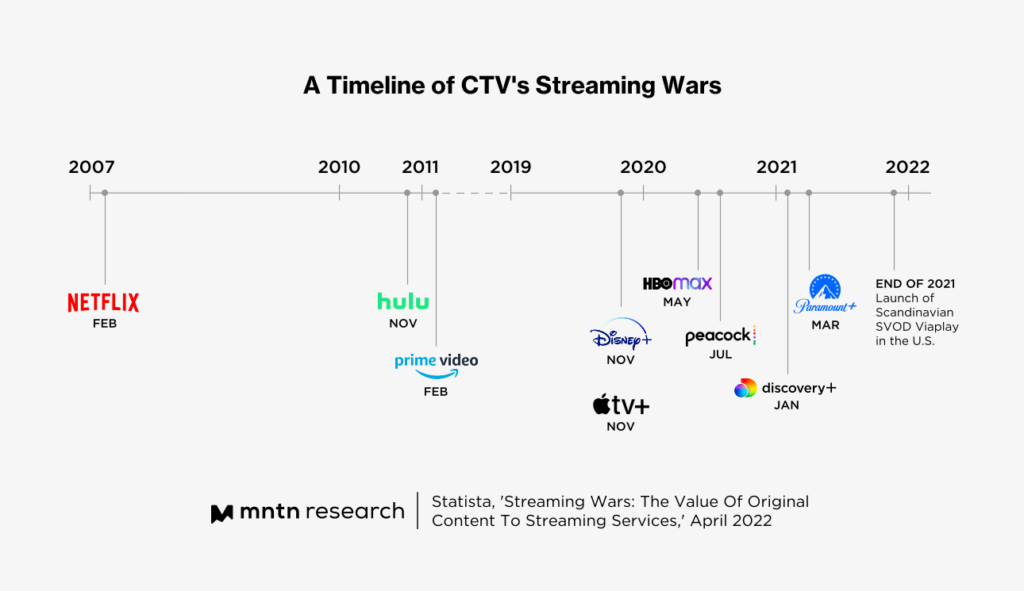

That today’s streaming viewer feels paralyzed with choice shouldn’t come as a big surprise. Once dominated exclusively by Netlifx, today’s streaming landscape has become a big business. In just the past few years, the landscape exploded with media, entertainment, and technology companies throwing their hats in the ring and investing heavily in competitive content slates. In the past three years alone, the number of premium services has tripled.

Today, HBO, Disney, NBC, Paramount, Apple, Amazon, and countless others are expanding their libraries and making shrewd moves to prevent churn and keep viewers streaming—and this isn’t factoring in the countless smaller players or FAST channels like Crackle or Tubi. As of last year, there were 817,000 unique program titles available via streaming channels, marking an increase of 171,000 (26.5%) since 2019—and that number has undoubtedly risen.

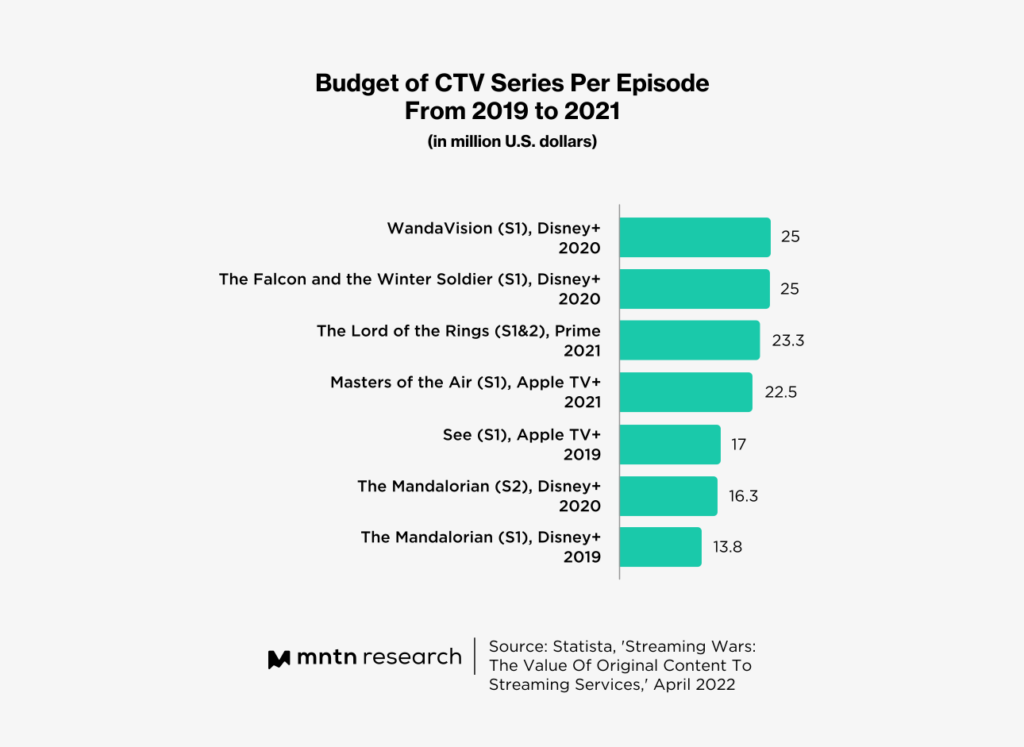

Thanks to streaming services increasingly being owned or launched by media entertainment companies, these program titles have become hot must-see-TV for fans of their respective properties—and platform holders are writing increasingly big checks to produce them. As a result, it’s no wonder that as of October 2022, the average viewer subscribes to five services—an increase from three reported before the COVID-19 pandemic and a likely source of the increasing feeling of unease.

Further, continuing market fragmentation and consolidation are making the streaming landscape confusing for even the savviest of consumers. Last year, WarnerMedia and Discovery merged to form Warner Bros. Discovery, and it wasn’t long before they talked of consolidating their respective streaming services.

Slated to launch later this year under a still-unknown name, the new HBO/Discovery combination will give viewers access to over 200,000 hours of programming across 100 brands, including WB, HBO, Discovery, CNN, TBS, Food Network, Animal Planet, and more. This shakeup has already created turmoil ahead of its merged service’s launch, as HBO Max makes cost-cutting moves including migrating exclusive programming from the service to FAST channels and backing away from animation and kids programming.

This same scenario might play out again later in 2023 or early in 2024 as Disney, which already owns Disney+, ESPN+, and a 66% majority stake in Hulu, is likely to buy out Comcast’s remaining 33% Hulu ownership. Already there are rumors and predictions that we might see a combined Hulu/Disney+ service, as it’s unlikely the media company wants to spread itself too thin across multiple channels.

While these mergers and consolidations are causing short-term confusion, they’re likely to eventually produce a positive impact on overwhelmed viewers in the future, giving them fewer channels to flip between and putting more content under each streamer’s roof.

Viewers Are Still Streaming

It turns out that there may not be “too much of a good thing,” at least when it comes to CTV. While nearly half of the respondents reported feeling overwhelmed by their options, an impressive 72% said they still love their experience with streaming video services. This helps to explain why viewership continues to climb alongside the amount of new content available.

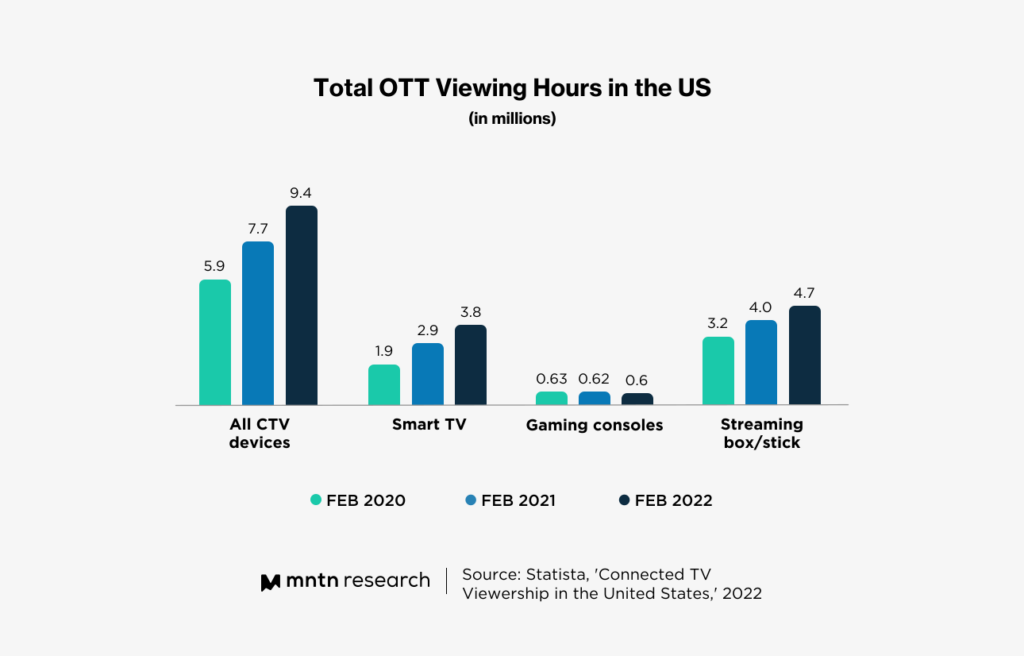

In February 2020, overall streaming viewership across all CTV devices equaled 5.9 million viewers for the month. Two years later, that same month and category saw 9.4 million. That came to equal roughly 169.4 billion minutes of CTV watched for the month, an increase from 143.2 billion just a month prior.

Despite the feelings of anxiety, viewers are not cutting back on their streaming; an overwhelming 93% of respondents polled report planning to keep all of their streaming services — or adding more over the next year.

This increase in streaming viewership is having impacts beyond the walls of CTV’s ecosystem. In July 2022, Nielsen reported a watershed moment for Connected TV. Streaming platforms – led by Netflix – finally surpassed cable networks to claim the largest share of U.S. TV viewing.

Changing Viewing Habits

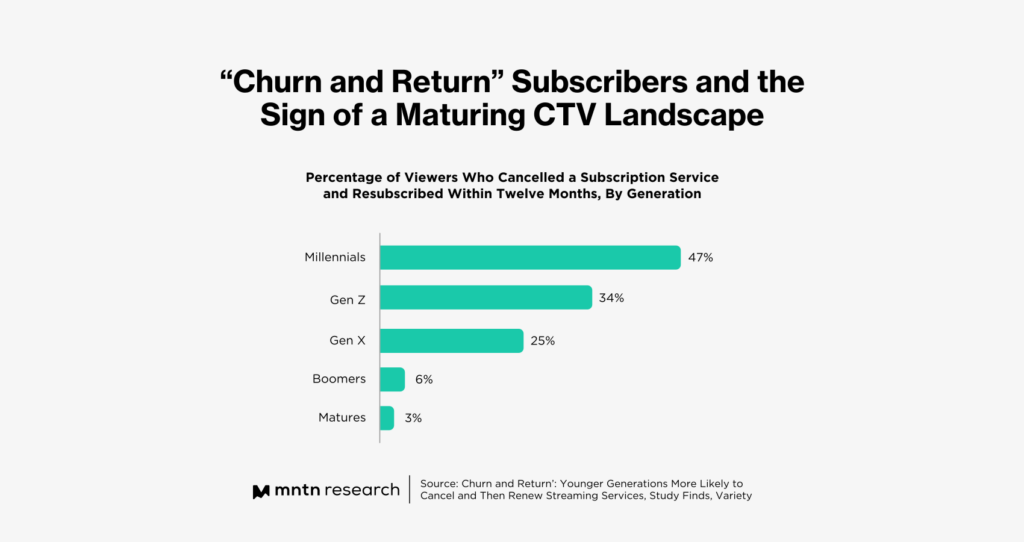

This choice of channels and their premium content competing with users’ money and attention has led to a new phenomenon—subscription fatigue. Almost all of the major streaming services have launched ad-supported offerings to help combat this, providing access to their content at a reduced cost. But some viewers have taken to a new strategy, “the churn and return.”

While typically a tactic used by younger generations, “churn and return” sees users signing up for a new service for a short period of time and binge-watching all of the exclusive content they want to see before unsubscribing and moving on to the next channel.

To combat this, streaming services are increasing their content outputs, stacking their release calendars to always have something “new,” and even pivoting to release new shows on a weekly basis to prevent binge-watching—a move that brings CTV away from the “watch it all at once” allure of its formative years and closer to how linear TV operates.

Thankfully for advertisers, CTV ad platforms can solve this rising strategy by using audience-first targeting to follow viewers from channel to channel using a combination of data points including IP address and device graphs. This methodology helps to piece together a fragmented streaming landscape and prevents being locked into one streaming service that might have a fluctuating viewer base.

Conclusion

While today’s viewers are reporting feeling overwhelmed by CTV’s content offering, they’re still streaming more than ever and finding new ways to alleviate their anxiety—-without leaving the streaming ecosystem. This commitment shows a maturing of the channel and an appreciation for how it fits into viewers’ daily lives.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.

Resources

1 State of Play (Nielsen)

2 How Fast Do You Cancel Streaming Services? It's a Problem For Hollywood (Los Angeles Times)

3 Predictions For Connected TV in 2023 (MNTN)

4 ‘Westworld’ and ‘F-Boy Island’ Among Axed HBO Max Shows Now Streaming on Roku (The Wrap)

5 Streaming Viewers Feel Overwhelmed By Options, Nielsen Survey Suggests (Forbes)

6 Streaming Overload: Viewers Feel Overwhelmed by Too Many Choices, Nielsen Survey Finds (The Hollywood Reporter)

7 Streaming Claims Largest Piece of TV Viewing Pie in July (Nielsen)

8 What Advertisers Need to Know About Market Fragmentation (MNTN Research)

9 “Churn and Return” Subscribers and the Sign of a Maturing CTV Landscape (MNTN Research)