Analysis

Why More Viewers Are Streaming Sports, Including March Madness

by Stephen Graveman6 min read

Abstract

- Sports—linear TV’s most popular programming—is being streamed more than ever.

- By 2025 it’s estimated that 118M U.S. viewers will stream their favorite sport

- The number of viewers that watch sports on digital channels versus cable TV is already tied (39%)

- 56% of viewers watched 2021’s NCAA March Madness through digital channels instead of broadcast television

The Rise in Sports Streaming

While streaming services dominated the world of television series and movies for years, there have always been two key markets that linear TV has bested its successor: news and sports. In fact, sports are the most popular programming on broadcast TV. While news makes up for 6 of the 100 most-watched primetime broadcasts, sporting events capture 61 of those top 100 slots. It’s this grip on sports that have kept linear TV popular with viewers and helped to mitigate churn—research firm MoffettNathanson discovered that most of the audiences abandoning linear TV for CTV “appear to be consumers who aren’t classified as sports viewers.”

But even as the last bastion of broadcast TV, sporting events are starting to succumb to the streaming service migration. According to The Trade Desk’s Future of TV Report, nearly 39% of viewers primarily watch sports via ad-supported CTV platforms or social media—a number that matches the 39% who still watch on cable.

According to eMarketer, these agreements are shaping the future of televised sports. By 2025, it’s estimated that 118 million U.S. viewers will stream their favorite sports, an increase of 71% compared to 2021.

Shaping Consumer Behavior

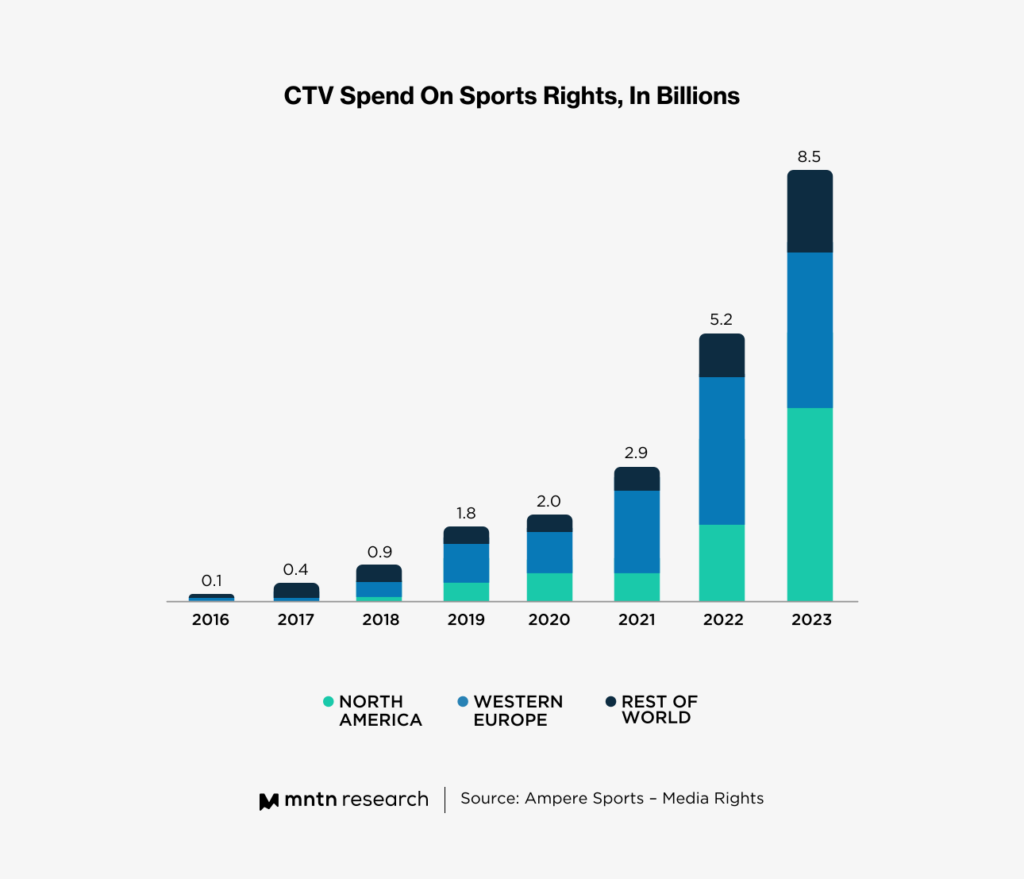

So why are there a growing number of sports fans watching their favorite games on Connected TV? First —and perhaps most obvious—is that there is more accessibility to OTT sports than ever before. Streaming services’ spend on sports rights globally is projected to reach $8.5B this year alone, a 64% increase from 2022 — with North America leading the charge (Fig. 1). This increase in sports streaming is having a profound impact on the industry as a whole—CTV’s share of sports rights will now encompass 21% of the global sports rights investment, up from 13% in 2022.

Traditionally, investment in CTV sports has lagged compared to television and film. But as streaming technologies have improved and more services entered the market, the streaming sports model has skyrocketed in popularity. Further, a challenging economic outlook for traditional sports broadcasters like broadcast and cable TV has led to rights owners investing more heavily in streaming platforms for media rights growth.

This has resulted in a mutually beneficial gold rush; sports organizations are chasing a shifting consumer base to streaming, and both media companies and streaming services are securing deals to differentiate themselves and keep users subscribed.

Examples of this include Amazon Prime paying $1 billion per season for rights to stream NFL “Thursday Night Football,” AppleTV+ securing the rights to MLB “Friday Night Baseball” and MLS games, and HBO Max acquiring US women’s and men’s national soccer team matches for 2023. Today, it’s harder to find a streaming service that doesn’t offer any type of sports programming (Fig. 2) and some leagues and regional sports networks are even launching their own services.

The end result is that sports are frequently available on-demand, on any device, and likely on users’ existing subscription services—shaping fans’ expectations and habits for following their favorite teams.

Breaking Down Viewership By Generation

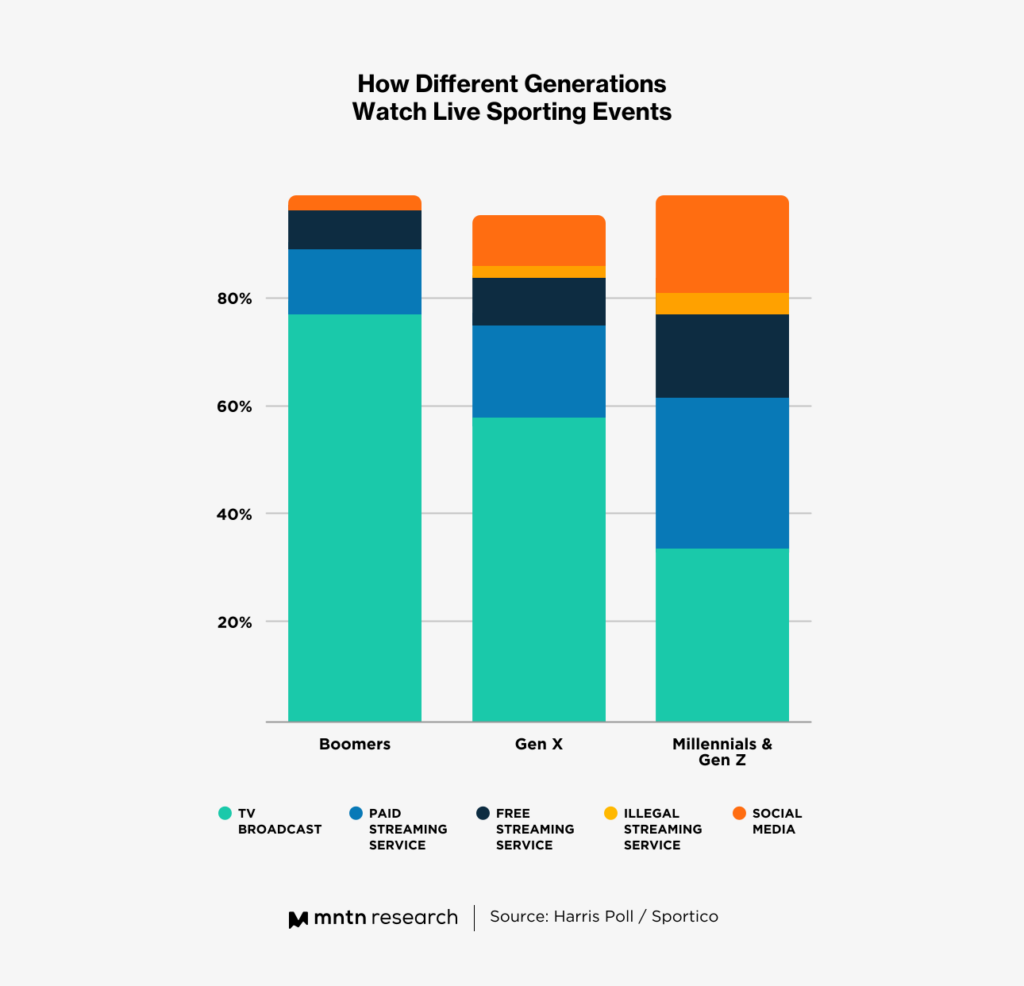

CTV sports viewership, perhaps unsurprisingly, skews younger generationally. A recent poll between Sportico and Harris Poll (Fig 3.) found that Millennials (ages 25-39) and Gen Z (25 and younger) prefer streaming services over broadcast television for live sporting events. For older generations, Baby Boomers (56+) overwhelmingly prefer the format they’ve always used, linear TV (77%).

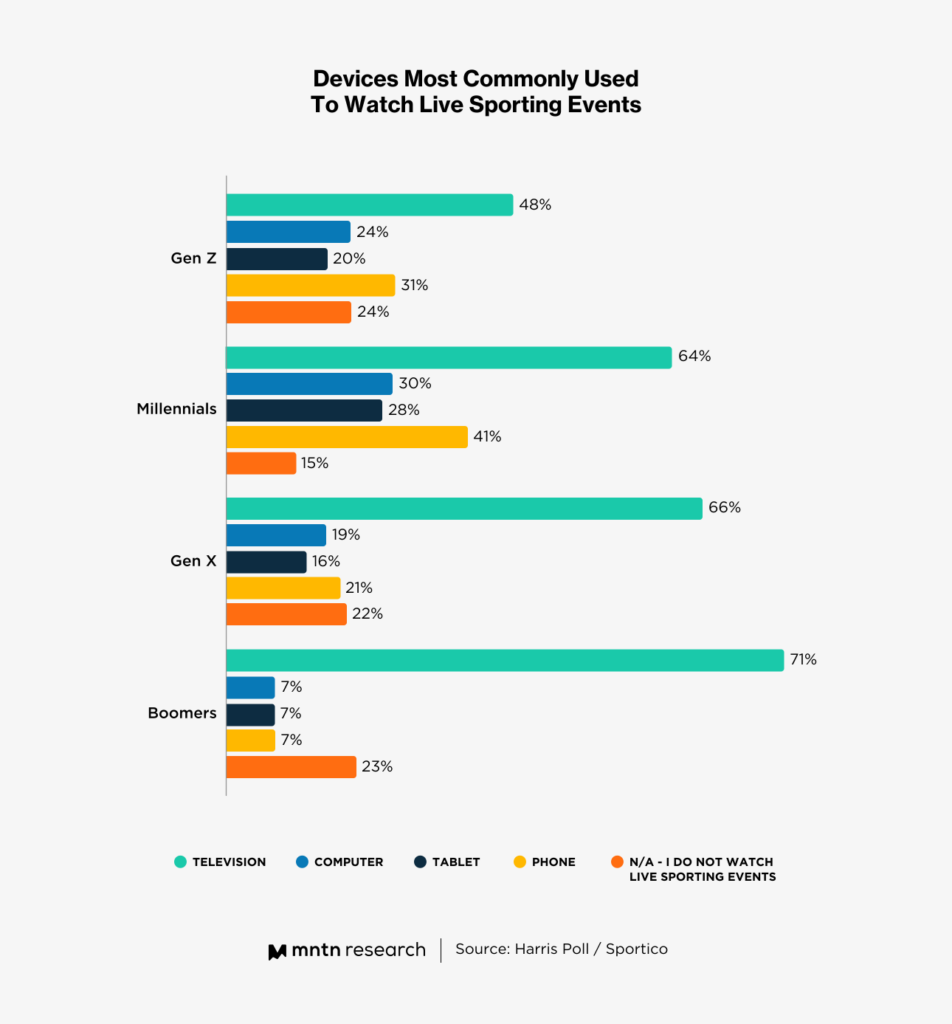

Regardless of the generation or platform used, respondents were all in agreement that sports belong on the big screen. From Gen Z (46%) to Baby Boomers (71%), most preferred to use their TV to watch live sports (Fig 4).

Many of the benefits of streaming sports appeal to fans of all ages and backgrounds and is likely fueling the momentum toward CTV:

- Flexibility and Convenience: Streaming sports allows viewers to watch their favorite games and events on-demand at any time, anywhere, and on any device. They can pause, rewind, or fast-forward the game, which is not possible with live television. These benefits are becoming increasingly popular in today’s busy world, work and social obligations, and competing content.

- Cost: Many streaming services offer sports packages at a lower cost than traditional cable or satellite providers; as sports continue moving to streaming this has made it easier for consumers to cut the cord. Moreover, viewers can choose the specific sports or teams they want to follow.

- Personalization: Streaming services offer personalized recommendations and content based on a user’s viewing history, preferences, and behavior, helping them discover new sports and events.

- Bonus Content: Streaming often strengthens the bond between fans and teams by offering exclusive pre-and-post-game content, athlete interviews, behind-the-scenes footage, analysis, archival footage, documentaries, and pre-recorded extras. This extra content helps to keep fans invested and engaged between games and even seasons.

March Madness on CTV

The NCAA March Madness tournament has become bigger than ever for both viewers and advertisers, with over 100 million viewers–or 65% of US households—projected to tune in and watch an average of 9.25 hours. Viewers will be able to tune into CBS All-Access or Paramount+ to catch the game, thanks to a 14-year contract between Turner, CBS, and the NCAA for $10.8 billion. Overall, networks streaming the games see a viewership increase of 86% compared to the period prior and reach nearly 2.5 more households per commercial than the average program.

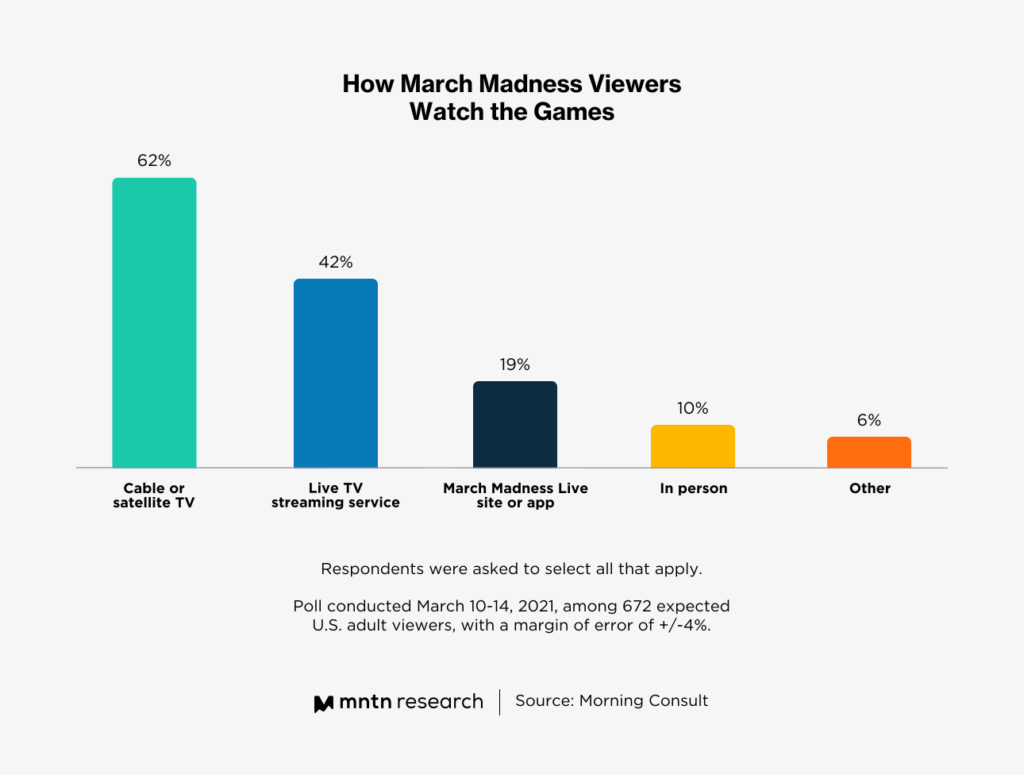

Streaming is expected to encompass a large percentage of viewership, with streaming viewership steadily increasing over the last several years. In 2021, Morning Consult found that only 62% planned to watch the tournament on broadcast television—a decline of 30% since 2017. At the same time, streaming rose from 37% in 2020 to 42% in 2021 (Fig 5).

But when accounting for the 19% that planned to watch on the March Madness Live site or digital app, the overall digital viewership for the tournament rises to 56%—within striking distance of linear television.

Conclusion

While sports programming has managed to keep broadcast and cable TV afloat during year-over-year increases in cord-cutting, the days of being exclusively on linear TV are over. Regardless of sport or tournament, more viewers across a variety of demographics are choosing to stream their favorite games and networks are using the opportunity to shape a more loyal and engaged fanbase.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.

Resources

1 Streaming vs. Cable and Satellite: Sports Viewers and The Evolving TV Conundrum (The Athletic)

2 Sports Networks Squeezed By Rising Costs and Fewer Subscribers (Axios)

3 Spending and Performance Gaps, Sports Streaming Audiences, & More | Weekly Marketing News (MNTN)

4 Streaming Services Up Spend on Sports Rights (Broadband TV News)

5 Streaming Channels Look to Intercept NFL’s Sunday Ticket (MNTN)

6 Streaming Prevails for Gen Z As Boomers Sustain Linear TV Dominance: Data Viz (Sportico)

7 50-Plus Fun Facts About March Madness (Forbes)