Partner Research

How Retail Brands Are Using Connected TV Advertising to Reach Today’s Customer

by Stephen Graveman13 min read

Abstract

- MNTN and Worldwide Business Research (WBR) polled 100 retail marketing and strategy leaders on their current advertising strategies

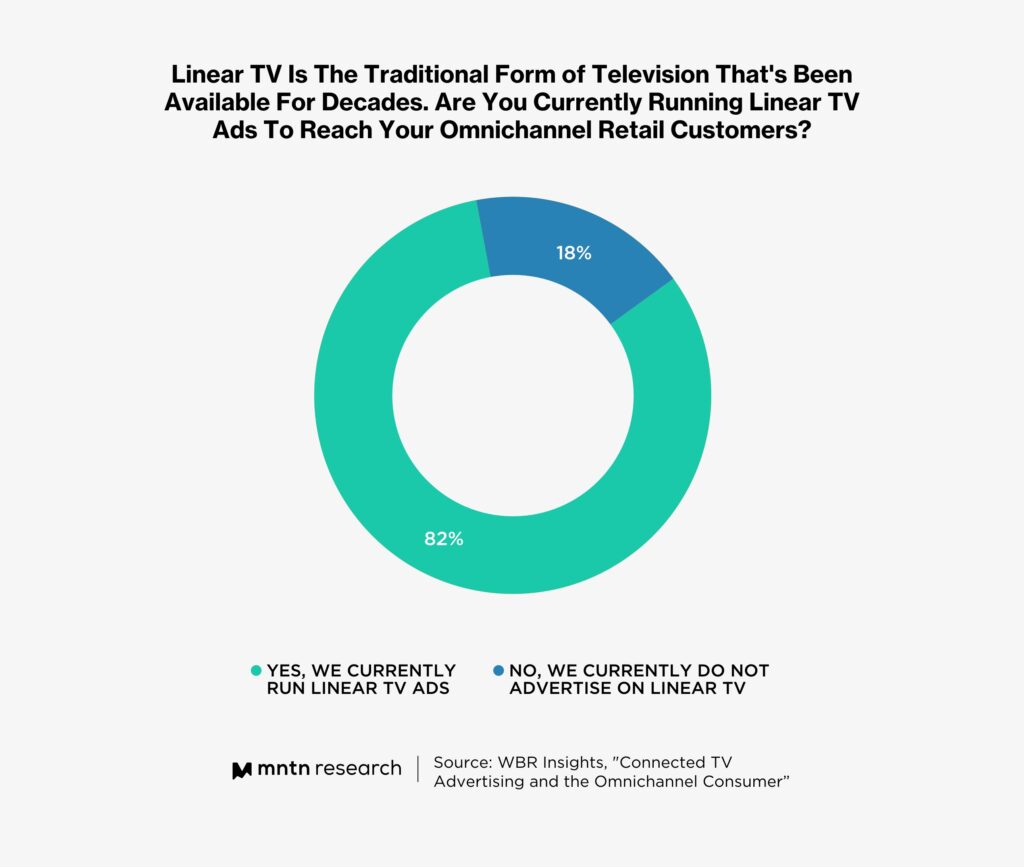

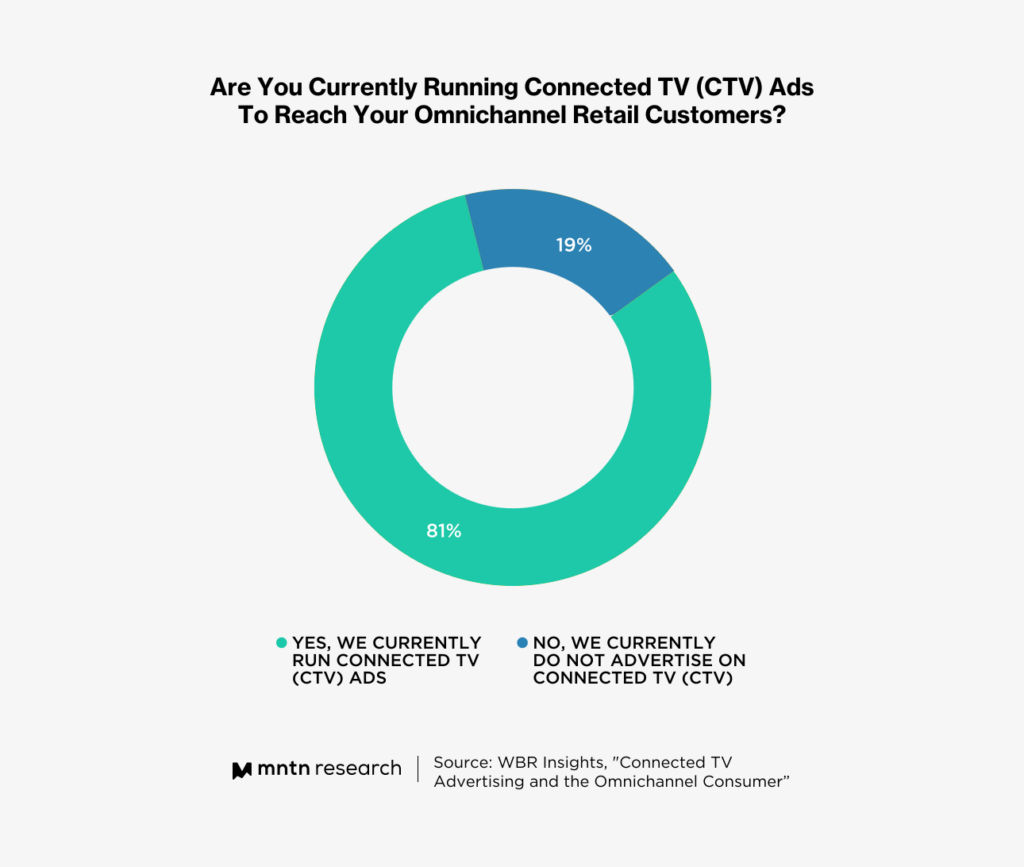

- 81% of respondents currently run CTV ads, almost equal to the same number running linear TV ads (82%)

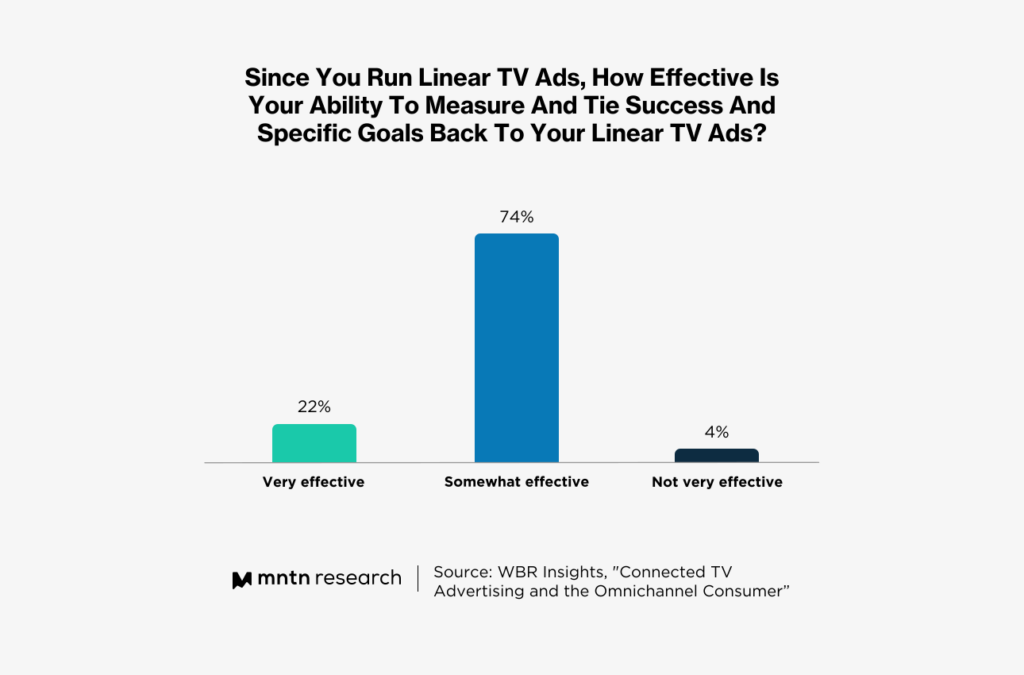

- 74% of respondents consider their ability to measure goals against linear TV ads only somewhat effective

- 65% say that CTV will play a significant role in their omnichannel marketing strategy in 2023

Table of Contents

- 01 Introduction

- 02 About the Respondents

- 03 Key Insights Among the Respondents

- 04 Social Media and Mobile Ads Are Essential to Omnichannel Marketing

- 05 Companies Struggle to Tie Goals to Linear TV Ads

- 06 CTV is Increasingly Important to the Future of TV Advertising

- 07 Conclusion: Future Capabilities in CTV Advertising

- 08 Key Insights

Streaming services are growing in popularity among consumers in the United States, so much so that the number of streaming viewers surpassed cable and broadcast viewers for the first time in 2022.

However, consumers have adopted an omnichannel approach to shopping. Instead of engaging with a single channel before making a purchase, they use a variety of channels— sometimes at the same time—to research products and services before buying. Connected TV (CTV) is emerging as a powerful tool for retailers to reach customers over one of their most-preferred channels.

Providing advertisers with vastly more capabilities than linear television, CTV ads will soon bridge the gap between digital shopping and television advertising, providing a true omnichannel experience for customers. This report explores how retail brands are currently using CTV ads, linear TV ads, and other types of advertisements to reach today’s customers. It also identifies the key challenges and opportunities associated with television advertising in the current environment.

About The Respondents

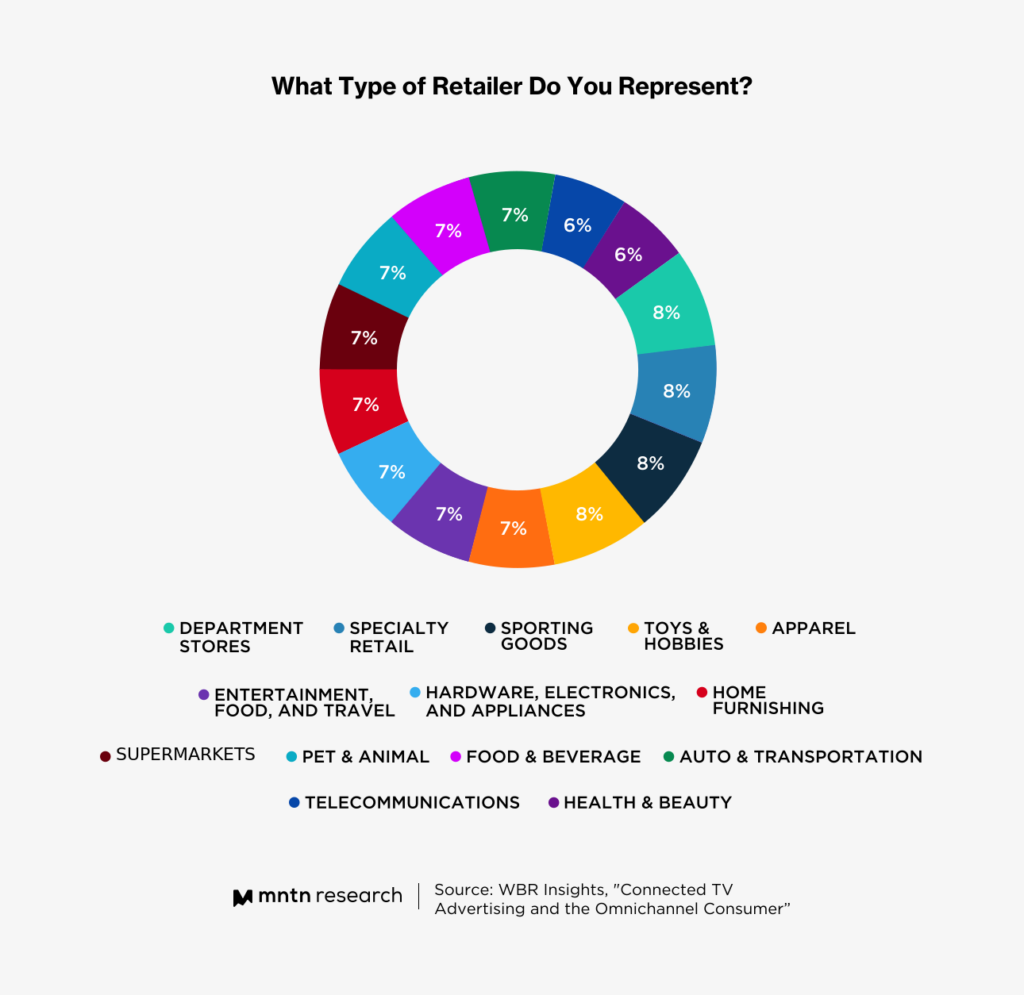

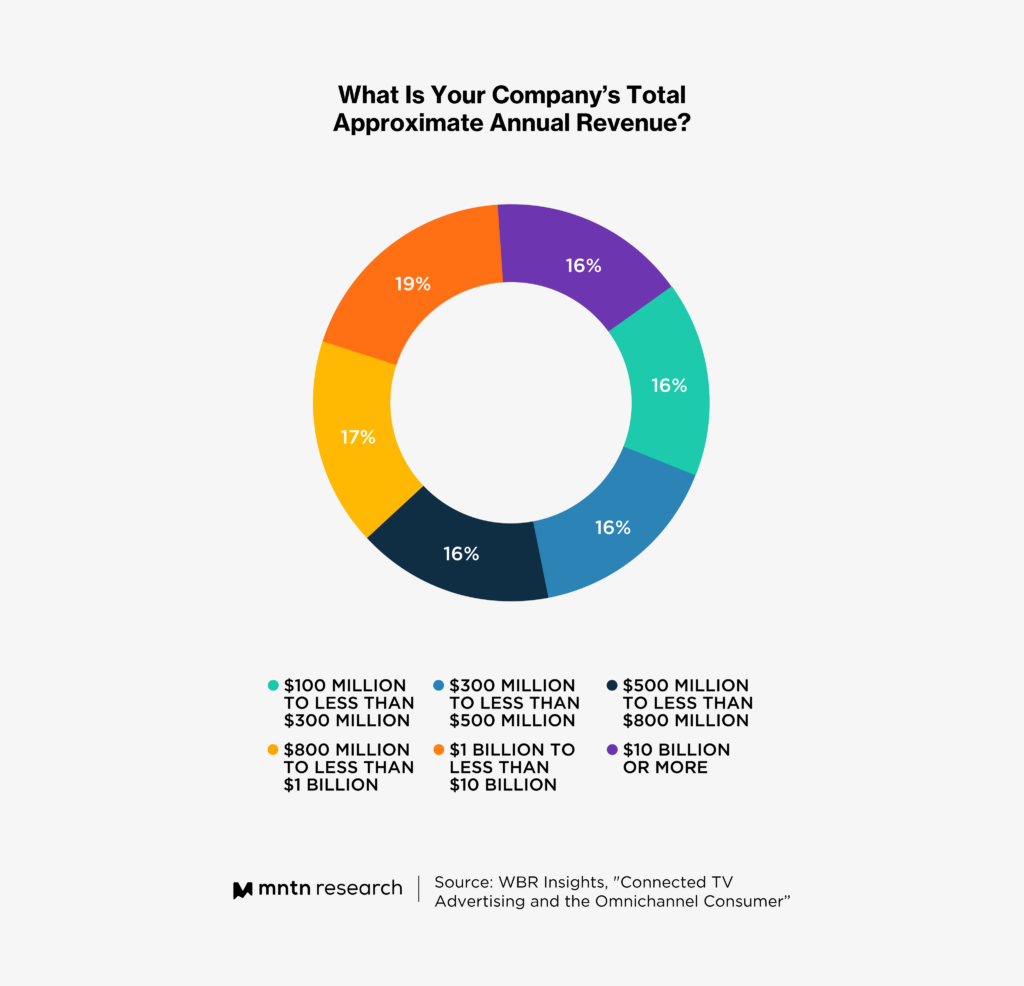

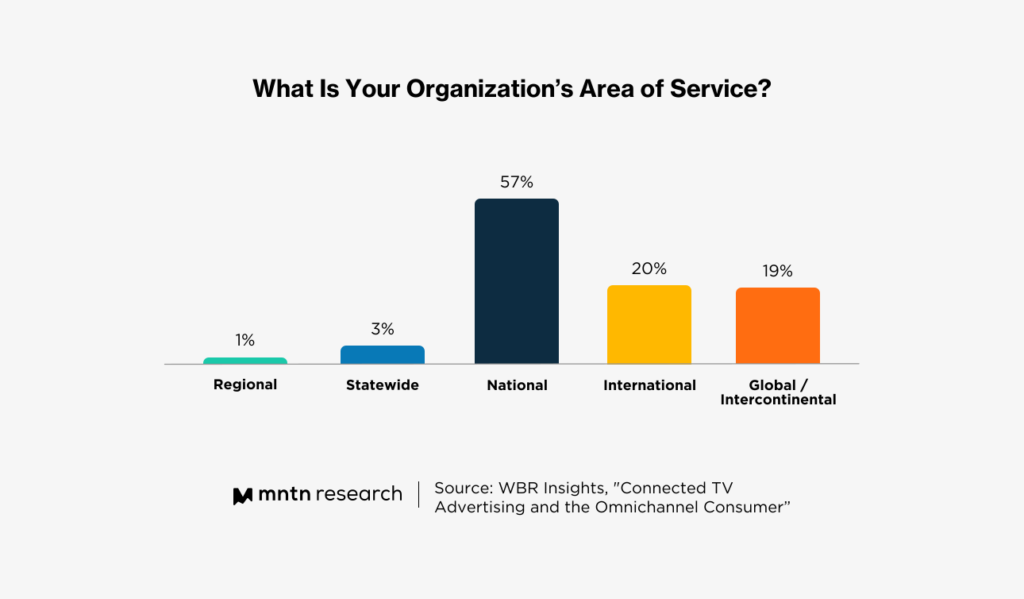

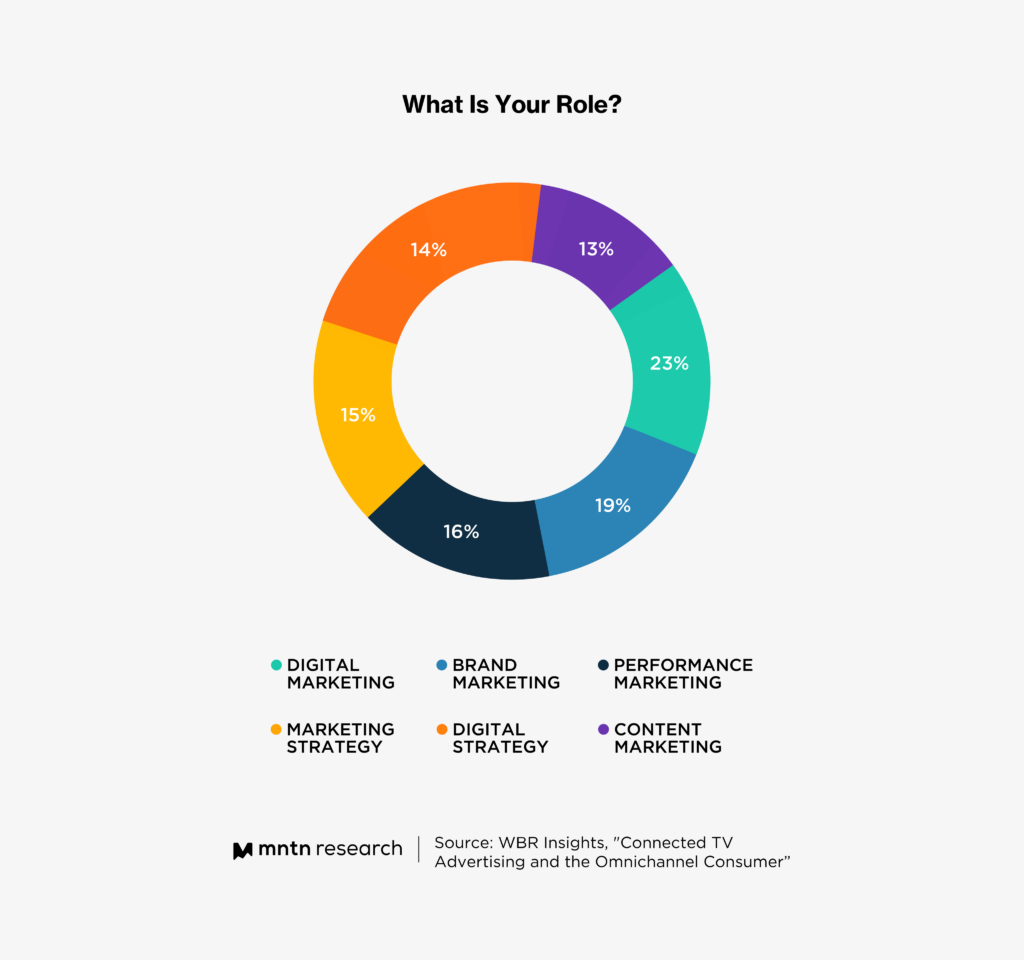

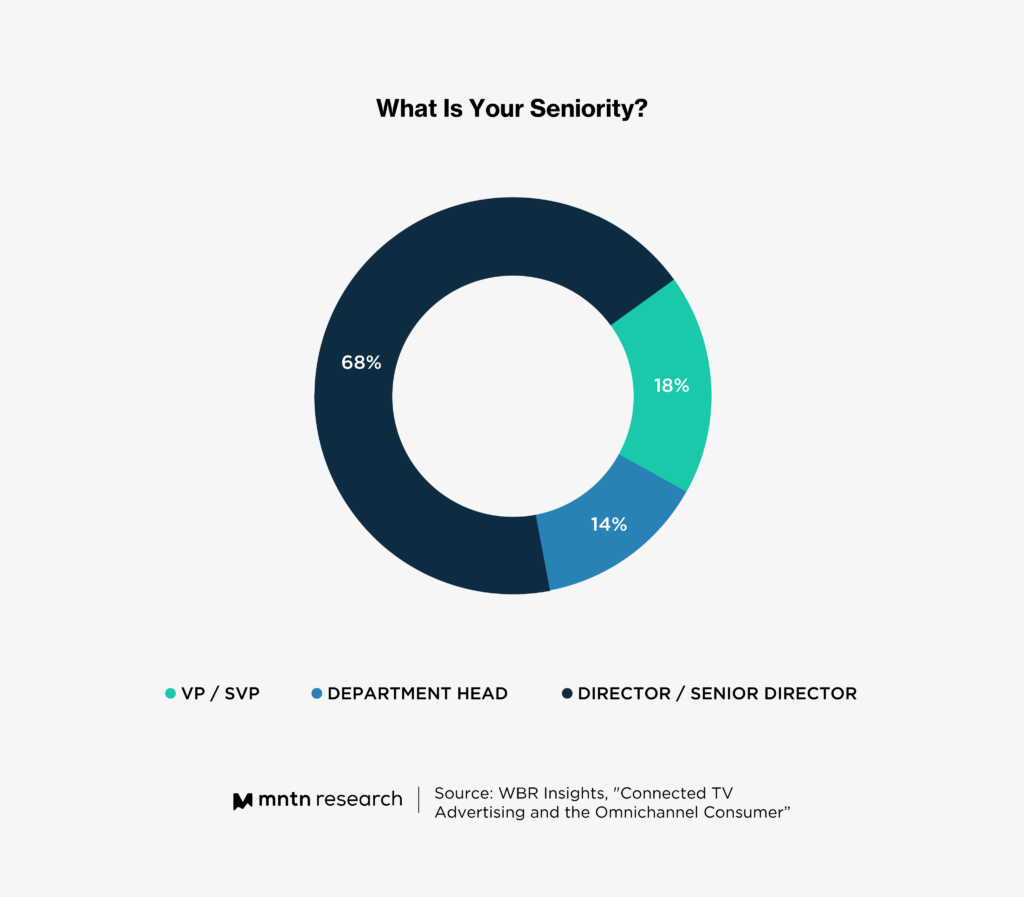

The WBR Insights research team surveyed 100 retail marketing and strategy leaders from across the U.S. and Canada to generate the results featured in this report. All the respondents are directly involved in their companies’ advertising efforts, and the companies they represent all do business in the United States.

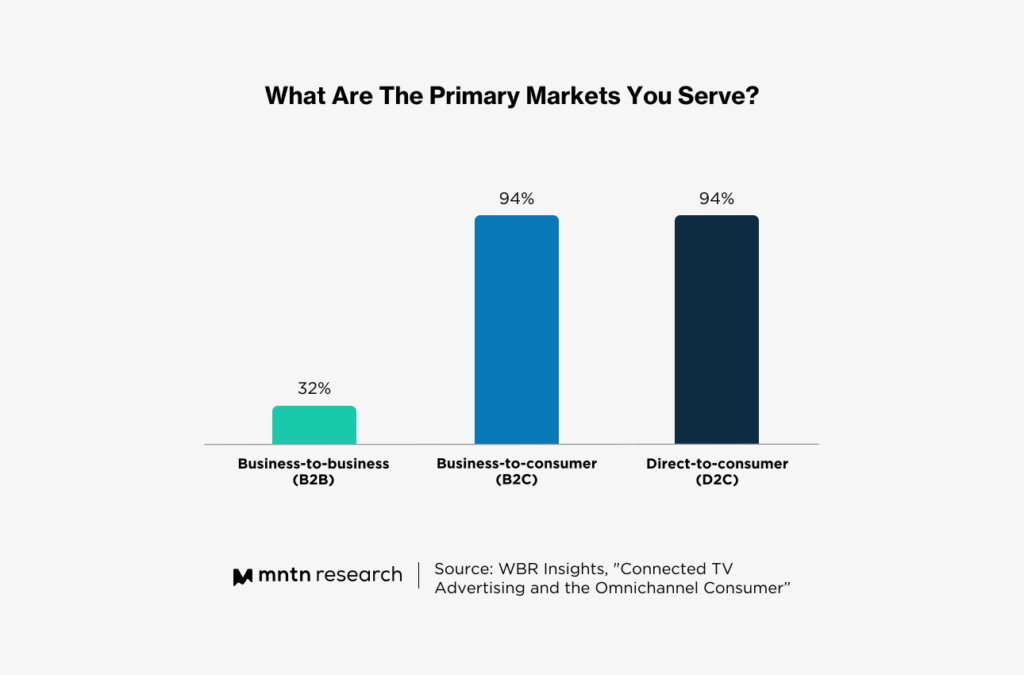

The respondents represent a variety of retail categories and company sizes, as measured by total annual revenue. In each case, 94% of the companies represented operate B2C and D2C brands.

Key Insights Among the Respondents

- 82% consider social media ads very effective for engaging omnichannel customers, while 81% say the same about mobile ads.

- 59% consider CTV ads very effective for engaging omnichannel customers.

- 65% say their digital advertising budgets will increase substantially over the next 12 months.

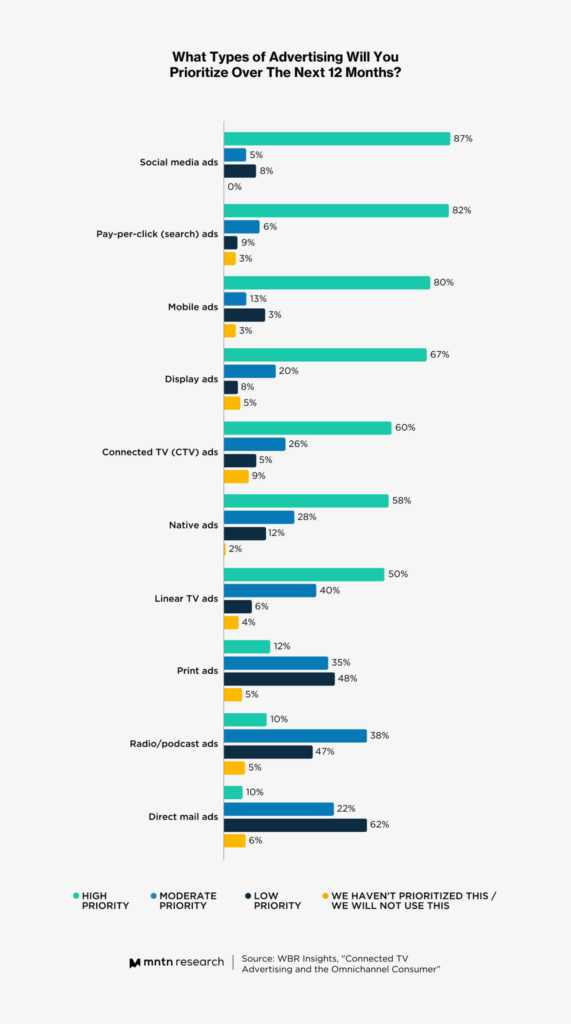

- 87% consider social media ads, pay-per-click ads (82%), and mobile ads (80%) high priorities over the next 12 months.

- 60% consider CTV ads a high priority over the next 12 months.

- 82% currently run linear TV ads, but 74% of these respondents consider their ability to measure goals against linear TV ads only somewhat effective.

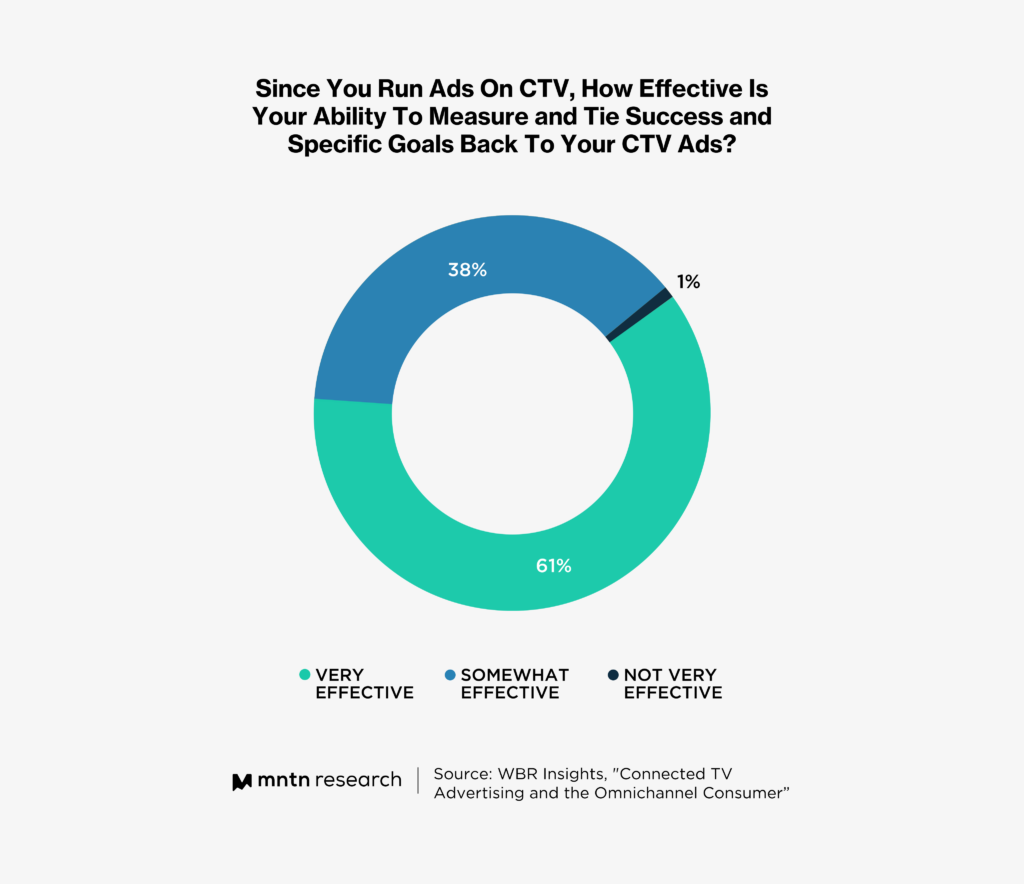

- 81% currently run CTV ads, and 61% of these respondents consider their ability to measure goals against CTV ads very effective.

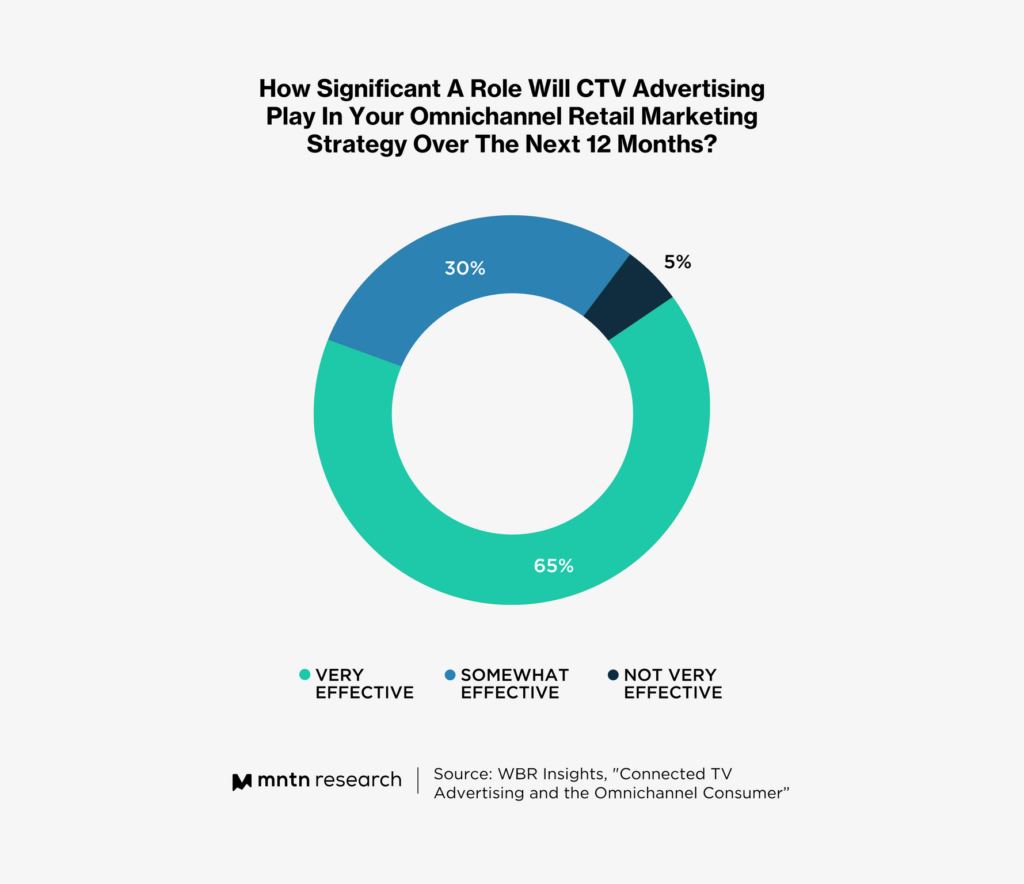

- 65% say CTV advertising will play a very significant role in their omnichannel retail marketing strategy over the next 12 months

Social Media and Mobile Ads Are Essential to Omnichannel Marketing

Today’s consumers rely on a range of channels to learn about products, engage with brands, and make purchases. Prominent channels like social media and search have become standard venues for retail advertisements and marketing campaigns. However, new channels are still emerging, and consumers will continue to determine their importance in the retail landscape.

Thankfully, retailers have taken significant steps to adapt their strategies to the omnichannel habits of today’s consumers. They’ve also identified specific types of advertising that are most effective for engaging customers, given their unique categories and product offerings.

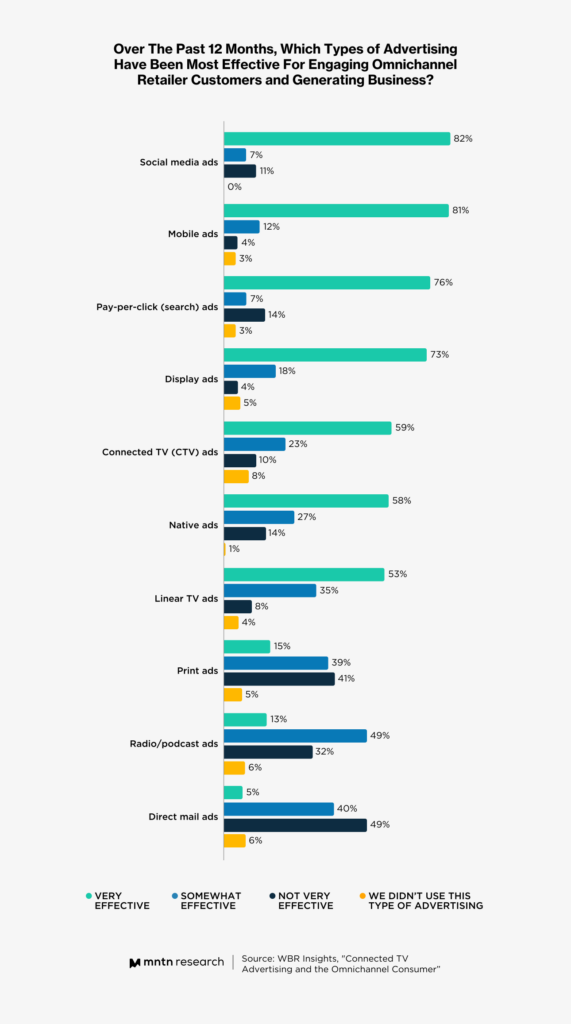

Most of the respondents to the study agree that social media ads (82%), mobile ads (81%), pay-per-click ads (76%), and display ads (73%) are “very effective” for engaging omnichannel retail customers and generating business. Likely, retailers will continue to prioritize these types of ads in the future, even as new channels and advertising types emerge.

Not surprisingly, few of the respondents believe that traditional forms of advertising, such as direct mail and print ads, are very effective for engaging consumers. Significantly, only 13% of the respondents believe that radio and podcast ads are very effective, despite the relative popularity of podcasts.

It is also noteworthy that 59% of the respondents believe CTV ads are very effective, while 53% believe linear TV ads are very effective. CTV ads are those displayed over streaming networks like Netflix and Hulu, while linear TV ads are displayed as commercial segments over traditional cable television.

As we will learn, many retailers still run linear TV ads, but they are beginning to find that CTV advertising offers more capabilities in terms of targeting and reporting.

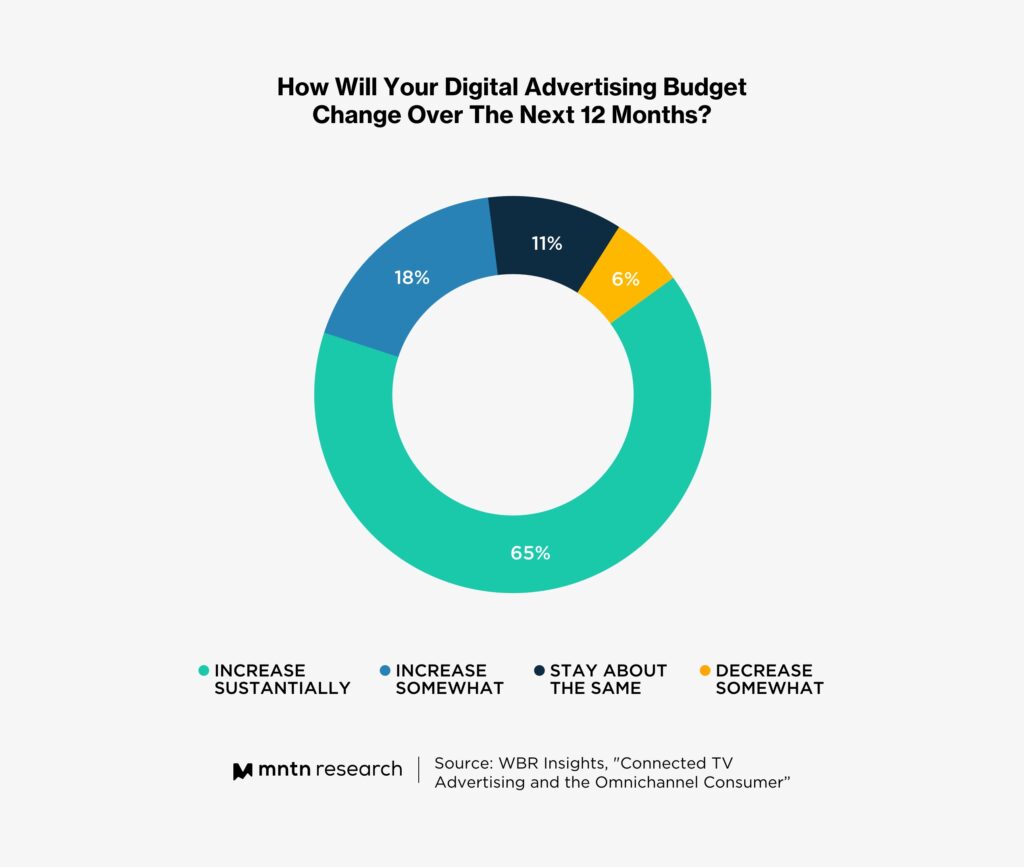

Retailers are also planning to increase their investments in advertising over the next 12 months. Altogether, 83% of the respondents say their digital advertising budgets will increase, including 65% who say their budgets will increase “substantially.”

Some of this growth is likely a response to recent changes in the economy, including rising inflation. Higher prices have resulted in less consumer spending, so retailers are investing in marketing to encourage their customers to buy more. However, this result also aligns with general and ongoing retail trends that show substantial increases in ad budgets.

Companies will continue to focus their advertising spend on the channels they find most effective. For example, 87% of the respondents list social media ads as a high priority while 82% list PPC ads as a high priority.

There is also a significant difference in how much retailers are prioritizing CTV ads and linear TV ads. Most of the respondents (60%) say CTV ads are a high priority, while only half of the respondents say linear TV ads are a high priority.

This suggests that some retailers may be shifting their spending on TV ads to CTV. Moving forward, we will explore why this shift is taking place.

Companies Struggle to Tie Goals to Linear TV Ads

Linear TV has been a standard advertising channel for retailers for decades. With the development of cable television, retailers could successfully broadcast advertisements to millions of viewers across the country, as well as internationally, with a single ad purchase.

But the status of linear TV ads is waning. Streaming services are now becoming more popular than cable and broadcast television. In the summer of 2022, streaming television captured 34.8% of viewership in July, while cable accounted for 34.4% and broadcast accounted for 21.6%.1 This represents the first time streaming TV has captured more viewership than other television formats.

Nonetheless, linear TV is still an important channel for retailers. Most of the respondents (82%) are currently running linear TV ads to reach their omnichannel retail customers. Linear TV ads will likely continue to be important to retailers’ advertising mix, as over one-third of U.S. viewers still engage with cable television.

However, linear TV ads have some deficiencies that are difficult to overlook in today’s digital advertising environment. TV attribution can be challenging with linear TV ads, as there is no way to generate data directly from consumer interactions with such advertisements. In other words, it can be difficult for retailers to determine if new or returning customers are making purchases only after viewing a linear TV ad, or otherwise.

The respondents reflect this sentiment as well. A majority (74%) say they are only “somewhat effective” at measuring and tying success and specific goals back to their linear TV ads. Only 22% say they are “very effective” at this.

Solutions are available to help companies measure linear TV ad results and perform attribution, but the ads themselves don’t always enable retailers to generate the data they need to develop customer profiles. Although only 4% of the respondents say their ability to measure linear TV ads has not been effective, all of them say they struggle because they “lack transparency or visibility into reporting metrics.”

CTV is Increasingly Important to the Future of TV Advertising

Connected TV ads are already matching linear TV in their popularity among retailers. However, they are surpassing linear TV ads in many respects, especially in terms of reporting and attribution.

Currently, 81% of the respondents are already running ads on CTV. This compares to the 82% of respondents who are running ads on Linear TV. Given recent trends in viewership, the share of advertisers leveraging CTV may increase over the next few years.

This is a distinct possibility as younger generations continue to adopt streaming services, forgoing cable and broadcast television altogether.

Most of the respondents who run CTV ads (61%) say their ability to measure and tie success back to CTV ads is “very effective.” Only 38% of these respondents say their measurement capabilities are “somewhat effective,” while just 1% say it is “not very effective.”

The 1% say they struggle with two factors. First, they don’t have the time or resources to conduct performance analyses on their ads. Second, the platform they use places too much emphasis on awareness and reach goals instead of more tangible metrics, such as return on investment (ROI) or return on ad spend (ROAS). Advertisers who are struggling with their CTV platforms could benefit by switching to a new solution.

The results featured here stand in stark contrast to the 74% of Linear TV advertisers who say their ability to measure the results of their ads is only somewhat effective. It also suggests that CTV could become more popular due to its effectiveness in aligning with core advertising objectives.

Indeed, 65% of the respondents say CTV advertising will play a “very significant” role in their omnichannel retail marketing strategies over the next 12 months. Another 30% say it will play a “somewhat significant” role, while just 5% say it will not play a significant role.

The 5% say they struggle with specific issues related to their advertising processes, as well as their CTV platforms. For example, they say their platforms have too many manual processes and that they’ve struggled to place CTV ads alongside premium inventory channels or content.

Outdated CTV platforms may not include important features for advertising in the current environment. These include TV audience prospecting tools, performance retargeting, and simplified creative management. Advertisers need means to produce creative efficiently, such as with an automaton tool or a creative-as-a-service (CaaS) offering.

Moving forward, CTV advertisers should analyze their current platforms to determine if they meet specific objectives, such as attribution, creative development, and ROI.

Conclusion: Future Capabilities in CTV Advertising

In their final line of questioning, researchers asked the respondents to describe what capabilities they’d like to use to enhance the performance of their TV advertisements in the future. Several respondents indicated that they’d gravitate toward “the capability to link and communicate with customers in an omnichannel environment through TV advertisements,” as one respondent puts it.

This capability would represent a significant shift in TV advertising, as it would blend the inherent capabilities of both the digital ad space and TV. Currently, most consumers can communicate directly with brands by engaging with ads and using specific channels like phone, email, SMS, web chat, apps, and forms. Including communication capabilities in TV ads would provide customers with a direct line to speak with brands and represent an unprecedented opportunity for advertisers.

Other respondents say they want to leverage personalization in their TV ads, one going so far as to call this capability “a must in the future of TV advertisement.” Again, this capability would bridge a divide that currently exists between TV and digital.

Traditional TV ad formats are still a relative standard in the industry, even on CTV. Brands can use targeting capabilities to display ads to different customer segments, but their ads are still more or less static once they launch.

Personalization capabilities allow brands to create dynamic ads that display automatically based on customer data and firmographic information. Using creative automation, brands could feasibly generate multiple versions of the same ad, each version catering to a specific type of customer. Once an ad is engaged, the ad platform could select which version to play based on who is watching.

Retail brands can expect to see more personalization capabilities rolling out over CTV advertising channels over the next few years. As such, they should take steps now to explore platforms that specialize in CTV ads, so they can be prepared to leverage these capabilities and gain an edge in the market.

Key Insights

- Continue investing in digital advertising. Social media, mobile, and PPC ads. These formats are still very effective in engaging omnichannel customers, and most respondents are treating them as a high priority over the next 12 months.

- Maintain your linear TV advertising strategy if it is providing you with results. However, continuously monitor rates of adoption for streaming services, as well as the industry metrics relating to CTV ad performance. You may need to adjust your spending in favor of CTV if adoption trends continue.

- Adopt CTV advertising as a standard if you haven’t done so already. Most of the respondents agree that CTV advertising will play a more significant role in the future, and recent reports suggest consumers will continue to adopt CTV at high rates.

- Onboard a CTV platform that provides capabilities for measurement, attribution, and creative development. Visibility and challenges related to creative were two of the most prominent complaints from respondents about their current CTV platforms.

- Stay aware of new capabilities in the CTV advertising space and be prepared to adopt them. Retail marketing leaders are interested in capabilities like direct communication with customers through CTV ads as well as increasing levels of personalization.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.