Partner Research

The Digital Advertising Strategies of Today’s Top Travel Brands

by Stephen Graveman13 min read

Abstract

- MNTN and Worldwide Business Research (WBR) polled 100 leading marketing and digital strategy leaders in the travel industry regarding their ad strategies.

- 70% of respondents say their organization currently runs CTV ads to reach travel customers; only 61% run linear TV ads.

- CTV’s measurement and targeting capabilities are increasingly putting the platform at the center of travel brands’ campaign strategies.

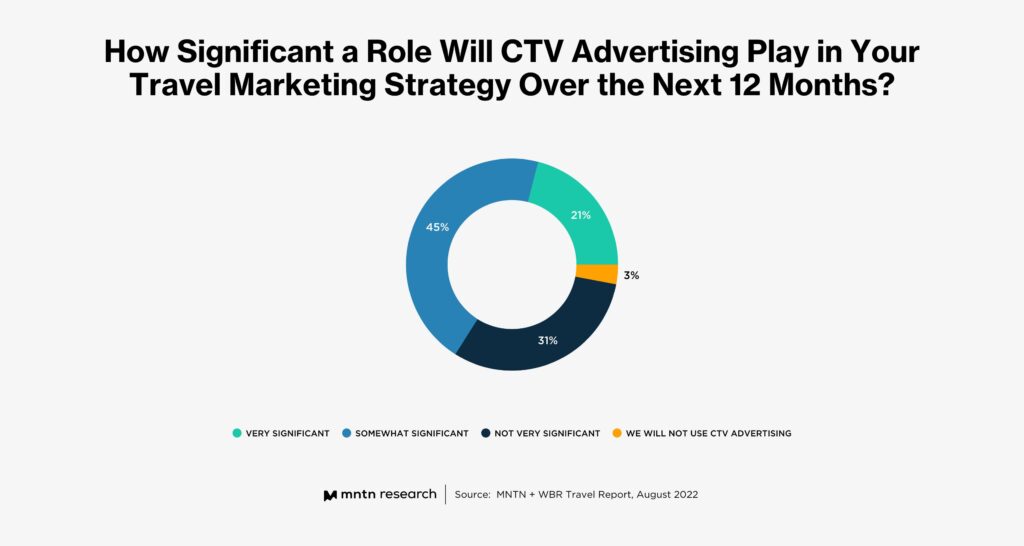

- 66% say CTV advertising will play a significant role in their travel marketing strategy over the next twelve months

Table of Contents

- 01 Introduction

- 02 A Closer Look at the Respondents

- 03 Key Insights From the Findings

- 04 Travel Brands Use a Combination of Digital and Direct Ads

- 05 Linear TV is Still Prominent in Travel Advertising

- 06 CTV is Rising in Popularity With Travel Brands

- 07 CTV Ads Will Be More Popular Than Linear TV

- 08 Conclusion

Travel organizations have had to weather numerous disruptions over the past few years. The most significant disruption has likely been the COVID-19 pandemic, which resulted in a dramatic drop in consumer travel in 2020. In response, many organizations had to adjust their advertising strategies to affirm their commitment to the health and safety of their customers.

However, both emerging and long-standing shifts in consumer behavior are having a broader impact on how the travel industry approaches advertising. Most consumers are now acclimated to digital advertising and are much more willing to engage with strategies like social media ads. Travel companies are also taking advantage of unique opportunities in televised advertisements thanks to the rise of connected TV (CTV).

This report explores how travel companies are adapting their advertising strategies to match current consumer trends. With a special focus on connected TV ads, the report will reveal how this advertising approach will shape traveler engagement in the coming years

A Closer Look at the Respondents

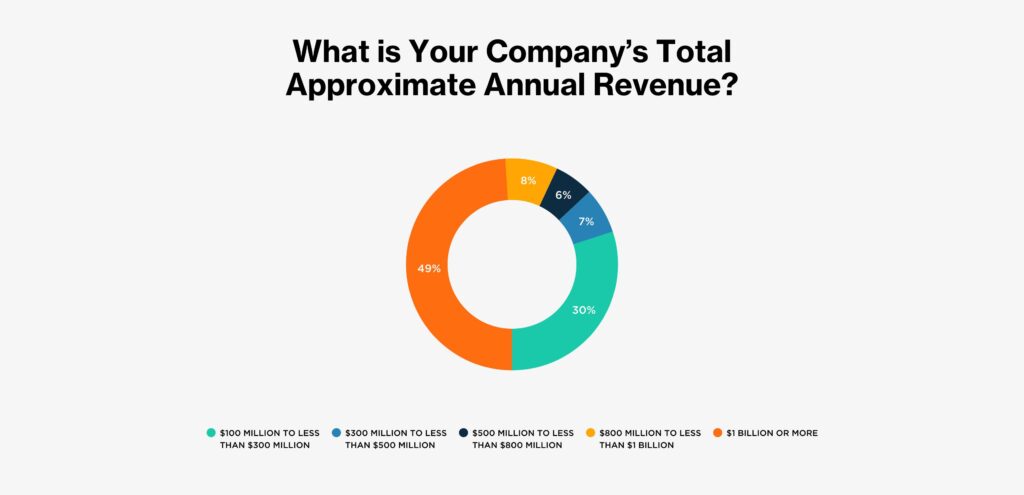

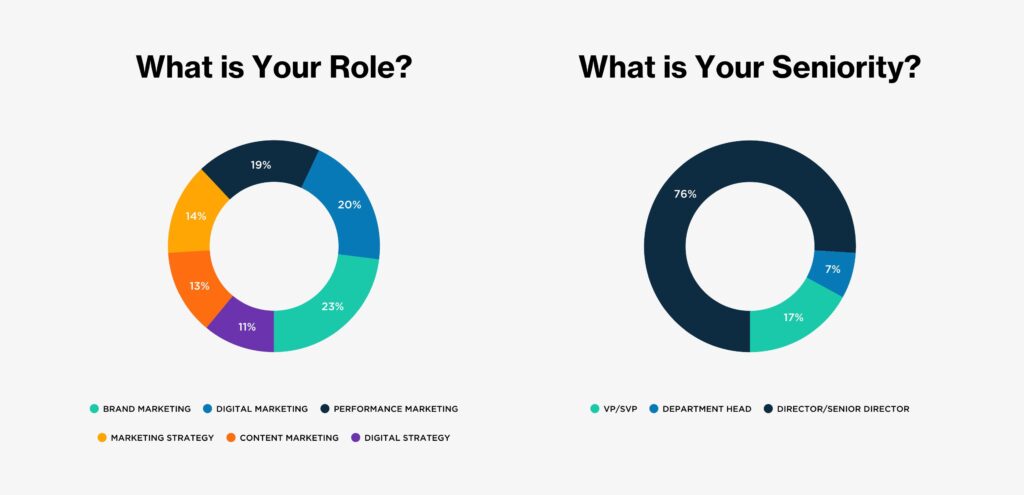

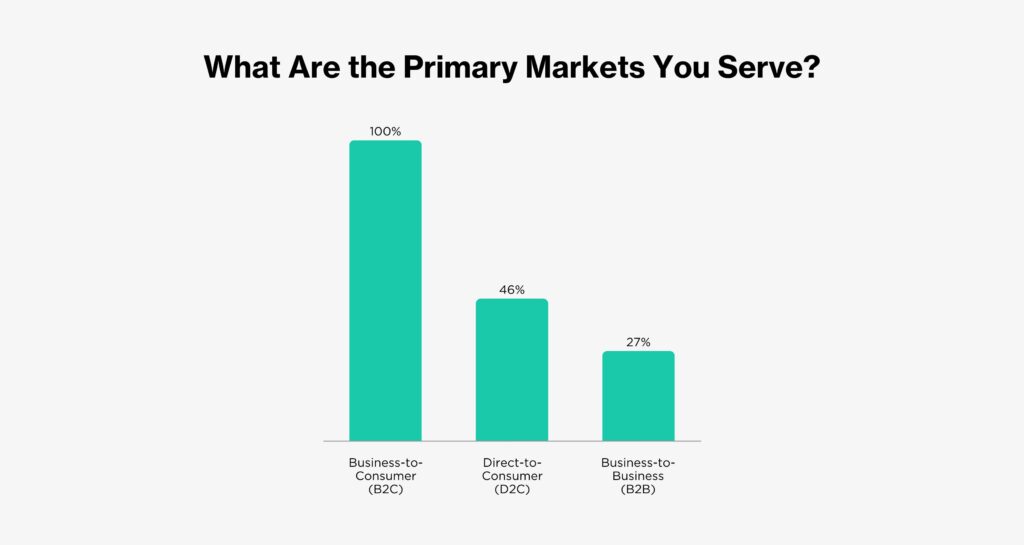

MNTN and the WBR Insights research team surveyed 100 marketing and digital strategy leaders from travel companies across the U.S. and Canada to generate the results featured in this report. All the respondents are directly involved in their companies’ advertising efforts, and all the companies represented currently do business within the United States.

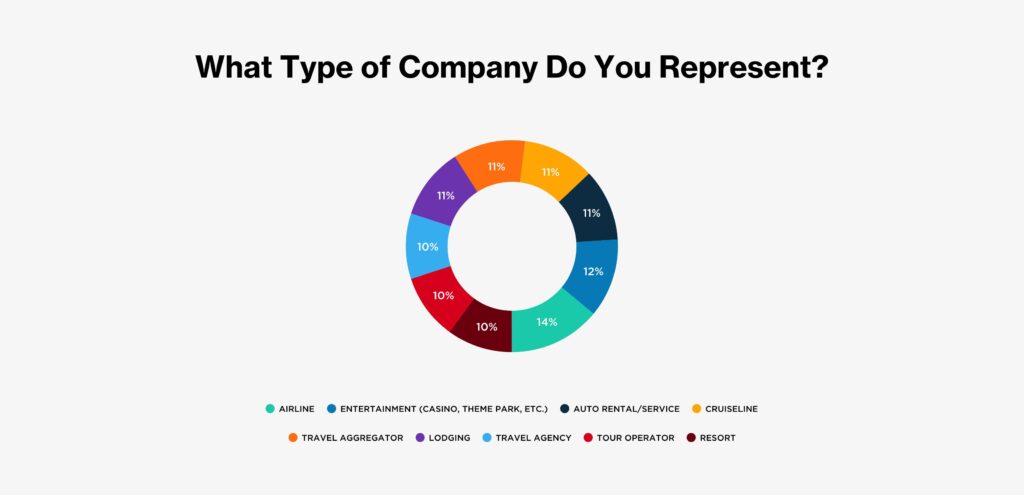

The respondents represent a variety of company types in the travel industry (Fig. 1), including airlines (14%), entertainment venues (12%), auto rental services (11%), cruise lines (11%), travel aggregators (11%), lodging companies (11%), and more.

Key Insights From the Findings

Among the respondents:

- 53% say Connected TV (CTV) ads have been at least somewhat effective at generating business over the past twelve months

- 83% say social media ads have been at least somewhat effective at generating business over the past twelve months

- 52% consider CTV ads a priority over the next twelve months

- 66% say CTV advertising will play a significant role in their travel marketing strategy over the next twelve months

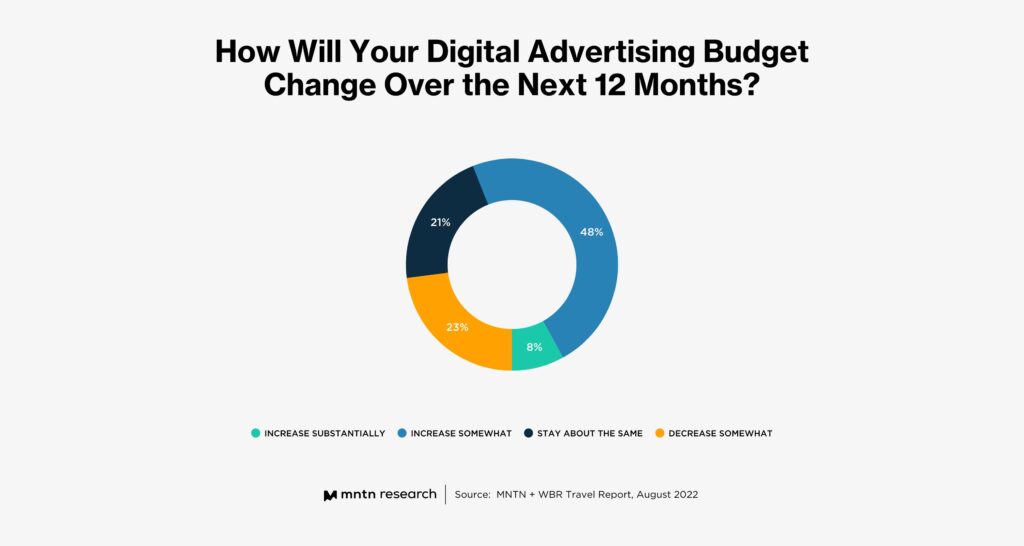

- 56% say their digital advertising budgets will increase over the next twelve months

- 61% say their organization currently runs linear TV ads to reach their travel customers

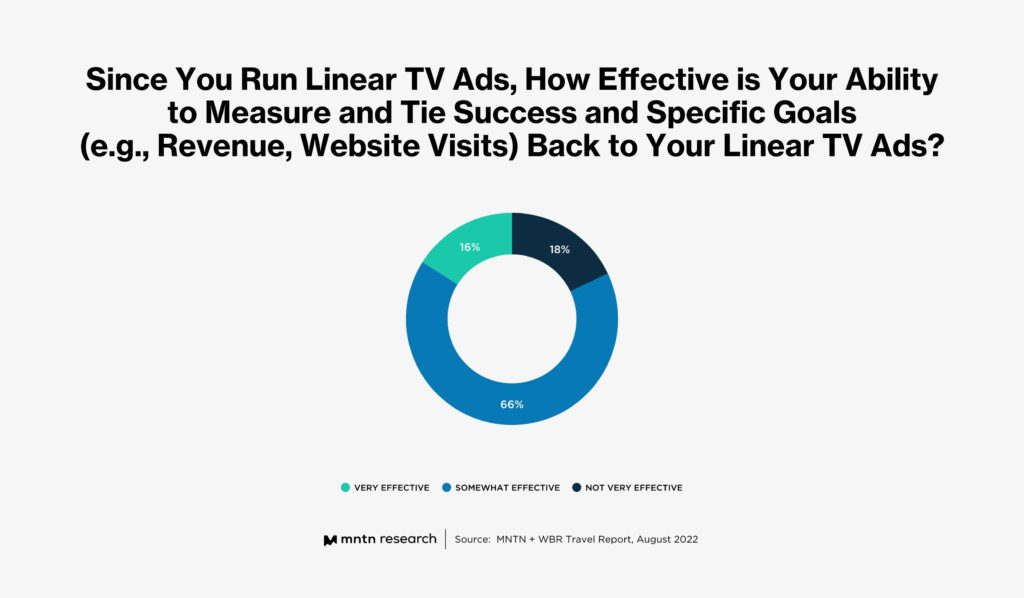

- Among these respondents, most say they are somewhat effective (66%) or very effective (16%) at tying success and specific goals back to their linear TV ads

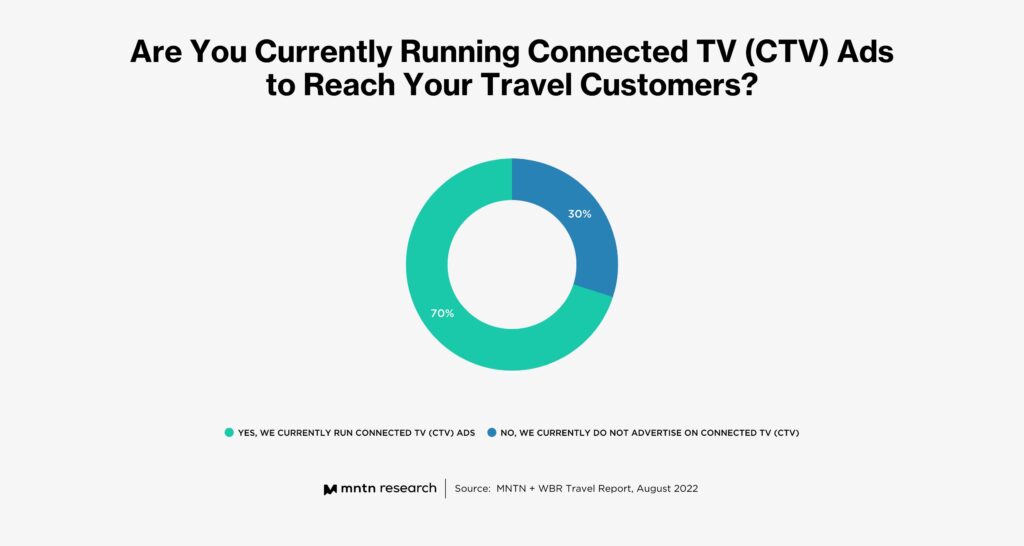

- 70% say their organization currently runs CTV ads to reach travel customers

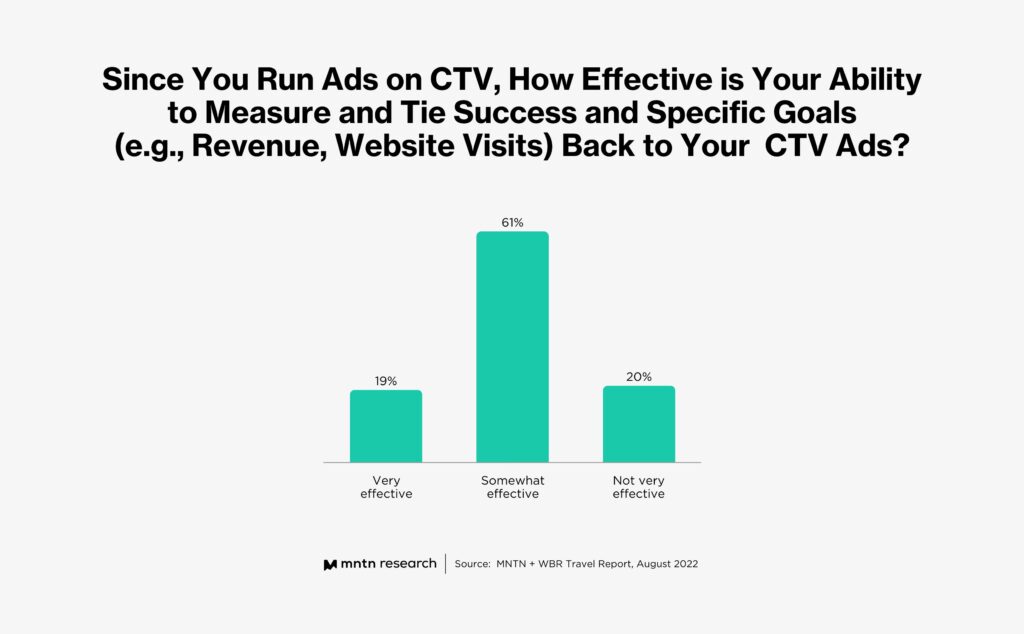

- Among these respondents, most say they are somewhat effective (61%) or very effective (19%) at tying success and specific goals back to their CTV ads

Travel Brands Use a Combination of Digital and Direct Ads

Travel marketing can be challenging due to how quickly consumer habits can shift. In recent years, disruptions like weather events, geopolitical conflicts, economic changes, and illnesses have forced travel companies to rethink their advertising strategies and adjust them to meet traveler expectations.

Most travel companies have embraced digital advertising as a means of engaging with their customers. Digital advertising tends to be more agile and easier to measure. However, traditional advertising, like direct mail and linear TV ads, is still prominent (Fig. 5). There are also emerging opportunities for organizations to reach their customers directly through connected TV ads.

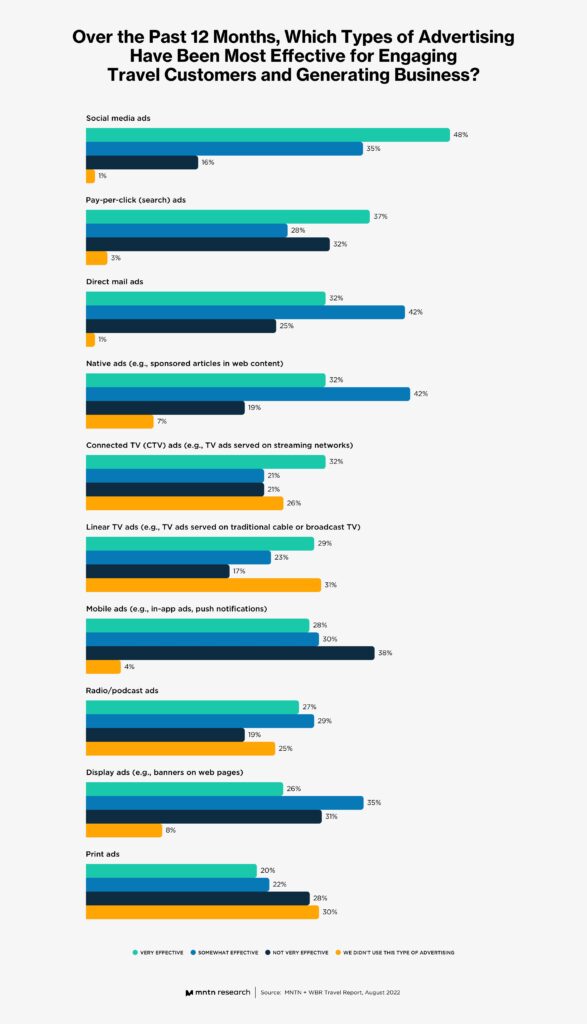

Currently, the types of advertising travel companies have found most effective include social media ads (48%), pay-per-click (PPC) ads (37%), direct mail ads (32%), and native ads (32%). Additionally, almost one-third of the respondents (32%) say connected TV ads are very effective for engaging travel customers and generating business.

Connected TV ads are served on streaming networks like Netflix, Hulu, Apple TV, and more. They stand apart from linear, or traditional, TV ads because they are much more targeted.

Consumers who sign up for streaming services provide streaming companies with data that indicates their interests, especially when it comes to entertainment. This enables travel companies to target their connected TV ads at streaming customers who are most likely to make a purchase, improving their effectiveness.

Connected TV advertising is typically funded by travel companies’ digital advertising budgets.

At 56%, most of the respondents expect their digital advertising budgets to increase at least somewhat over the next 12 months (Fig. 6). These companies will likely invest more money into advertising strategies that are already proving to be effective.

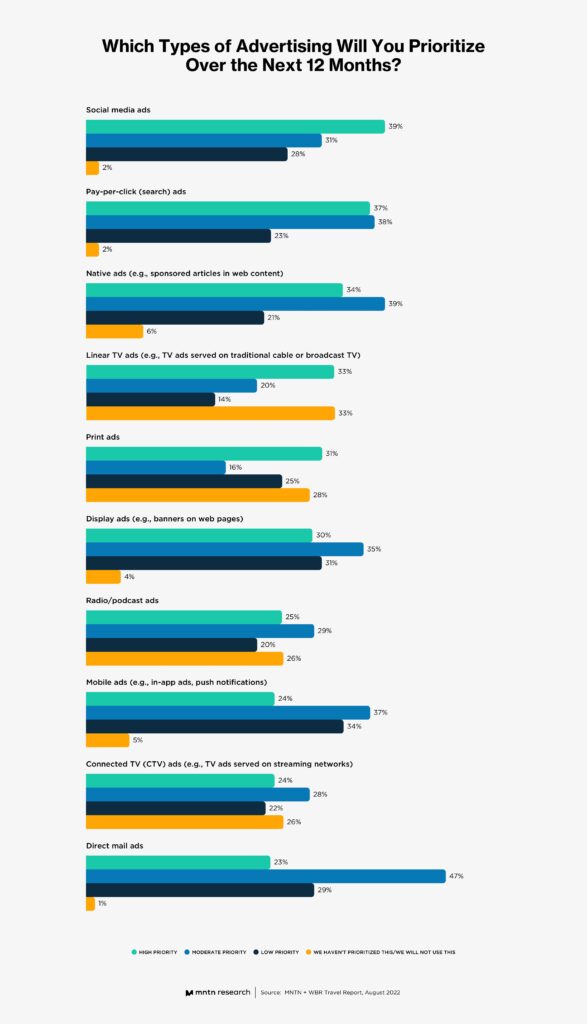

Indeed, the respondents say they are prioritizing advertising strategies like social media ads, PPC ads, native ads, and display ads (Fig. 7).

However, they are also prioritizing traditional advertising strategies like linear TV ads and print ads. Fewer respondents are prioritizing mobile ads, such as in-app ads and push notifications, and direct mail ads.

It is notable, however, that 52% of the respondents will set CTV advertising at least as a moderate priority. About one-quarter (24%) say it will be a high priority.

CTV advertising is still a relatively new way to engage customers. It has risen in prominence among consumers’ adoption of streaming services and their move away from traditional cable.

Nonetheless, it will likely become more widely utilized among travel companies in the coming years. According to Broadband TV News, there has been a 29% increase in the number of U.S. households streaming advertising-based video on demand (AVOD) in 2022 alone.

Linear TV is Still Prominent in Travel Advertising

Linear television (LTV) is the traditional form of television that most U.S. consumers relied upon for entertainment and information in the 20th and early 21st centuries. Although the adoption of LTV has slowed in the wake of the rise of CTV, it is still an important advertising medium in travel companies’ toolboxes.

For example, seniors and retirees represent an important customer group within the travel market, and they are much more likely to have a cable box at home compared to younger generations.

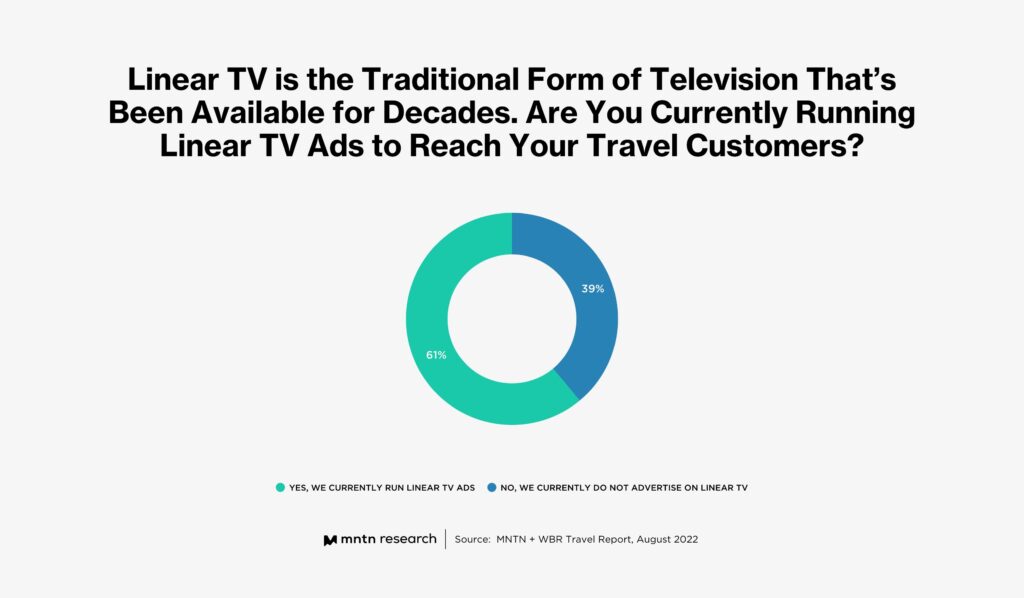

Although 39% of the respondents are not currently running LTV ads, most are doing so in some capacity (Fig. 8). As we will learn, LTV is now becoming a less popular mode of advertising compared to digital avenues, including CTV.

Most of the respondents currently running LTV ads say their ability to measure and tie success back to specific goals is either somewhat effective (66%) or very effective (16%) (Fig. 9). These organizations believe they can track the results of their LTV ads directly against goals like revenue, website visits, and more.

Still, 18% of the respondents currently running LTV ads say their ability to track and tie goals back to them is not very effective.

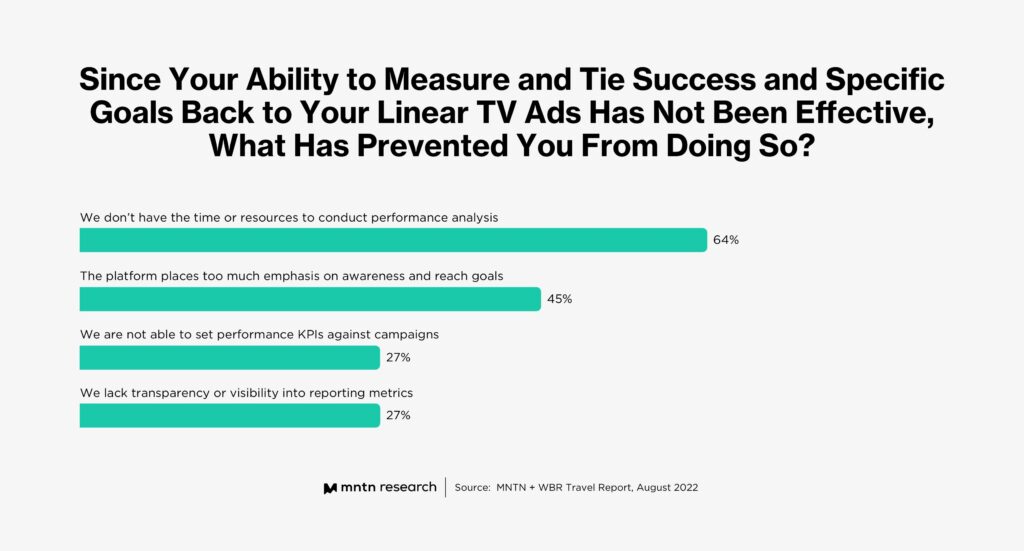

These respondents say they are prevented from tracking their goals via LTV ads for a variety of reasons (Fig 10).

Most (64%) say they don’t have the time or resources to conduct performance analyses of their LTV ads. It can be challenging to correlate LTV ad spend with specific metrics because they are not digital and there is no direct exchange of data with customers. As such, many companies struggle to pinpoint when customers who see LTV ads get engaged and move to make a purchase.

Similarly, 45% of these respondents say their LTV platforms place too much emphasis on awareness and exposure and not enough emphasis on the tracking of value metrics. In each case, 27% of the respondents say their LTV ads make it difficult to set performance KPIs against campaigns, and they lack visibility into reporting metrics.

CTV is Rising in Popularity With Travel Brands

CTV ads provide a more data-driven alternative to traditional TV advertising. CTV is television content streamed over the internet to smart TVs and over-the-top (OTT) devices like Roku or Fire TV Stick.

Because connected TV ads are associated with digital TV subscriptions, CTV platforms typically have a wealth of customer data at hand to draw links between engagement and purchasing decisions.

With the right reporting tools, travel companies can identify specifically how ad campaigns contribute to the business.

Most of the respondents (70%) say they are currently running CTV ads (Fig. 11). That’s a larger portion of the respondents compared to those running LTV ads. Likely, CTV has begun to overtake LTV as the most prominent method of reaching TV customers.

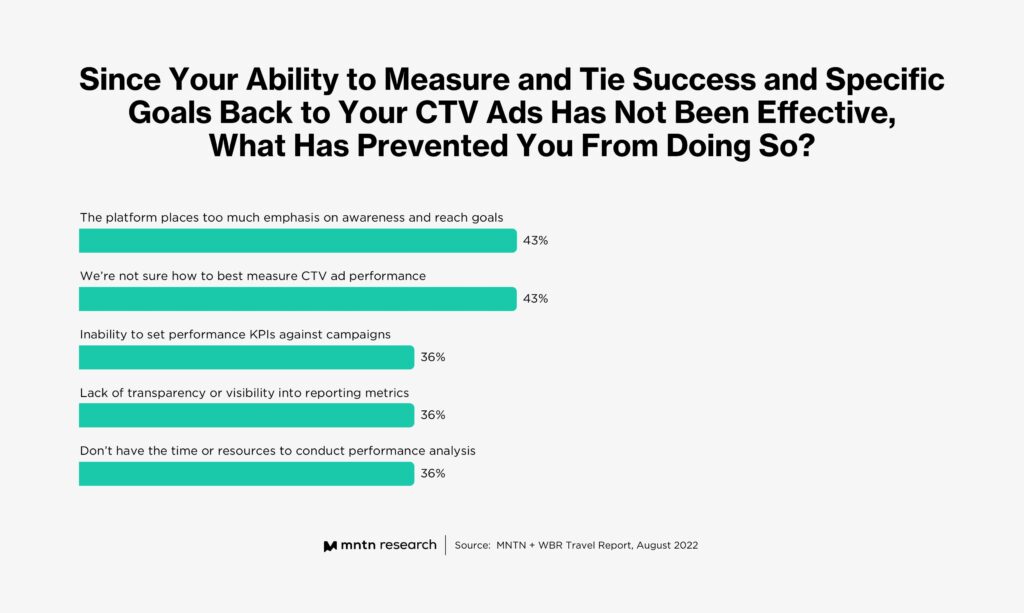

At 80%, most of the respondents who run ads on CTV say their ability to measure and tie success to specific goals is at least somewhat effective (Fig. 12). However, a significant number of the respondents (20%) say their abilities to measure and tie success and specific goals back to their CTV ads are not very effective.

That’s slightly higher than the portion of respondents who say the same thing about their ability to measure the results of LTV ads. This could be due to deficiencies in their CTV targeting and tracking platforms.

For example, MNTN Performance TV provides users with TV retargeting, comprehensive campaign measurement, attribution, and creative capabilities. Not every CTV advertising platform can provide the same suite of offerings.

Indeed, 43% of the respondents who struggle to tie their CTV ads to business goals say they aren’t sure how best to measure CTV ad performance (Fig. 13). 43% also say their platform places too much emphasis on awareness and “reach goals,” and not enough emphasis on measurable results.

These were similar complaints among those organizations that struggled to read the KPIs of their linear TV ad campaigns. These travel organizations may need to reconsider their current advertising platforms and move their efforts to one that provides better targeting, attribution, and reporting.

CTV Ads Will Be More Popular Than Linear TV

Travel companies have shown that they are leveraging connected TV advertising and linear TV advertising in almost equal measure. They’ve also demonstrated that they struggle with some of the same challenges in both their linear and connected advertising platforms. However, connected TV advertising platforms show more promise because they are more data-driven and can provide travel brands with better reporting and attribution.

The key question is how travel companies intend to use these tools in the future, and whether CTV ads will overtake linear TV ads in prominence amid consumers’ widespread adoption of streaming services.

At 66%, most of the respondents agree that CTV advertising will play at least a somewhat significant role in their marketing strategies for the next 12 months (Fig. 14). This includes 21% of the respondents who say it will play a very significant role.

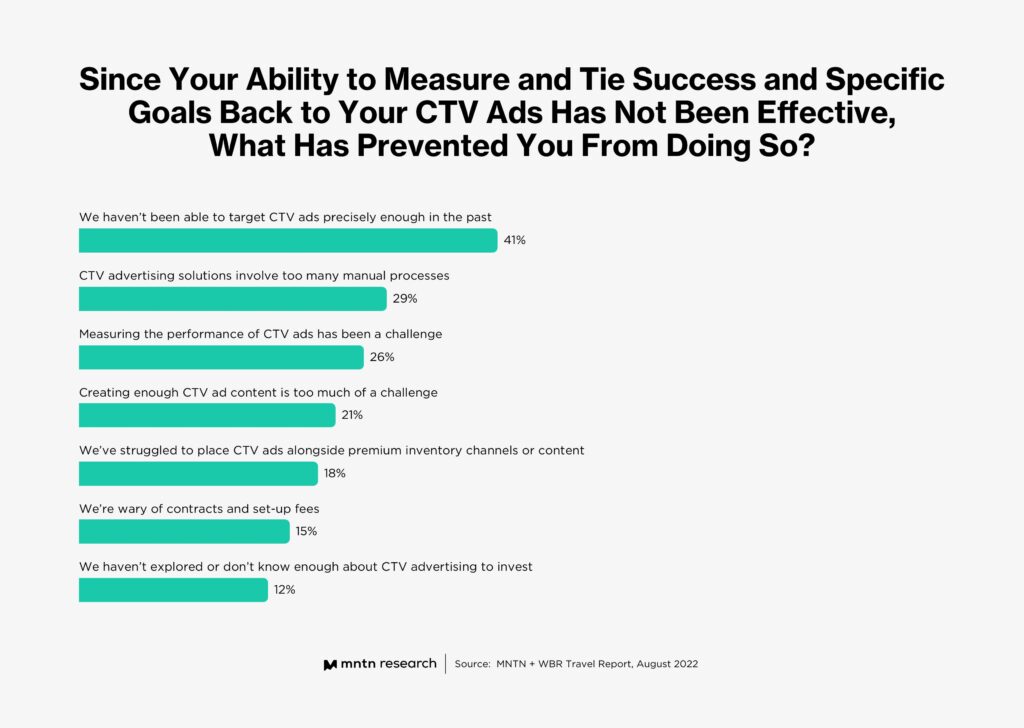

Among the respondents who say CTV advertising won’t play much of a role in the next 12 months, 41% say a primary reason is that they haven’t been able to target CTV ads precisely enough (Fig. 15). Likely, these companies are struggling with platforms that don’t provide them with enough resources, and their ads are reaching customers who aren’t interested in traveling or using their products.

In each case, over one-quarter of these respondents also say their current solutions involve too many manual processes (29%) and that measuring the performance of CTV ads has been a challenge (26%).

These respondents may need to switch to a platform that reduces manual input and includes attribution as a core feature. For example, MNTN provides hassle-free creative management and enables users to target countless audience categories as a core feature.

“We will put content capabilities at the front of development to increase visibility on TV platforms and channels.”

– Digital marketing department head, auto rental service

Conclusion

In their final line of questioning, researchers asked the respondents to describe what capabilities they’d want to use to enhance the performance of both their linear TV and CTV ads in the future. A few of the most frequently mentioned capabilities revolve around content: Specifically, content creation, management, and personalization capabilities.

“We will put content capabilities at the front of development to increase visibility on TV platforms and channels,” says a digital marketing department head at an auto rental service.

“There is nothing more important than immersive content capabilities for me when it comes to TV advertisement, irrespective of the channel,” says a marketing strategy director at a tour operator.

Similarly, a VP of performance marketing at a cruise line says, “I would like to see a development in content creation capabilities to provide more immersive content across linear and CTV channels.”

Other respondents are interested in platforms that will provide them with more digital capabilities similar to those they enjoy on other channels, such as social media and search. For example, multiple respondents say they want better targeting capabilities.

“Social targeting capabilities will allow us to enhance the value of TV advertising for us,” says a performance marketing director at an airline.

A marketing strategy director from a cruise line says they want “Better advertisement targeting capabilities for linear TV and better personalization capabilities for CTV advertisements.”

One marketing strategy VP at a travel aggregator perhaps puts it best: “Considering the future is digital, digital capabilities are something that we would seek to enhance for this channel of advertisement.”

It’s notable, however, that some respondents are still unsure about the future of TV advertising. Respondents who say they are shifting their ad spend away from TV indicate they are doing so because they believe other channels offer better measurement, targeting, and reporting. Few respondents, however, intend to write TV ads off entirely.

Connected television ads are likely the future of TV advertising as consumers continue to shift toward streaming channels. While some consumers may choose paid-for streaming services to avoid ads, those who choose free options will be much more receptive to advertisements that suit their interests and offer them unique travel opportunities.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.