Partner Research

How Leading Brands and Agencies Are Approaching Measurement, Media, and Creative in 2022

by Stephen Graveman16 min read

In partnership with:

Abstract

- MNTN and Digiday surveyed 80 brand and agency executives to learn how they’re navigating CTV measurement, creative management, and media buying in 2022.

- 79% of brands and agencies report medium-to-high accuracy when measuring their CTV campaigns in 2022

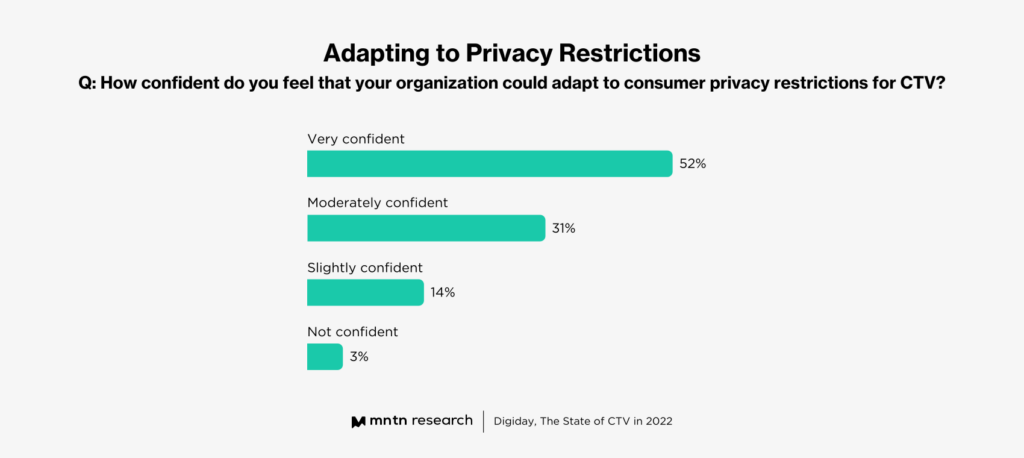

- 83% of respondents are confident that their organization could adapt to consumer privacy restrictions for CTV

- Nearly half of all brands and agencies say inventory fragmentation poses a challenge in managing deals with multiple platforms

Table of Contents

- 01 Introduction

- 02 Data, Measurement, and Privacy in CTV

- A New Frontier for CTV Measurement

- Will Privacy Changes Impact CTV?

- 03 The New World of CTV Creative

- Evolving Creative Amid the Rise of FAST Channels

- Finding the Right Creative Management Solutions

- 04 Finding the Right Technology Solution

- Taking An Audience-First Approach to Advertising

- How to Build a Foundation for Better Measurement, Media, and Management

- Conclusion

- 05 Conclusion

Introduction

Over the past year, connected TV has solidified its position as a go-to option in the omnichannel marketing mix. Advertisers are no longer approaching CTV as an additional or supplemental way to boost brand awareness and complement traditional advertising channels. Instead, marketing teams are taking advantage of CTV’s creative and performance opportunities to make the channel a key advertising focus that drives measurable business results.

The next 12 months and beyond will present new opportunities and challenges for CTV advertisers. Brands and agencies are working to refine CTV measurement — determining which tactics to measure CTV campaign success work best for their teams and across streaming platforms — while prioritizing viewer and household privacy amid ongoing legislation and regulatory changes.

The demand for effective, privacy-compliant measurement is also occurring at a time when the CTV ecosystem is becoming increasingly fragmented and forcing companies to make new decisions around approaches to creative and media buying. Furthermore, the rapid growth of FAST (free, ad-supported streaming) services and channels — and ad-supported versions of top streamers — is pushing brands to expand their CTV ad formats in order to meet the demand and media buyers to make decisions that align with the different advertising opportunities and options available.

To spotlight how advertisers are navigating CTV measurement, creative management and media buying in 2022, Digiday and MNTN surveyed nearly 80 brand and agency executives. This report highlights what they told us and, through additional case examples and qualitative insight from CTV pros, explores steps marketing teams need to take around the three factors in order to build a successful CTV marketing process and infrastructure for the future.

Data, Measurement, and Privacy in CTV

A New Frontier for CTV Measurement

CTV is a performance-driven channel, which is a primary reason why brands and agencies are incorporating it into their media mix. A 2021 IAB study found that 60% of U.S digital buyers planned to shift media budgets from linear TV to CTV, and 81% of U.S. marketers cited targeting and efficiency as reasons for shifting ad spend to CTV.

For many new brands, however, investing in CTV marks their first foray into TV marketing ever.

“Brands that have never used television before can now use it as a performance channel to drive positive ROAS,” said Chris Innes, Chief Operating Officer at MNTN. “Brands that have been on TV for decades can now tie a direct ROAS off of television.”

Being able to accurately tie a consumer action directly to a CTV ad is also the key challenge for marketing teams. CTV advertising teams are striving to measure the performance of campaigns by figuring out the exact impact ads have — from how many households their campaigns reach to how many people in those households their campaign prompts to take an action, such as visiting a site or making a product purchase.

“With CTV, a viewer who is excited about an ad on their TV screen can’t immediately click on that ad to go to a site — they have to use another medium,” said Hannah Burke, product manager at MNTN. “Brands are working to improve CTV attribution by using models to track whether a user visited a site on another device within a certain window of time after a TV ad was served in their household.”

“Brands are working to improve CTV attribution by using models to track whether a user visited a site on another device within a certain window of time after a TV ad was served in their household.”

Hannah Burke, Product Manager, MNTN

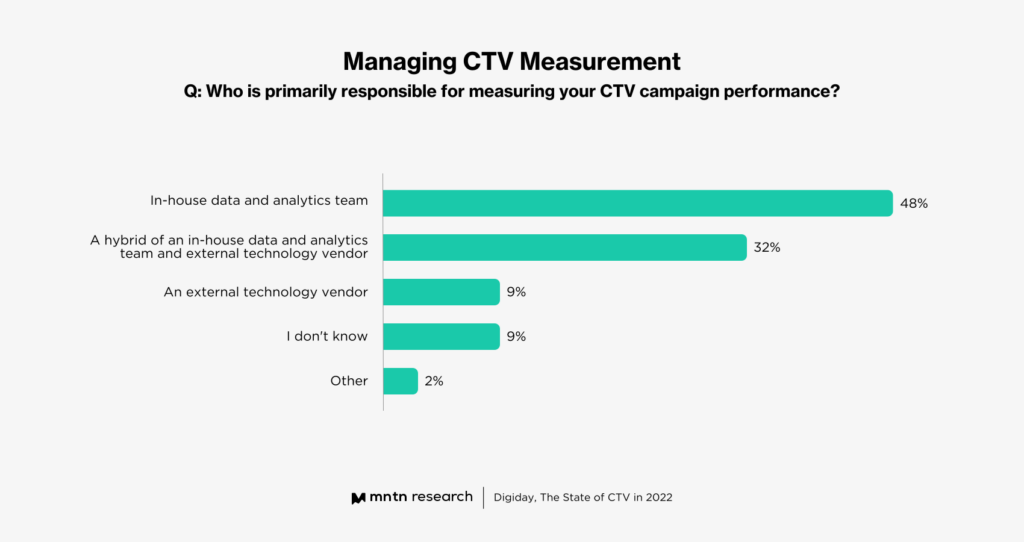

Nearly half of survey respondents said that their in-house data and analytics teams are entirely responsible for measuring campaign performance (48%) while 32% said a hybrid of in-house data and analytics teams and external technology vendors is their approach to handling measurement.

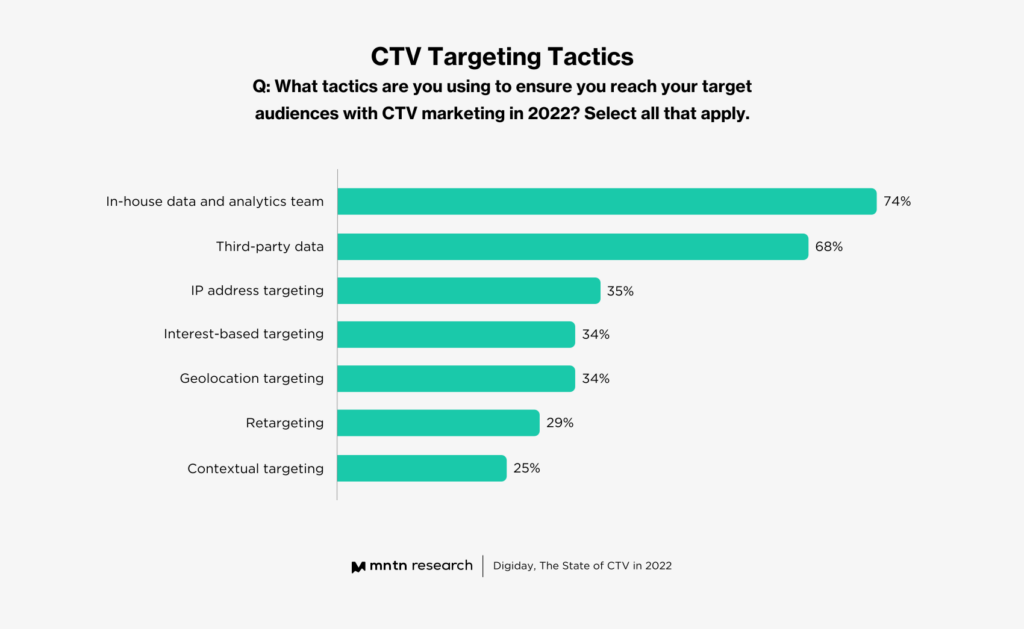

Respondents said they are using numerous tactics to ensure that their CTV campaigns reach their intended audiences, including first-party data (74%), third-party data (68%) and IP address targeting (35%).

Retargeting, contextual targeting and geolocation targeting are also in the mix, suggesting that teams are finding the most success when using more than one tactic at a time to reach audiences through CTV.

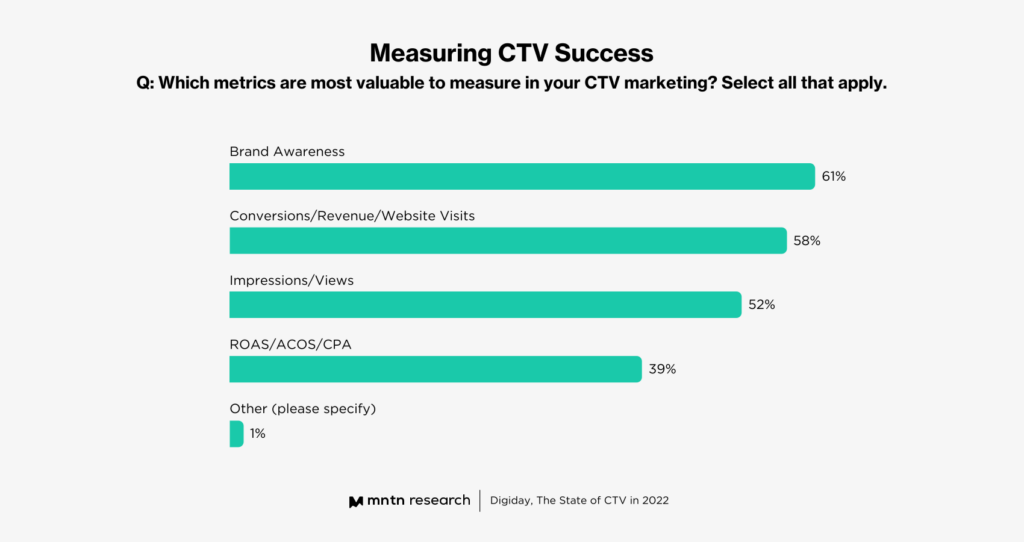

Respondents also said they are prioritizing a variety of metrics to measure CTV success, with brand awareness (61%) and conversions, revenue, or website visits (58%) being the most important KPIs.

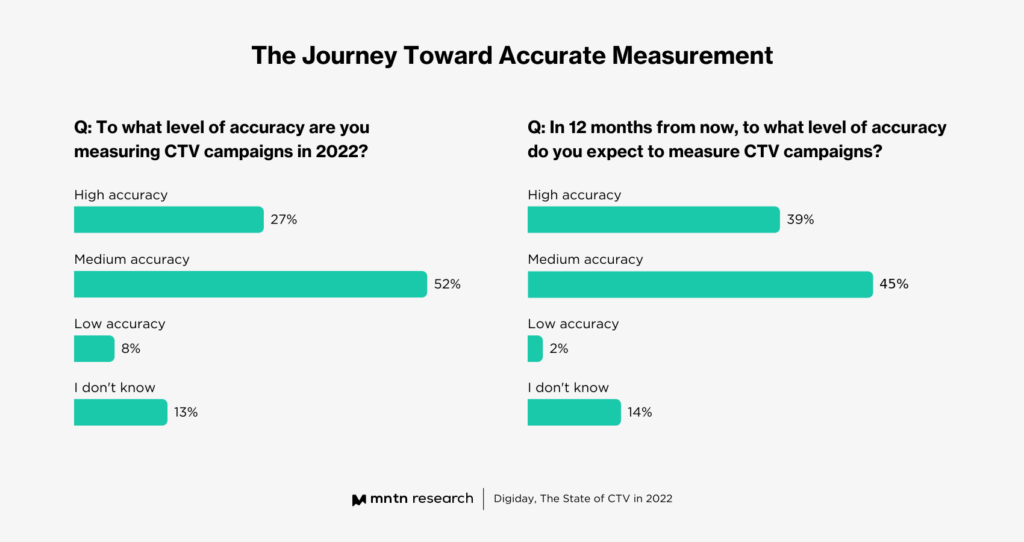

The outlook on achieving accurate measurement in the future is hopeful among a majority of respondents — 79% said they’re currently getting medium to highly accurate results, a metric that jumps to 84% in a year from now.

Concurrently, a small group of respondents said they don’t know what level of accuracy they are getting now (13%) or will achieve in the future (14%), suggesting the need to invest in internal and external CTV resources to improve measurement accuracy.

The survey followed up the measurement accuracy questions by asking respondents: If you expect CTV campaign measurement to become more or less accurate in the next 12 months, why? Their responses were nearly split and included the following:

- Measurement will be more accurate: Respondents cited more advanced targeting and development of analytics; the addition of marketing mix modeling to gauge unaided brand awareness; consolidation of measurement technology providers; and stronger reporting and tech integrations as reasons why measurement will become more accurate.

- Measurement will be less accurate: The main reason why certain respondents predict CTV measurement will become less accurate is because of ongoing internet privacy rollouts that will make users harder to track across the web. One respondent said that “as personal data gets harder to track, people will be harder to target” while another said that since cookies don’t exist in the CTV space, it’s more challenging for marketers to reach an effective industry solution for measurement

Will Privacy Changes Impact CTV?

Connected TV has largely been unaffected by privacy changes that are sweeping the advertising landscape, from the continued deprecation of third-party cookies to Apple’s crackdown on privacy with updates that require users to opt-in to sharing their personal data.

“CTV is already ahead of digital and social when it comes to privacy. The channel doesn’t support cookies and is a tool for communicating ad messages to a mass audience,” said Innes at MNTN. However, Innes added, viewers still deserve control over opt-outs and how their data is used and monetized in the CTV space.

“There is so much control around what data is shared on desktop and mobile, and there needs to be the same level of control with television,” said Innes. “On every TV commercial, there should be a small QR code in the top right that allows people to see who is serving the ad, what campaign it’s part of, what brand purchased it and where the targeting data came from.

“There is so much control around what data is shared on desktop and mobile, and there needs to be the same level of control with television.”

Chris Innes, Chief Operating Officer, MNTN

While CTV advertisers still don’t have the tools to provide the same level of privacy control and transparency as other marketing channels, teams are still focused on educating themselves now to be prepared. Being equipped with knowledge around how elements such as IP addresses and data targeting function within streaming will be critical to navigate potential privacy restrictions in the future.

A majority of respondents are confident their companies could adapt to consumer privacy restrictions in the CTV space — 52% said they were very confident and an additional 31% said they were moderately confident.

The New World of CTV Creative

Evolving Creative Amid the Rise of FAST Channels

The FAST market has moved beyond airing repurposed YouTube videos and television reruns. Services and channels such as The Roku Channel and ViacomCBS’ Pluto TV have invested in more quality programming that includes original shows and exclusive content.

The evolution is contributing to the growth of FAST viewership and advertisers’ interest in the market. A Statista survey of U.S. consumers found that 73% of respondents preferred free content with ads rather than paying for ad-free viewing. The growth in ad-supported streaming viewership and subscription fatigue is continuing to influence the increase in CTV ad spend; according to eMarketer, programmatic CTV ad spend will increase by 39.2% in 2022, after an 82.4% increase in 2021.

Concurrently, streamer giants such as Peacock and HBO Max have released or debuted with ad-supported plans, and more are slated to follow suit. Disney+ recently announced it will launch an ad-supported plan by the end of 2022, while Netflix is also planning to debut less expensive ad-supported plans in the future.

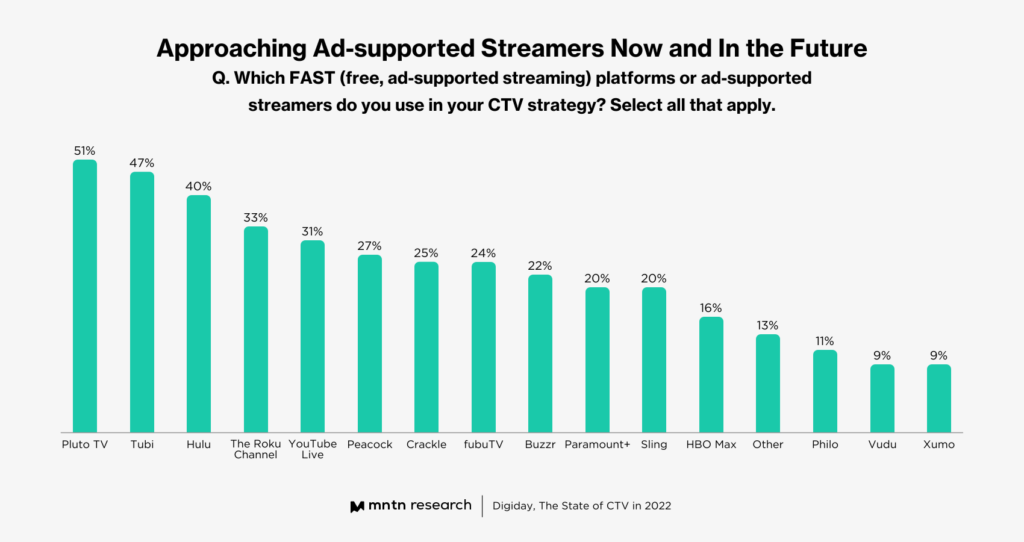

Survey respondents said they are currently using numerous FAST platforms and ad-supported streamers in their strategy, the most popular being Pluto TV (51%), Tubi (47%), Hulu’s ad-supported plan (40%) and The Roku Channel (33%). Over the next 12 months, respondents plan to incorporate ad-supported plans from Buzzr, a FAST network dedicated to game shows (36%), as well as Pluto TV and Tubi (32%) into their CTV strategy.

The preceding charts make it clear: The ecosystem is already expansive, and, indeed, ad-supported streaming’s growth is contributing to inventory fragmentation in CTV. In response, marketers are reevaluating their creative management and media buying approaches to CTV ads.

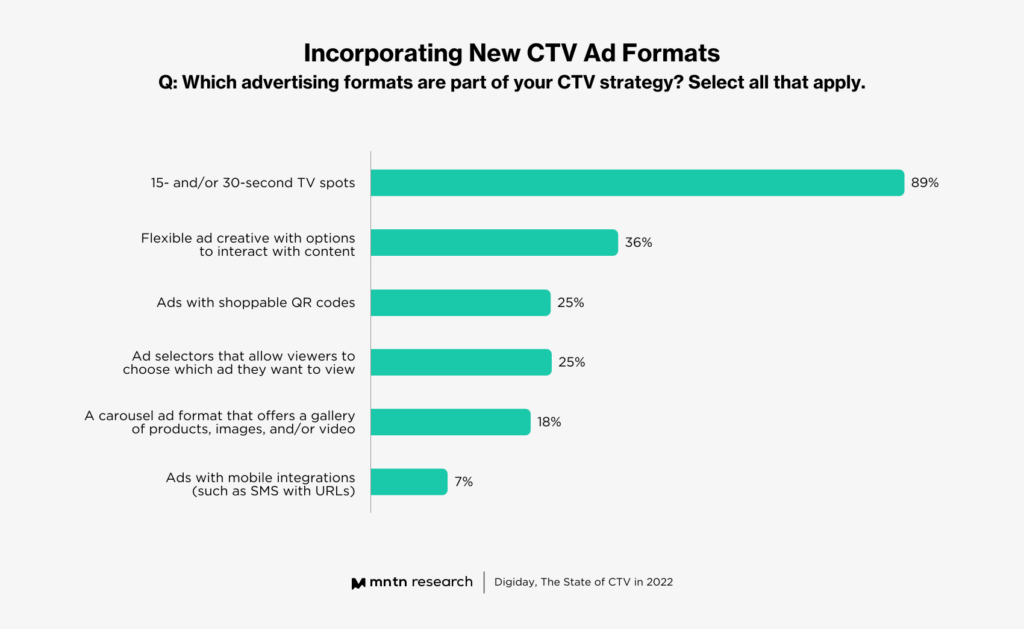

For example, Rafa Bracero, director of marketing strategy at MNTN, said that it’s more important than ever for CTV advertisers to stop thinking of traditional Q. Which advertising formats are part of your CTV strategy? Select all that apply. 89% 36% 25% 25% 18% 7% 15- or 30-second ad spots in a vacuum. Rather, it’s important to weave those ads into a larger, immersive engagement. Marketing teams are striving to create omnichannel ad experiences that extend beyond a TV to other user devices and mediums such as desktop, display, and mobile devices, in an effort to keep ads top of mind.

“With a multichannel approach to CTV, marketers also have to be able to unify the way they track campaign performance from the TV experience to the second screen experience,” said Bracero. “Being able to effectively unify the omnichannel experience for CTV makes a really big difference for brands.”

Survey respondents said that 15- or 30-second TV spots are the primary ad format they use for CTV (89%), but they are also approaching flexible ad creative with options to interact with content (36%), shoppable QR codes, and ad selectors that let viewers choose what they want to view (25%).

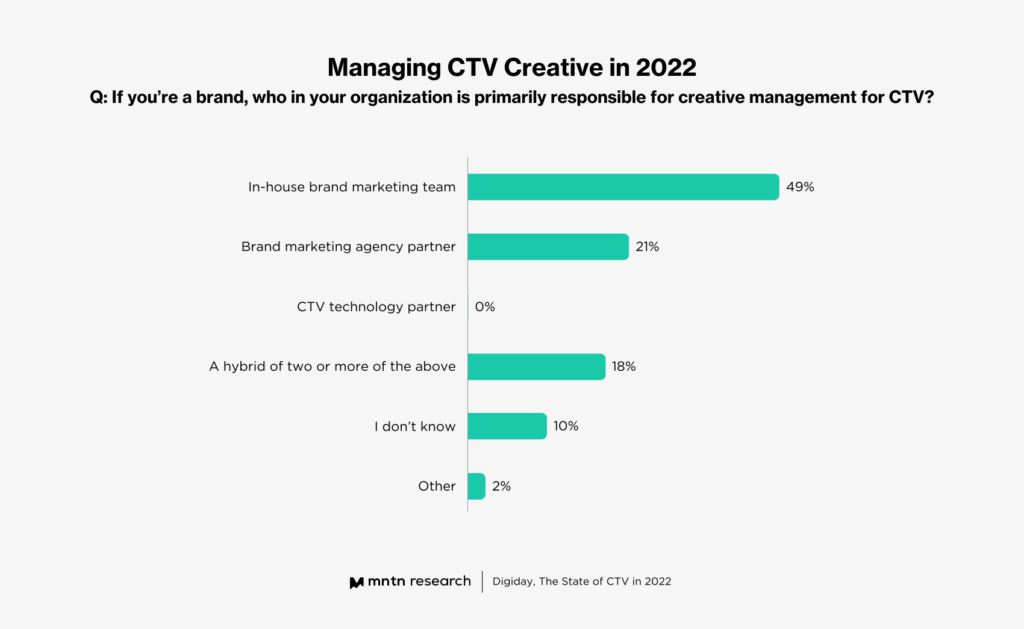

Nearly half of respondents said that in-house brand marketing teams (49%) are primarily responsible for CTV creative management, while additional answers included a brand marketing agency partner (21%) or a hybrid of partners (18%).

Finding The Right Creative Management Solutions

As brands seek to improve creative management strategies, some are relying on CTV ad tech partners that offer solutions that help streamline the creative production, targeting, and testing process. Replacements, a fine china, crystal, and silverware retailer, is using technology solutions that enable the brand to consistently deliver relevant campaign messaging to audiences and, ultimately, increase site traffic and revenue.

Over the past year, the brand has invested in creative and performance ad technology for CTV to help its marketing team excel at three tactics: Refreshing ad creative, testing different ads against different audiences, and launching retargeting campaigns to increase site traffic from prospecting.

Prior to investing in these solutions, Replacements only used one evergreen creative that it would refresh each holiday season. The brand is now able to refresh TV ads on a quarterly basis to prevent ad fatigue and maximize campaign performance. Replacements still has full creative control over ads, and has recently focused on concepts and scripts that depict people unboxing its fine china products—the goal with the ads is to inspire different generations to reinvent how they can entertain and gather at home.

“We’re excited about getting the raw formats to start testing content across other channels. This will help us learn about engagement with the new content,” said Dennis Neelam, director of business analytics and customer insights at Replacements. “[Our technology and creative partnership] provides us with high-quality content that is specifically tailored for CTV and helps us compete with much larger competitors.”

After seeing increased site traffic from its prospecting strategy, Replacements launched a retargeting campaign that allowed the company to segment its audience to target users who demonstrated high-intent behaviors while on its site, such as viewing product pages. The strategy helped the brand smartly spend its budget, solely on dynamic CTV ads targeted toward users that were more likely to convert.

The strategy of consistently updating the campaign with new and relevant creative—combined with segmenting and retargeting—has led to demonstrable growth for Replacements in the CTV space. The brand’s CTV campaign ROAS has grown 417% month over month. And CTV campaign revenue improved 240% in Q4 2021 compared to Q4 2020.

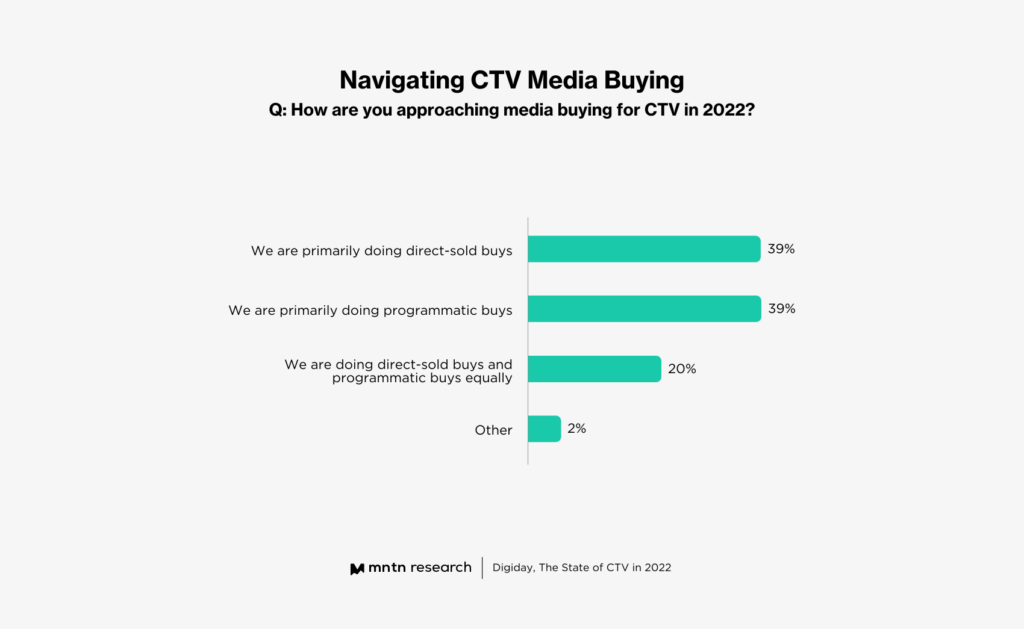

The growth of ad-supported streaming is also pushing buyers to rethink how they approach direct-sold versus programmatic buys. The survey found that a majority of respondents are primarily executing direct-sold buys (39%) or programmatic buys (39%).

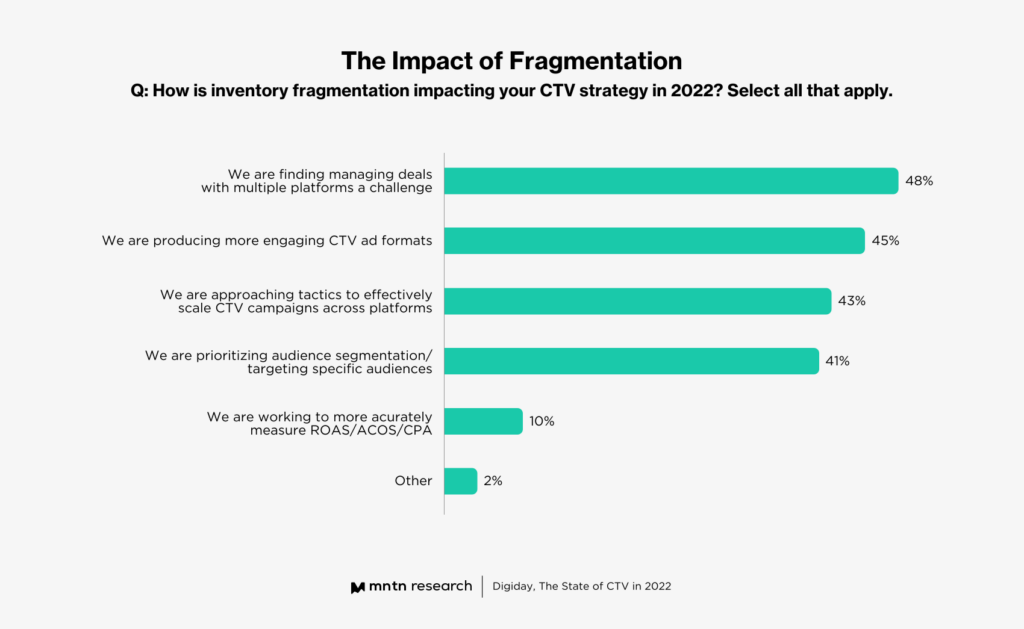

Nearly half of survey respondents (48%) said that inventory fragmentation poses a challenge in managing deals with multiple platforms. Fragmentation is also pushing 45% to produce more engaging CTV formats and 43% to adopt tactics to help them scale CTV campaigns across different platforms.

Finding The Right Technology Solution

Taking an Audience-First Approach to Advertising

Bracero said that the challenge with direct-sold buys with networks is that they require a significant amount of scale from a media standpoint, and internal management resources like being able to manage multiple contract negotiations and pacing. Other pain points include inevitable inventory issues and having to manage platform measurement for each deal.

“If you’re not doing direct deals, then you’re doing something more programmatic in nature,” said Bracero. “By doing a programmatic buy, you’re able to focus on audience-based media buys instead of a plethora of networks and programs. As advertisers invest in programmatic advertising for CTV, an audience-first approach is crucial.”

Burke at MNTN added that building an audience for a programmatic buying approach is crucial in increasing the scale and driving performance of CTV advertising campaigns.

For example, a home improvement retailer might only be considering placing ads with one TV network that airs home improvement programming. However, this approach could limit the retailer’s ability to reach all types of consumers in the DIY demographic, such as those moving to a new home, those performing home renovations, and those looking to update kitchen appliances.

“When that retailer takes an audience-first approach, it might find that DIY consumers not only watch HGTV, but also FXX because they happen to also be sci-fi fans,” said Burke. “We should be able to buy ads anywhere out there as long as we’re following the right users around. Making sure that the technology is in place to effectively operate in a programmatic space is super important.”

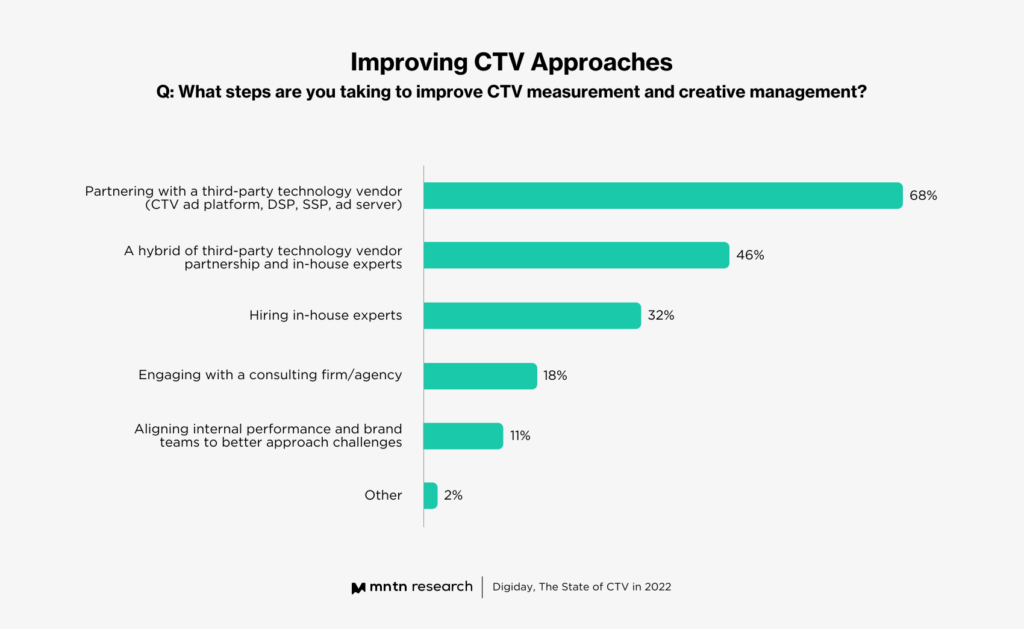

No matter the media buying approach, marketers are relying on third-party technology vendors—completely outsourcing or through a hybrid in-house and external approach—to manage aspects of CTV performance. Marketing teams are partnering with vendors that can offer ID agnostic audience segments and access to large amounts of data, in addition to being able to use real-time analytics and insights to inform ad placement decisions

“As advertisers invest in programmatic advertising for CTV, an audience-first approach is crucial.”

Rafa Bracero, Director of Marketing Strategy, MNTN

How to Build a Foundation for Better Measurement, Media, and Management

The interconnection among CTV measurement, media buying, and creative management has never been more apparent in 2022, and marketing teams are analyzing how each factor impacts one another as they seek to drive CTV performance—and striving to find ad solutions that can help them navigate each factor.

Brand marketing and performance teams are looking to track the customer journey from when an ad is seen to when a purchase is made, regardless of the device they use. They also want to know whether premium media inventory is available—channels such as ABC or ESPN—and whether the media placement is brand safe or brand suitable. Additionally, teams are seeking to extend the CTV ad experience beyond a living room TV and onto second screens such as a mobile device.

“These are all factors that brands are taking into consideration when they are activating in the CTV space,” said Bracero at MNTN. “When brands are considering a CTV technology solution, they are seeking partners with qualities related to these elements such as the ability to perform A/B testing to understand how content is performing; offerings such as real-time attribution and optimization; and whether the partner provides premium, quality inventory.”

To improve CTV measurement and creative strategies in the future, more than half of survey respondents (68%) said they are partnering with third-party technology vendors such as CTV ad platforms, ad servers, and DSPs or SSPs, while 46% are taking this approach along with hiring in-house experts to better manage approaches.

With a technology partner as an anchor, marketing teams are asking themselves the following questions as they strive to build a stronger foundation for successful CTV performance:

How can a brand accurately tie a CTV ad to a conversion?

Ultimately, it can be complicated to successfully measure attribution especially across multiple devices. Marketers are working to develop a cross-device attribution map not only to understand that they served an impression to a household, but also ensure people in that household were directly impacted by the ad by visiting that brand’s site to make a purchase.

How can a brand unify the omnichannel experience for CTV?

Brands are working with CTV ad tech partners to create ad experiences where users can see and engage with the creative that first reached them on TV screens, on new screens such as mobile devices and laptops. This approach will require rethinking a creative management strategy that potentially invests in new ad formats.

How will programmatic buying impact performance?

Manually matching audiences to ads can be time-consuming, difficult to scale, and requires specific types of team resources. Marketing teams are working to achieve better CTV performance outcomes by using technology that scales the audience matching process and provides real-time analytics to inform ad placements.

Conclusion

Marketing teams are investing in the resources and technology needed to follow through on these questions. With this foundation, brands will have a better chance of meeting and exceeding their advertising performance goals through CTV in 2022 and beyond

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.