Research Digest

In a Wobbly Economy, Performance TV Is Stealing the Show

by Frankie Karrer5 min read

Abstract

- 84% of marketers now include streaming in their marketing mix.

- Two-thirds of advertisers classify Connected TV as a performance marketing channel.

- When navigating times of economic uncertainty, 77% brands say that they were either likely or very likely to focus on performance.

Upfronts and Newfronts season sets the tone for the rest of the year for TV advertisers. And this year, the big story is all about Connected TV. Advertisers say they plan to allocate 40% of their 2023 budgets to CTV, bringing upfront spend on this channel to $8.14 billion.

This is to be expected in the new world of streaming—84% of marketers globally say they now include streaming in their marketing mix. Where TV used to be an awareness-only play with a high price point that precluded smaller brands from participating, CTV has made the TV advertising world vastly more accessible. In an interview with Forbes, tvScientific co-founder and chief executive officer Jason Fairchild explained that this has opened up the door to new kinds of advertisers within the TV space. “This year will be one of the last years where … large direct-to-consumer (DTC) brands will not participate in the upfronts,” he said. “We are currently seeing that CTV is evolving into a performance-based medium that has more appeal to direct-to-consumer companies.”

These days, there are two approaches to advertising on television: branding and performance marketing. And interest in the latter, in particular, is on the rise. In a survey conducted in partnership with Advertising Week, MNTN found that while 81% of marketers said they use CTV to raise brand awareness, two-thirds classify it as a performance marketing channel. And many brands use CTV to drive specific outcomes—52% of respondents said they use CTV with the aim of generating measurable web visits, conversions, and revenue.

So, Why the New Focus on Performance?

Well, there are a number of reasons. The first is the recent uncertainty in the market. With the state of the economy putting many brands on guard, TV advertisers want results they can prove. One way to do this is through data-based, attributable metrics. As Tony Marlow, CMO of LG Ad Solutions, explains, the ease of precision measurement on CTV platforms has made all the difference in proving ROI from this channel: “CTV is a mature, time-tested, proven performance channel and is therefore highly appealing to media buyers at a time when ad dollars need to stretch further.”

At MNTN, the brands we work with agree with that sentiment. “With massive targeting capabilities and the ability to add custom audiences, we’ve been able to really hone in on who is most likely to visit our studios to maximize results,” says Brittany Graff, Head of Marketing at Painting with a Twist, about their MNTN Performance TV campaigns. “The transparent tracking ability has really helped us communicate the value of the advertising channel to our franchisees.”

This focus on performance in times of economic volatility is standard fare in the world of advertising. In their 2023 Annual Market Report, Nielsen found that it’s one of the main tactics brands use to navigate these conditions. In fact, 77% of those surveyed said that they were either likely or very likely to shift spending to digital channels or focus on performance, as seen in the chart below.

Speaking of Nielsen, the TV ratings giant may have also played a role in pushing the TV advertising space towards performance-based marketing. In 2021, Nielsen lost its accreditation due to issues surrounding a miscounting of viewers during the pandemic. By the time it was restored recently, that period of uncertainty had opened the door for alternative forms of measurement. These days, buyers have to more closely consider whether their clients objectives are more performance-based or brand-based.

Performance TV Drives Results

If you’re wondering what kind of results advertisers who incorporate performance TV into their strategies can expect to see, look no further. Q4 is one time of year when marketers typically leverage their ad strategies to drive as much performance as possible. In our Q4 Performance Report, which analyzed data sourced from the MNTN platform in 2021 and 2022, we found that performance-based CTV marketers generated more revenue and conversions, and even saw their average conversion rate improve by 21% YoY in 2022. ROAS also saw significant growth during the holiday season, rising 26% and 18% YoY in November and December, respectively.

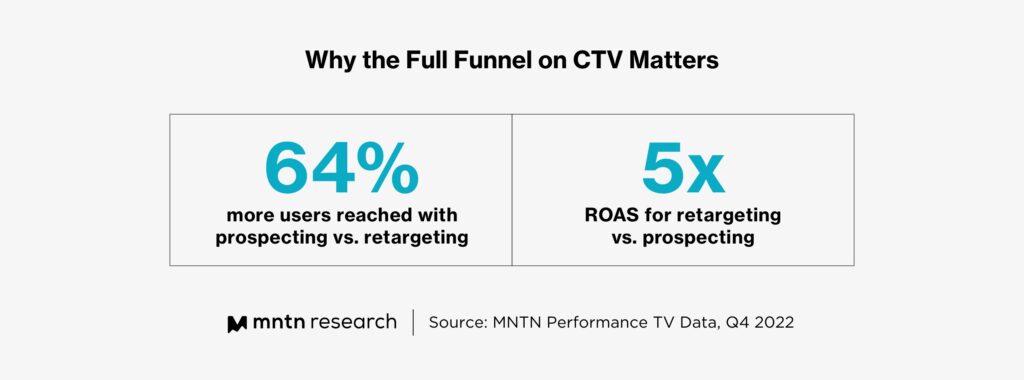

The report also found that Connected TV really has turned the TV screen into a viable, full-funnel channel for advertisers. When it came to prospecting, campaigns run on Performance TV had a higher average conversion rate. And retargeting-based campaigns generated higher return on ad spend, and a lower cost per acquisition.

Connected TV can also be a powerful tool for testing, allowing marketers to use the information they gather from their performance TV campaigns to help shape the rest of their marketing strategies—just like the Atlanta Hawks did through the MNTN platform. “Outside of its strong digital prospecting and retargeting capabilities, the in-depth tracking dashboard helped us quantify results–leading to better strategy decisions,” reports their Senior Marketing Manager Kate Lanier. In a time when every dollar counts, the ability to track results and adjust your strategies accordingly can make or break the success of a campaign.

The Future of TV is Performance

Bottom line: TV advertisers are shifting their priorities in light of CTV’s emergence as a performance-based channel. With its precise targeting capabilities and ability to generate measurable web visits, conversions, and revenue, CTV is becoming an essential part of a full-funnel strategy for advertisers, allowing them to achieve provable results when the rest of the ad landscape feels anything but.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.

Resources

1 A Whole New World: Breaking Down Programmatic and Upfront TV Spend in 2023 (MNTN Research)

2 Understanding Audiences Is Critical in Effective Cross-Media Strategies (Nielsen)

3 This Year Connected TV Will Have A Bigger Part In The $20 Billion Upfront (Forbes)

4 How Marketers are Approaching the TV Ad Renaissance (Advertising Week)

5 And the Winner of This Year's Upfront Is... (Cynopsis Media)

6 Painting with a Twist Creates a CTV Advertising Performance Masterpiece With MNTN (MNTN)

7 Nielsen Regains Key Media Accreditation (Wall Street Journal)