Research Digest

The Big Screen Reigns Supreme: Why Advertisers Should Prioritize CTV Over Mobile

by Frankie Karrer5 min read

Abstract

- The “lean back” viewing experience and premium ad environment of Connected TV help this channel drive high performance for video ad campaigns.

- Connected TV completion rates have outperformed mobile over the last three years, falling in a range of between 96-98%.

- CTV has a share of 71% of all video ad views, as compared to mobile’s 11%.

- The “halo effect” of Connected TV on other channels helps to elevate their performance as well.

Battle of the Video Ad Channels

Connected TV and mobile can be strong channels for any video ad campaign. But how do the two channels stack up when it comes to performance? As the video ad ecosystem continues to evolve, and the TV screen becomes a bigger part of the digital mix, it’s a good idea to get a sense of how things are playing out.

Where Connected TV Outperforms Mobile

One of the KPIs that Connected TV consistently hits high numbers in is video completion rates. Extreme Reach tracked the completion rates of multiple channels across nine quarters, and found that for Connected TV, those rates have fallen in a range of between 96-98% during that time period, as seen in the chart below. For comparison purposes, MNTN’s own data has shown average completion rates for CTV rest around 97-98%.

Mobile web and app completion rates, on the other hand, are much lower, with mobile web driving rates between 72-79% and mobile app even lower at a range of 56-64%.

Connected TV also consistently outperforms other formats in ad view shares when it comes to video advertising. In H1 of 2022, FreeWheel found that CTV had a share of 71% of all video ad views, more than 10% higher YOY than this channel’s share was in H1 of 2021. This is as compared to mobile, which had a share of 11% of ad views this time last year.

CTV Is the Home of Premium, “Lean Back” Video Content

Part of the reason that Connected TV outperforms mobile when it comes to ad completion rates and views is that CTV is more likely to be seen as a home for premium content. Both channels may be capable of running video ad content, but Connected TV benefits from an environment of professionally produced advertisements and high-quality video (not to mention its larger, more engaging home on the TV screen). As a result, viewers of Connected TV ads are more likely to have a positive association with those brands. In fact, 46% of adults say that they find television advertising to be the most trustworthy ad channel, as compared to social media’s 19%. Among advertisers, mobile is also seen as a less brand-safe environment because it can be harder to control which content is viewable alongside mobile ads.

Connected TV’s other advantage as a channel is its “lean back” user viewing behavior. When viewers watch Connected TV, they tend to be settled in one location, and are fully engaged in the content shown on their television screen. Mobile, on the other hand, has a more active scrolling environment, in which users are often enticed to move along to the next video as quickly as possible to consume the largest amount of content possible.

Why This Should Matter to Advertisers

The process of producing video advertisements can be costly and time consuming despite being worth the effort—viewers retain 95% of an advertiser’s message when delivered by video, as compared to 10% of messages read in text. Advertisers should be looking to get the best bang for their buck when it comes time to actually serve those ads to prospective customers, and Connected TV’s high completion rates and views fit the bill.

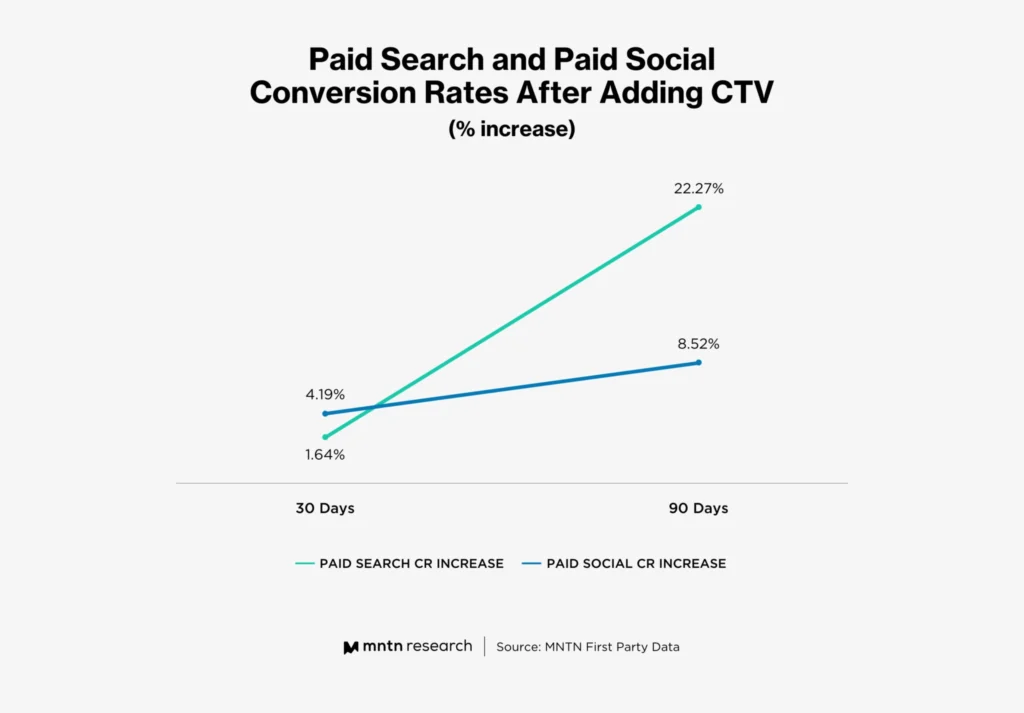

Connected TV has not only shown itself to be a strong driver of performance—it has positive effects on other channels as well. CTV has a “halo effect” on channels like paid search and social, elevating their results to boost performance across the board. When looking at MNTN first party data, it became clear that adding Connected TV to the ad mix of a campaign increased the conversion rates for both paid search and social after just 30 days, and continued to contribute to that rise in performance significantly over the next 90 days.

After all, TV and mobile devices go hand in hand—83% of TV watchers hold onto their secondary devices while watching TV. And these “second-screeners” have shown that they will use those devices when they want to learn more about a product or service advertised on TV, whether by exploring the brand’s website or app (34%), via a search engine (30%) or by visiting an ecommerce site (19%).

Conclusion

Advertisers looking to run video campaigns should be prioritizing Connected TV over channels like mobile. CTV’s laid back viewing experience and premium, big screen environment has helped it prove itself as a performance channel, driving higher completion rates and ad views than any other video ad channel. And when run with other channels, it has a positive effect on their performance as well. Ultimately, when deciding how to divvy up their video ad budget, marketers would be better served to look to the big screen.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.

Resources

1 Video KPIs to Compare Performance of Mobile and CTV (eMarketer)

2 U.S. Video Marketplace Report: 1H 2022 (FreeWheel)

3 Consumers View TV as the Most Trustworthy Advertising Channel (MNTN Research)

4 Connected TV Creates a Halo Effect For Paid Search and Social (MNTN Research)

5 Pervasive Second-Screen Habit Opens CTV Opportunities (Mediapost)

6 An Exploration of Second-Screen Use by TV Viewers (MNTN Research)