Analysis

The Growing Relationship Between CTV and Retail Media Networks

by Jacob Trussell6 min read

Abstract

- With the surging popularity of Connected TV devices, and the launch of ad-supported tiers on legacy streaming platforms, demand for video is at an all time high.

- A 2022 eMarketer report shows that retail media networks have become the second fastest-growing channel next to CTV.

- Retail media networks are now making moves to sync with CTV platforms, which will create more opportunities to reach customers the best way possible–with video.

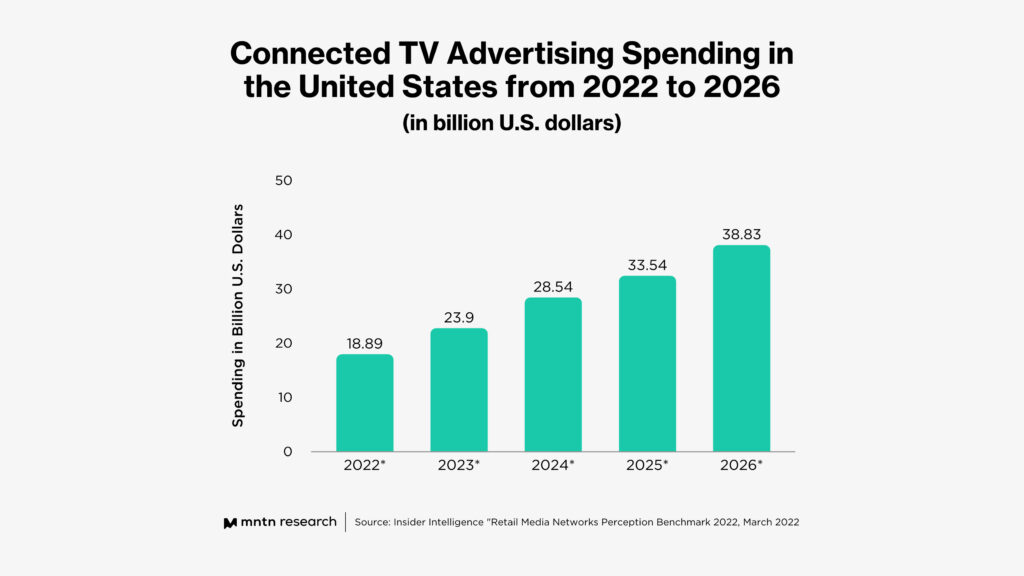

Over the past few years, Connected TV has become one of the fastest growing advertising channels on the internet. Between 2019 and 2020, CTV ad spend grew from $6.42 billion to $9 billion.

Seems like a lot of cash is already flowing to the biggest screens in your home, right? But in 2022, that number more than doubled to $18.89 billion. With the launch of ad-supported streaming tiers at the end of 2022 (and into 2023) CTV’s popularity continues to explode. By 2026, ad spend on CTV is forecasted to more than double its 2022 numbers and skyrocket to $38.83 billion.

Those are wild numbers that frankly prove everything we know at MNTN Research. If you want to be where the money is at, then you need to be on CTV.

But no platform makes it to the top of adland without having some fierce competitors nipping at their heels. In 2022, industry headlines heralded the poison pill that could very well siphon off CTV ad spend and stop the channels growth in its tracks: Retail Media Networks.

But if you’re like us, you may have asked yourself once or twice this year, “Wait…what even are retail media networks?”

We’ll help you wrap your head around these opportunities, and what – if any – influence they may have on your present and future CTV campaign strategies.

WTF are Retail Media Networks?

According to the company Epsilon, “A retail media network (RMN) allows a retail brand to give their partner brands access to customers, using the retailer’s key assets: their first-party customer data and channels (including their website). With the retailer’s first-party data, brands can reach in-market buyers at the point of purchase, across formats and owned channels.”

In other words, RMNs give brands the ability to utilize a larger retailer’s first-party data to run ads on their channels. As an example, Wal-Mart would give a smaller business access to their trove of audience data to help them find new customers by utilizing ad placements on the retailers website.

TL;DR: the big boxes are giving the keys to the smaller boxes to leverage their data to better reach their target customers.

How are RMNs intersecting with CTV?

“Cool cool, but what does any of this have to do with Connected TV?”, you’re most likely asking yourself right now.

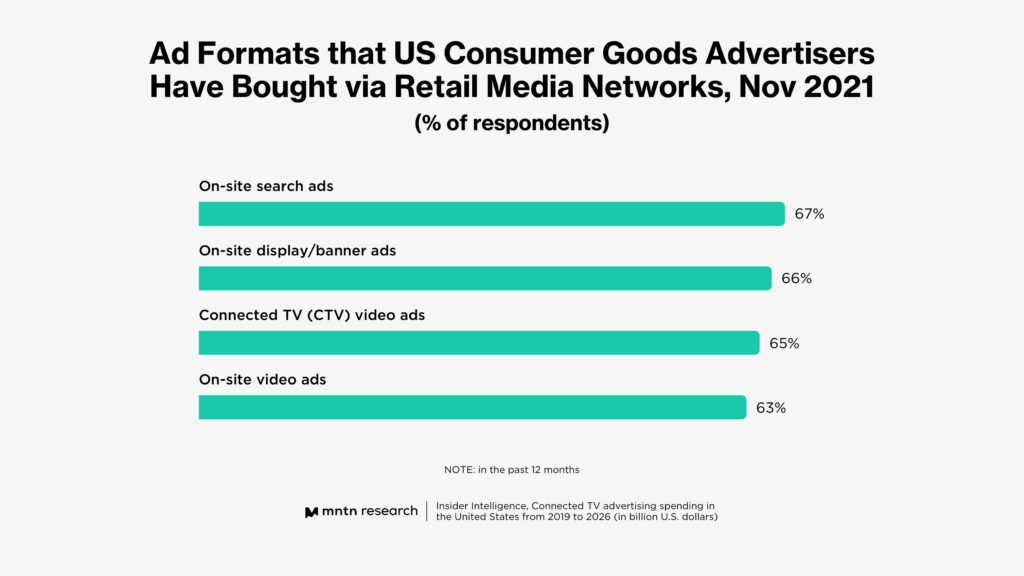

According to eMarketer, “…the lion’s share of retail media dollars is spent on performance-based ads tied to product searches. However, several retail media players, including Amazon, have made moves toward syncing their media networks with CTV platforms.” This will unlock the ability for brands to run video ads on CTV platforms that harness the first-party data provided by the retail media network. This is reflected in a survey eMarketer conducted on ad formats that U.S. CPG brands have purchased via RMNs. As you can see, on-site search and display lead the pack, but it’s closely followed by CTV ads (and it’s distantly related cousin on-site video ads.)

The syncing of RMNs with CTV platforms is still in its infancy. The same eMarketer report found that most retail media network ad dollars are spent on performance-based ads tied to product searches. But that’s slowly changing thanks to partnerships like what Roku and Walmart established. The deal those two giants struck would see Walmart deliver ads from its network to Roku devices, where a shopper could purchase the product with their TV remotes. It’s a first of its kind deal, and we don’t expect it to be the last.

If we can forecast for a moment, take Amazon for example. They are already both a retail media network, and a streaming platform, so the opportunity for Amazon to combine their retail media inventory with their streaming ad inventory is not a matter of if, but when.

Harnessing the Headwinds of Retail Media Networks

Many brands, especially ones with an outsized eCommerce presence, have likely already been hooked into a RMN, creating digital storefronts on platforms like eBay or Wayfair.

For those brands, getting a jump start merging RMNs data with CTV’s creative capabilities should be a breeze as they are already familiar with the basics of the platform. The largest RMNs brands should consider (and let’s be real, are probably already advertising on) is Amazon, which is followed closely by Walmart, Target, and an assortment of other well known names.

The heavier lift getting started with a RMN will be for brick-and-mortar retailers who may not have fully made the leap to eCommerce over the last few years. Those who were able to prioritize that switch were able to weather the 2020 storm better than those who relied heavily on in-store foot traffic. There will be a learning curve for these retailers to apply their in-person strategies online, but we think that’s an exciting challenge, rather than a barrier of entry, for smaller brands. Especially ones that want to start running ads on Connected Television.

This is where the value of Retail Media Networks and their relationship with CTV becomes clearer. As reported by eMarketer, “media networks are a higher-margin business than brick-and-mortar or online retail, so retailers with depressed foot traffic found they could make up for some lost revenues by leaning into their ad offerings.”

On top of that, since Retail Media Networks are supported by their ecommerce platforms, these ad channels haven’t seen quite as much turbulence as compared to the cutbacks to ad spend many brands are making. That makes RMNs a safer bet for brands when economic uncertainties strike.

Conclusion

That eMarketer report shows retail media ad spending has more than tripled its pre-pandemic total to become the second fastest-growing channel next to CTV, and it isn’t expected to slow down. Regardless of a rocky market, retail media spending has not declined, which illustrates the opportunity for continued annual growth for brands despite recent economic uncertainties.

Search and display ads are still top dog in retail media spend, but video is catching up–especially as retail media networks intertwine with CTV ad platforms. This surfaces natural opportunities for aligning your video assets into a unified retail marketing campaign that can be deployed across disparate channels to continue growing your audience on the biggest screens in their home.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.