Analysis

Early Adoption Phase Ends for CTV Advertisers As Budgets Ramp

by Stephen Graveman5 min read

Abstract

- The early adoption stage for CTV has ended, as the majority of brands have spent the last several years reallocating marketing budgets to the platform.

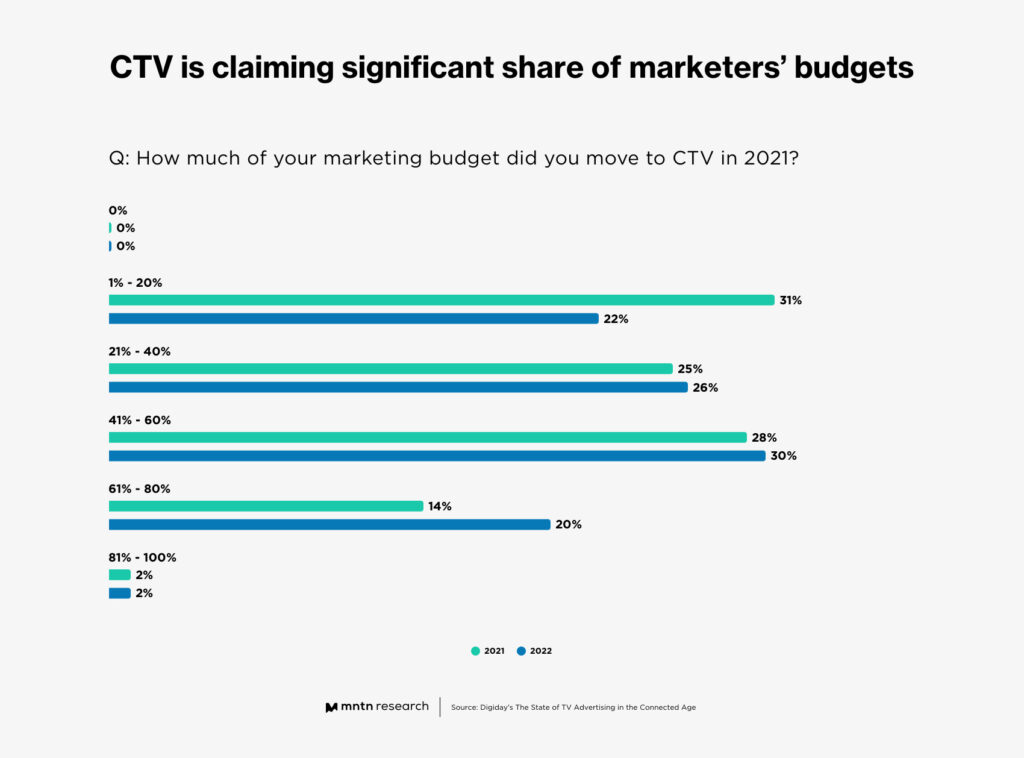

- More than half of all brands and agencies polled allocate more than 40% of their marketing budgets to CTV.

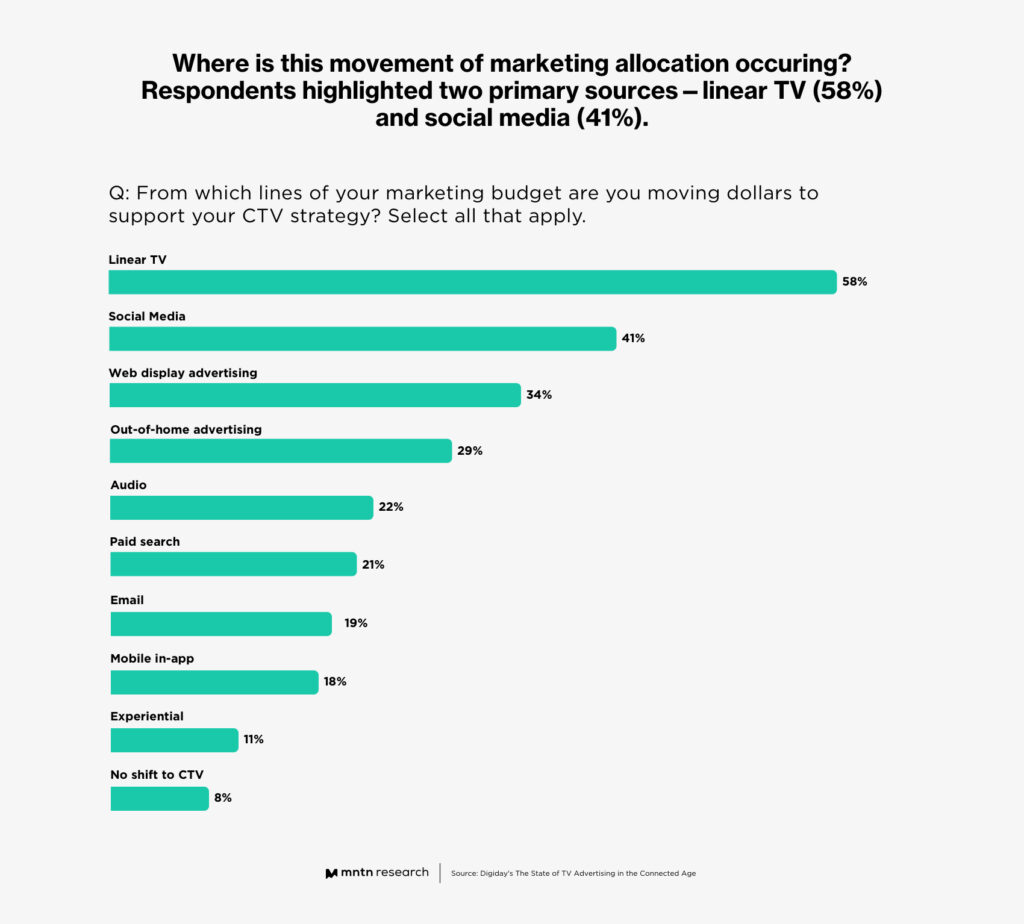

- The two categories that CTV is pulling ad dollars away from the most are linear TV and social media marketing

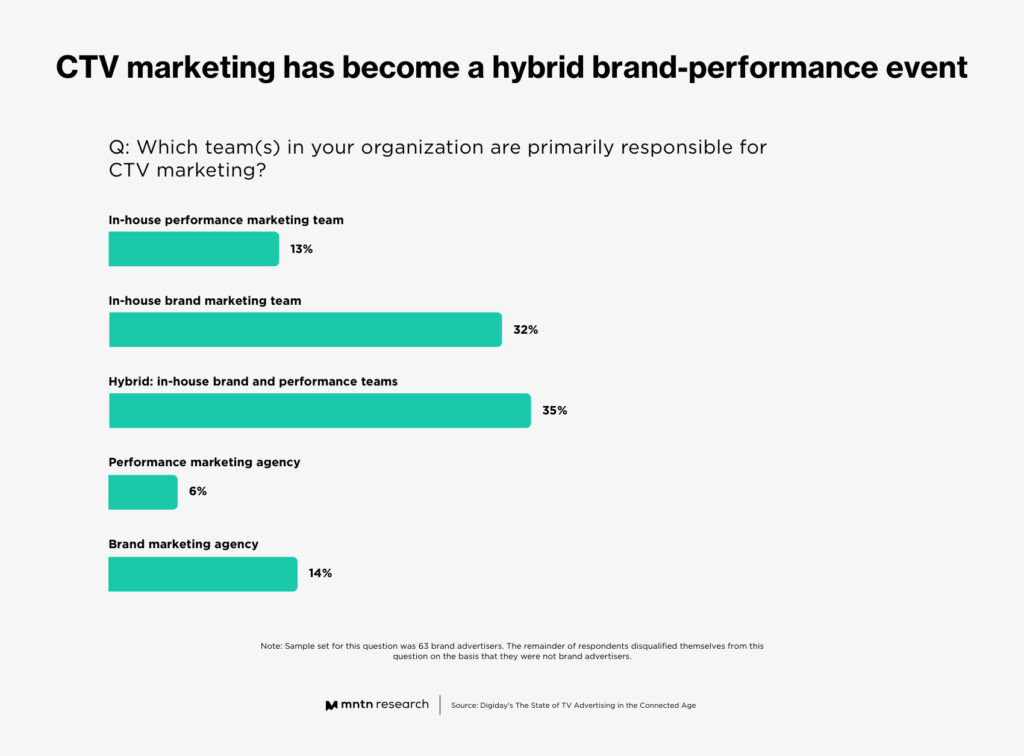

- CTV is rethinking how advertisers view the TV ad and creating a new brand-performance hybrid team in marketing departments.

No longer a fledgling advertising channel that’s new and unproven, Connected TV has risen to transform the advertising landscape—and forced advertisers to rethink their budgets. This sort of transformation has caused a series of ripple effects, including changes to how advertisers see TV ads, how viewers interact with them, and how brands manage media planning. As a result, there are a lot of questions surrounding the impacts CTV has had, what happens next, and what other transformative impacts it will have on viewing habits, budget allocation, advertiser behavior, and more.

To get deeper insights into how CTV is changing advertising, Digiday polled 123 leading brands and agencies to learn how their teams are evolving their advertising strategies with the platform.

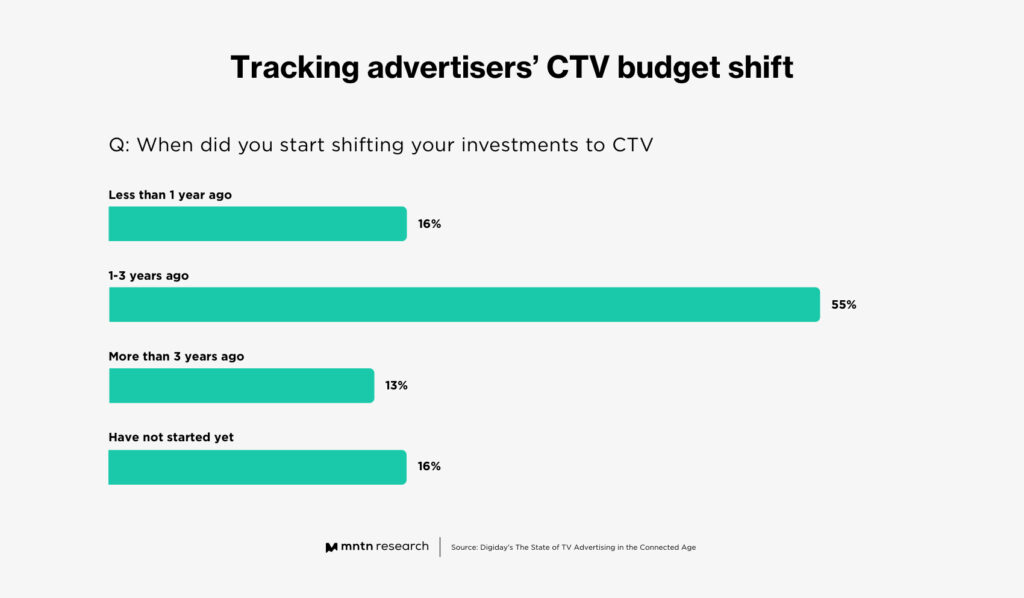

The Early Adoption Phase for CTV Is Over

For most brands and agencies interviewed by Digiday, CTV’s accelerated adoption rate isn’t new; it has been happening for several years already. More than half of respondents (55%) said that they started shifting marketing budgets away from other channels and towards CTV as early as 2018 (Fig. 1). Last year, CTV ad spend rose by 59.9% to hit $14.44 billion and is on track to reach $19.1 billion by the end of 2022. The early adoption phase for CTV is over; today it’s no longer a question of whether it’s a viable ad platform, but rather how to best utilize it strategically.

When Digiday asked brands and agencies how much of their marketing budget was moved to CTV in 2021, respondents revealed a significant increase (Fig. 2). Further, when Digiday asked the same respondents how much they planned to move in 2022, almost every group revealed plans to reallocate even more. As more brands and agencies rely heavily on CTV advertising, this trend is expected to continue climbing in subsequent years.

How Advertisers Are Reallocating Budgets

As CTV ad spend increases, advertising budgets are being shifted towards the platform and away from other avenues. An eMarketer study found that, after siphoning ad budgets away from other channels every year since 2016, mobile advertising’s once-unstoppable domination of the digital ad market is slowing down—and they note the emerging popularity of CTV advertising as the primary reason. According to Digiday respondents, the two primary sources losing their marketing budgets to CTV are linear TV at 58% and social media at 41% (Fig 3).

The shift of ad dollars from social media to CTV coincides with social media platforms’ increasing problems. 37% of users polled say they distrust social media more than ever, and 60% of viewers report preferring to watch video content on CTV over social media. Outlets like Advertising Week predict this trend to continue, noting, “As digital performance likely craters due to the disappearance of cookies and the gatekeepers exerting more control over their ecosystems, digital marketers will seek a new channel for their spend. The growth in spend in 2022 will be in large part due to a shift from digital to CTV.”

Future Impacts on Marketing Media Planning

As CTV ad spend continues increasing exponentially, it will lead to short and long-term effects for marketing media planning. By marrying television’s powerful storytelling capabilities with digital marketing’s targeting and measurement, CTV has moved television ads beyond the realm of solely brand marketing and into a space that is mixed with performance-focused goals. Already, brands are realizing that they can use CTV to both build general awareness and prompt viewers to visit a website and convert—which is breaking down the walls between performance and brand marketing teams.

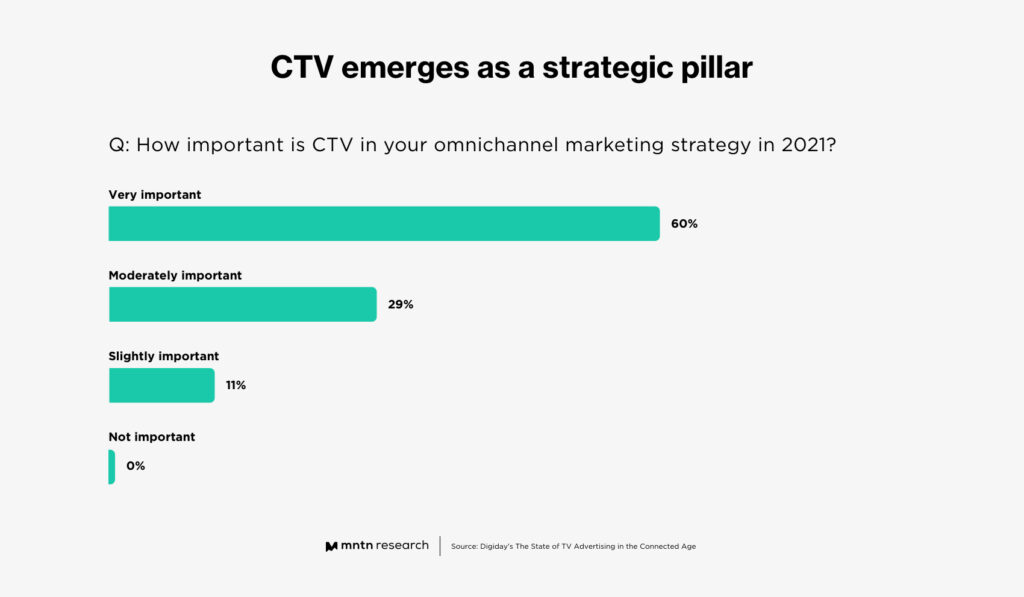

This evolution is changing both how advertising functions and how performance and brand marketers see their roles. Digiday recently asked brands and agencies which teams in their organization are responsible for CTV marketing. While a combined 46% of respondents are running a pure-awareness CTV campaign across both external and internal teams, a hybrid brand-performance approach is rising in popularity—and follows closely behind at 35% (Fig. 4). Beyond the focus on advertising, the Digiday poll found that CTV’s role in strategic planning is growing as well, with 89% of respondents reporting CTV as significantly important to their advertising strategy (Fig 5).

Conclusion

With more people streaming TV than ever before (213.7 million a month) and watching more CTV every day (an average of 80 minutes), the platform’s impact on the overall advertising landscape shows no signs of slowing down. Already, advertisers are projected to exceed $26 billion by 2025, which means advertisers will continue to reallocate budgets from other channels and follow their consumers to CTV. While the early adoption phase has ended, brands who haven’t embraced the platform still have time to catch up—but that window is closing rapidly. And for brands who already leverage CTV in their marketing strategy, it’s clear that rethinking the dynamics between brand and performance marketing is producing results—and paving the way for future success.

Subscribe to the MNTN Research Weekly

Sign up to receive a weekly feed of curated research, sent straight to your inbox.

Resources

1 The State of TV Advertising in the Connected Age (Digiday)

2 Mobile Advertising is Still King, But More Industries Are Looking at Nonmobile, Thanks to CTV (eMarketer)

3 How CTV Viewers Embody the True Diversity Brands Covet (Ad Age)

4 CTV 2022: Attribution, Fragmentation, Clean Rooms and More (Advertising Week)

5 CTV and digital advertising: How Connected TV is one of the fastest growing channels in 2022 (Insider Intelligence)

6 US Connected TV Advertising 2021 (eMarketer)